Dallas Texas Wire Transfer Instruction to Receiving Bank is a set of detailed guidelines and steps that need to be followed when initiating a wire transfer from a sender's bank account to a receiving bank in Dallas, Texas. This process ensures a seamless and secure transfer of funds between two financial institutions. The wire transfer instructions typically include important details such as the sender's account information, the recipient's account information, the amount to be transferred, and any specific instructions or reference numbers provided by the sender. These instructions need to be followed precisely to avoid any delays or errors in the transfer. Keywords: Dallas Texas, wire transfer, instruction, receiving bank, sender's bank account, recipient's account, transfer of funds, financial institutions, secure transfer, account information, specific instructions, reference numbers, delays, errors. Types of Dallas Texas Wire Transfer Instruction to Receiving Bank: 1. Domestic Wire Transfer Instruction: This type of instruction is used when the sender and the receiving bank are both located within the United States. It involves the transfer of funds between two domestic bank accounts, typically within the same banking system. 2. International Wire Transfer Instruction: This instruction is utilized when the sender's bank and the receiving bank are located in different countries. It involves transferring funds across borders, which may require additional information such as SWIFT codes, intermediary banks, and foreign exchange conversions. 3. Business Wire Transfer Instruction: This type of instruction is specifically designed for businesses that need to transfer funds for commercial purposes. It may include additional details related to invoice numbers, purchase orders, or other business-related information required by the receiving bank. 4. Personal Wire Transfer Instruction: This instruction is commonly used by individuals who need to transfer funds for personal reasons, such as sending money to a family member, making an international payment, or purchasing property abroad. It typically involves providing personal identification details and ensuring compliance with anti-money laundering regulations. By following the Dallas Texas Wire Transfer Instruction to Receiving Bank accurately, individuals and businesses can ensure a smooth and efficient transfer of funds, whether it is a domestic or international transaction. It is important to provide accurate information and keep track of any fees or charges associated with the wire transfer process to avoid any surprises or complications.

Dallas Texas Wire Transfer Instruction to Receiving Bank

Description

How to fill out Dallas Texas Wire Transfer Instruction To Receiving Bank?

