Dear [Freeport Warehouse Authority], I am writing to request a warehouse exemption for our facility located in Middlesex County, Massachusetts. Middlesex County is a populous and diverse county in the eastern part of the state, known for its historic towns, vibrant communities, and thriving industry. With its strategic location and excellent transportation links, Middlesex County has become a hub for businesses and is home to numerous warehouses and distribution centers. Our company, [Company Name], has been operating in Middlesex County for [number of years] and our warehouse plays a crucial role in our operations. As an integral part of our supply chain, our warehouse allows for efficient storage, inventory management, and distribution of our products to customers not only within Middlesex County but also across the state and beyond. In order to support our continued growth and contribute to the local economy, we kindly request a Freeport warehouse exemption for our facility. The Freeport exemption, also known as the 100% exemption from local property taxes, is designed to encourage the growth and diversification of businesses by providing a tax incentive for qualifying properties. By granting us this exemption, we will be able to invest more of our resources into expanding our operations, improving technology and infrastructure, and creating new job opportunities for the residents of Middlesex County. This will not only benefit our company but also contribute to the overall economic development of the region. Our warehouse meets all the necessary criteria for a Freeport exemption. It is primarily used for the storage and distribution of goods and materials, and these goods are held for a limited time, typically less than a year. Our facility contributes to the efficient movement of goods and supports the local supply chain, making us eligible for this exemption. We understand that granting exemptions is a decision that requires thorough review and consideration. We have attached all the relevant documentation, including proof of property ownership, warehouse usage details, and any other supporting materials required for the application process. Furthermore, we kindly request a prompt review and favorable consideration of our Freeport warehouse exemption application for our Middlesex County facility. If you require any additional information or have any questions, please do not hesitate to contact us. Thank you for your time and attention to this matter. We look forward to a positive response that will enable us to continue contributing to the growth and prosperity of Middlesex County. Sincerely, [Your Name] [Company Name] [Contact Information]

Middlesex Massachusetts Sample Letter for Freeport Warehouse Exemptions

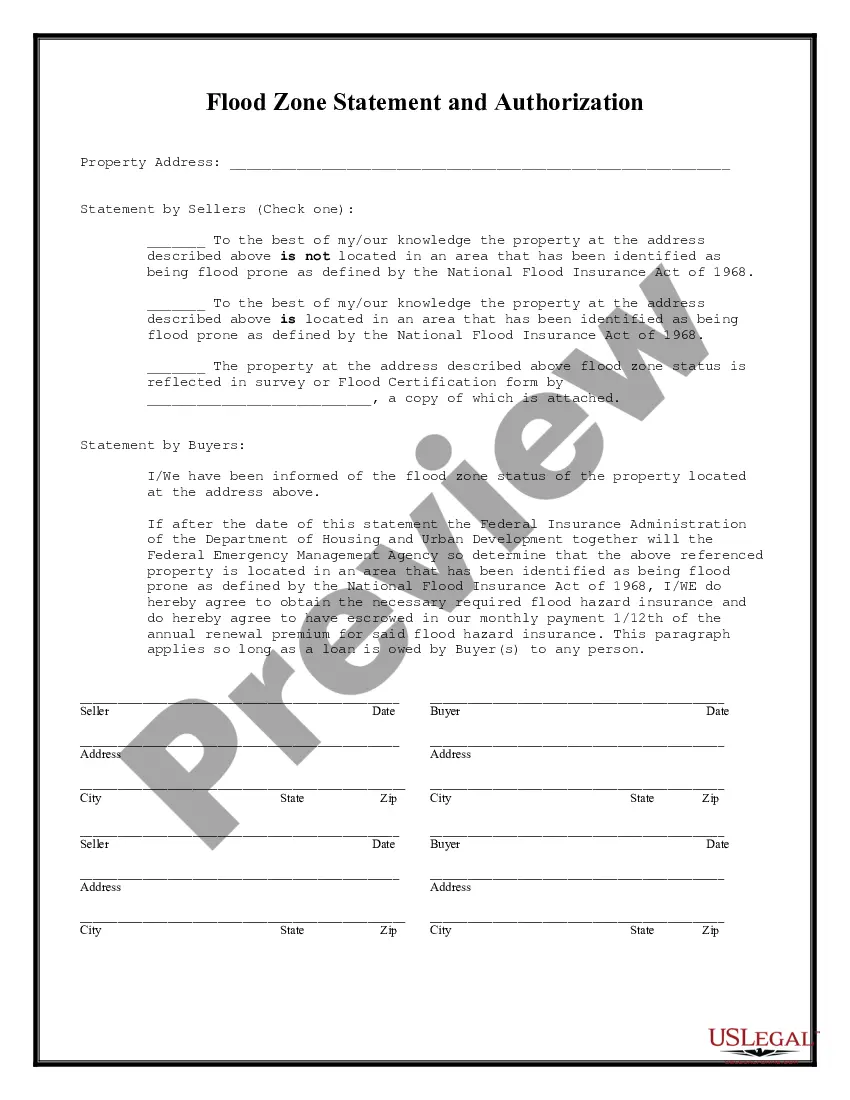

Description

How to fill out Middlesex Massachusetts Sample Letter For Freeport Warehouse Exemptions?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Middlesex Sample Letter for Freeport Warehouse Exemptions, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed materials and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how to locate and download Middlesex Sample Letter for Freeport Warehouse Exemptions.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the legality of some documents.

- Check the related forms or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Middlesex Sample Letter for Freeport Warehouse Exemptions.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Middlesex Sample Letter for Freeport Warehouse Exemptions, log in to your account, and download it. Of course, our platform can’t take the place of an attorney completely. If you have to cope with an exceptionally complicated situation, we recommend using the services of an attorney to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-specific documents effortlessly!