Whether you intend to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

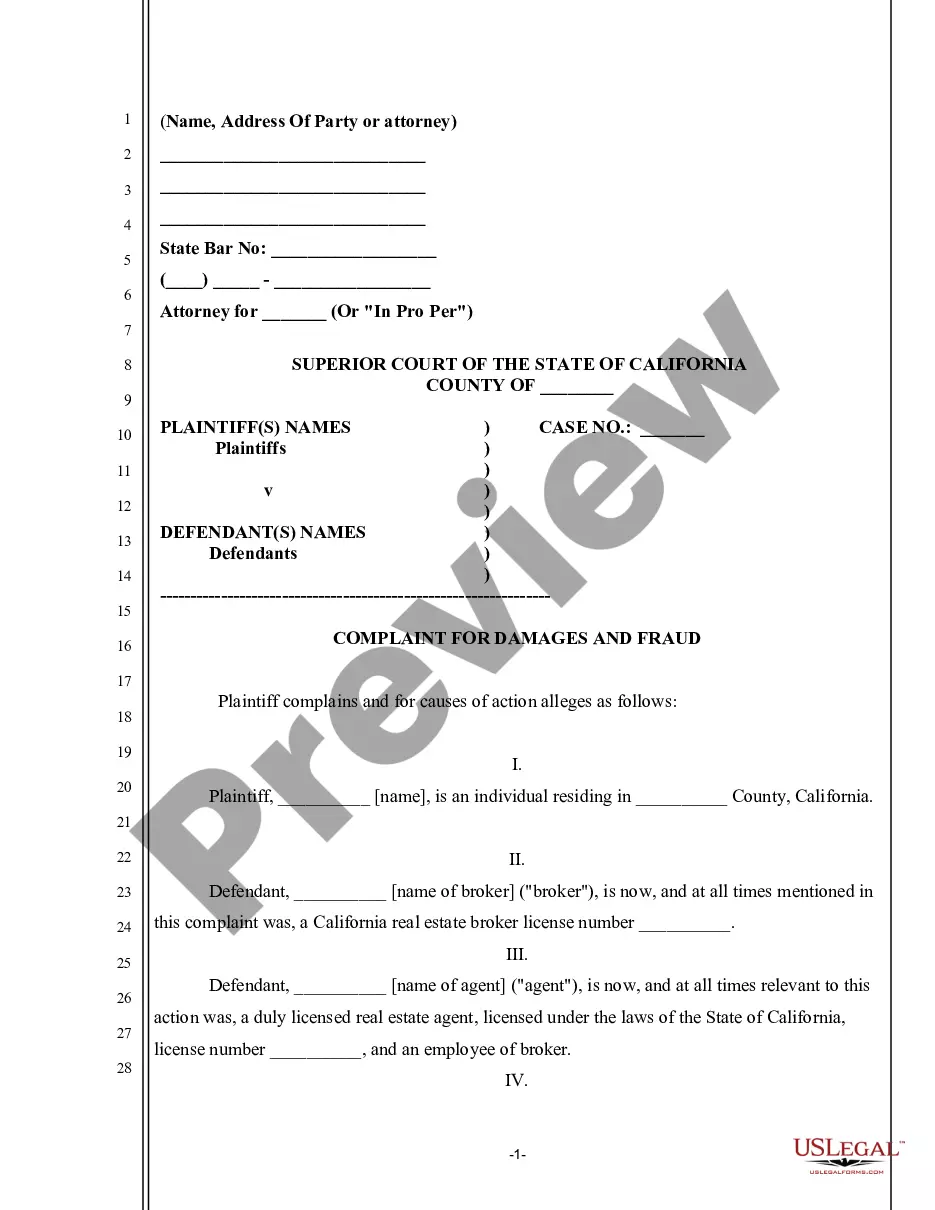

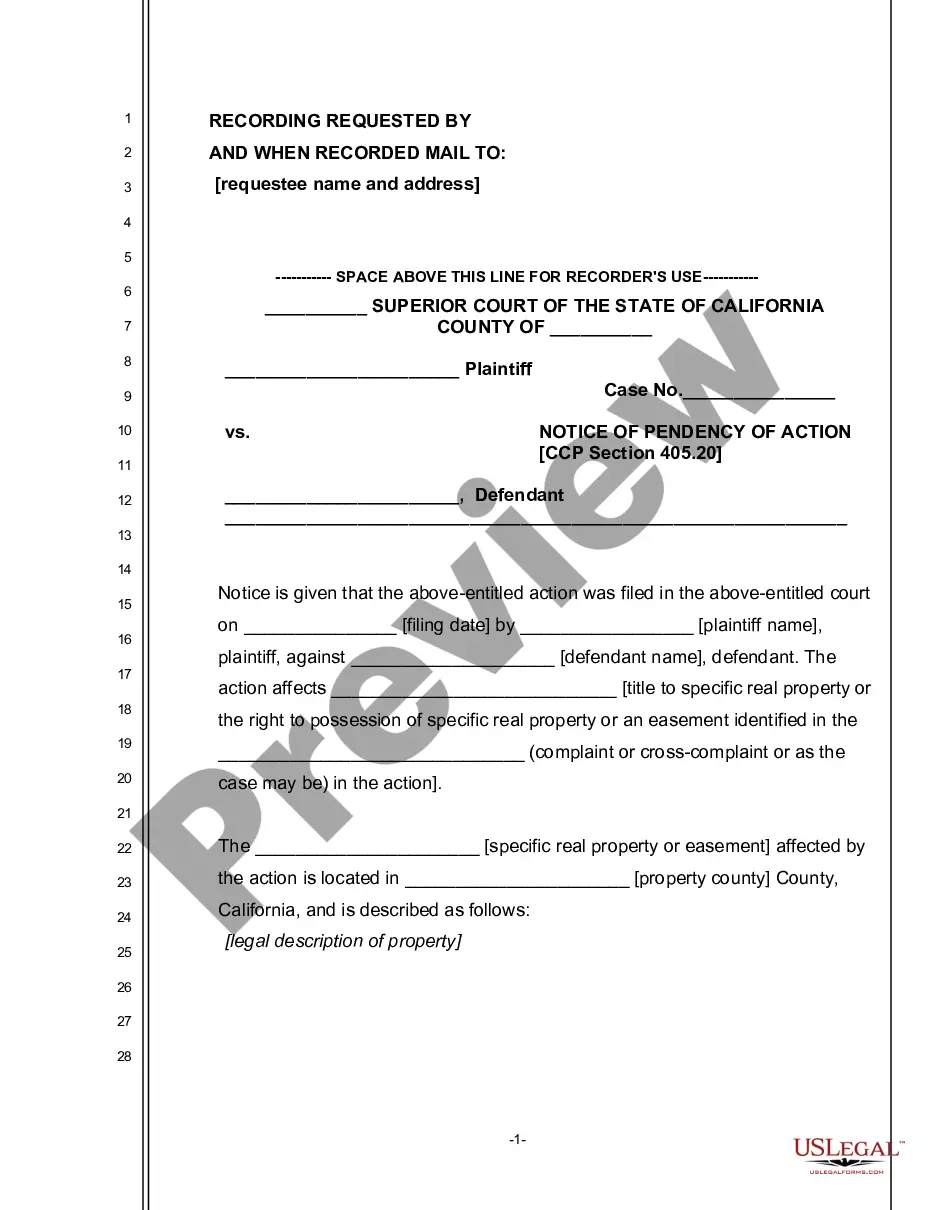

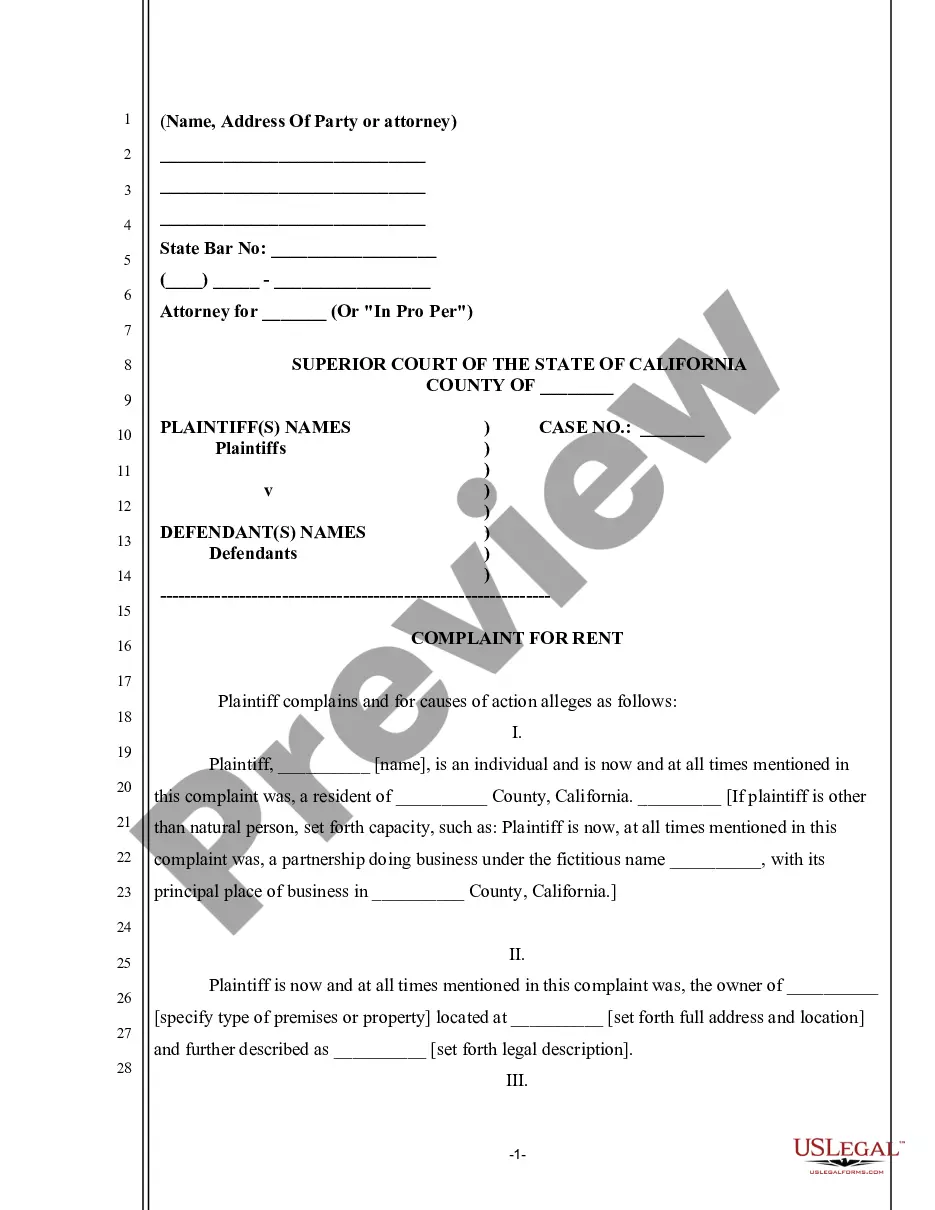

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Dallas Wire Transfer Instruction to Receiving Bank is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Dallas Wire Transfer Instruction to Receiving Bank. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Wire Transfer Instruction to Receiving Bank in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!