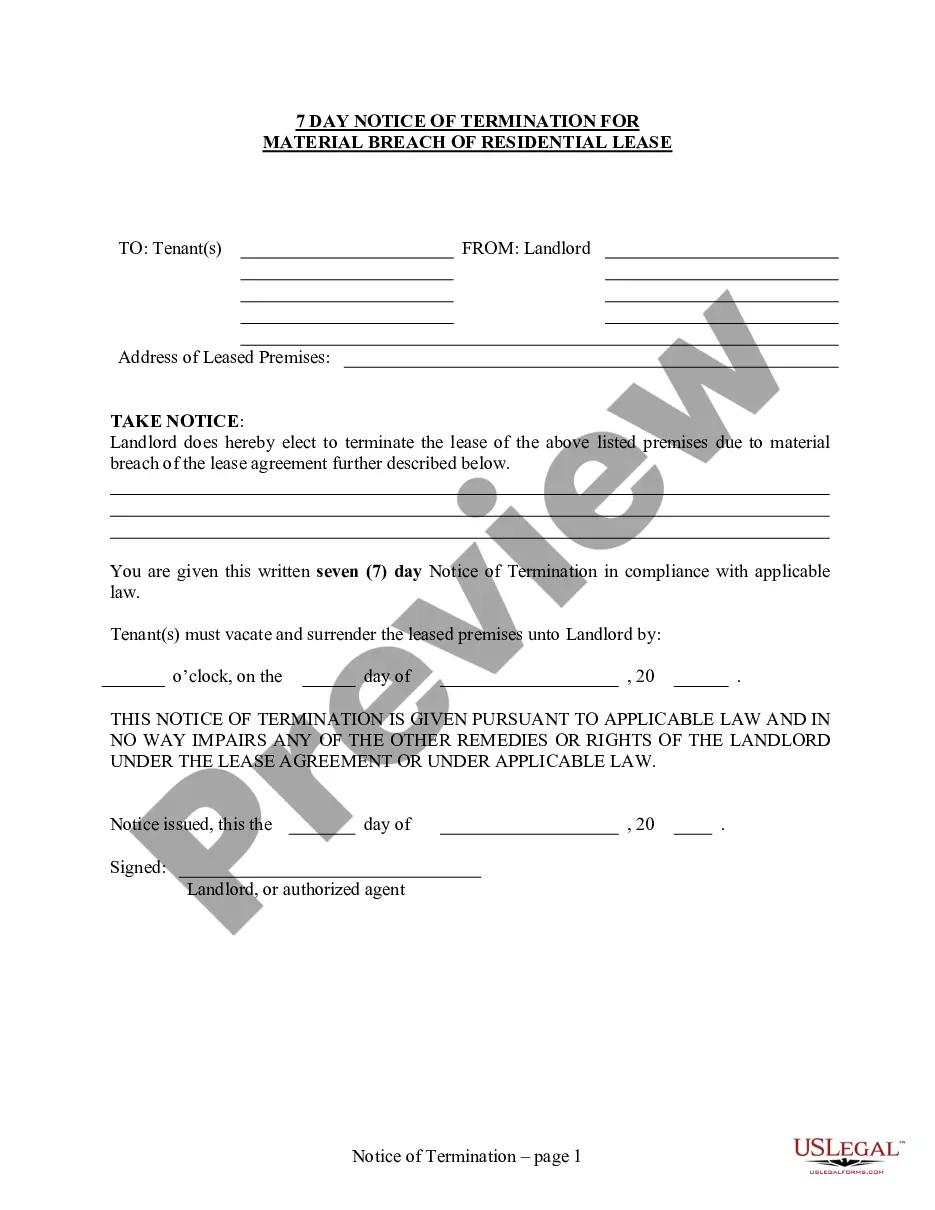

A Chicago Illinois Return Authorization Form is a formal document used by individuals or businesses in Chicago, Illinois to request permission to return goods or products to a merchant. It serves as a written record of the customer's intention to return an item and facilitates the return process by providing necessary information to the merchant. The Chicago Illinois Return Authorization Form typically includes fields to be filled out with important details such as the customer's name, address, contact information, purchase date, and original invoice or receipt number. These details help merchants verify the original purchase and ensure that the return falls within the established return policy. Keywords: Chicago, Illinois, Return Authorization Form, document, request, permission, goods, products, merchant, written record, customer, return, item, information, purchase date, original invoice, receipt number, return policy. Different types of Chicago Illinois Return Authorization Forms may exist depending on the specific merchant or industry. Some variations might include: 1. Online Return Authorization Form: This form is typically designed for e-commerce businesses operating in Chicago, Illinois, allowing customers to initiate return requests for products purchased online. 2. Retail Store Return Authorization Form: This form is generally used by brick-and-mortar stores in Chicago, Illinois, giving customers the opportunity to request returns for items purchased in physical retail locations. 3. Manufacturer Return Authorization Form: Certain manufacturers in Chicago, Illinois may require customers to obtain a return authorization before returning a defective or damaged product directly to them. This form would be specific to the manufacturer's policies and procedures. 4. Wholesale Return Authorization Form: Wholesalers in Chicago, Illinois might have their own return authorization form for retailers or resellers to request returns of large quantities or bulk orders. 5. Service-based Return Authorization Form: In some cases, service-based businesses in Chicago, Illinois might utilize a return authorization form to document customers' requests for refunds or cancellation of services. These variations of the Chicago Illinois Return Authorization Form cater to different industries and help streamline the return process specific to each business type.

Chicago Illinois Return Authorization Form

Description

How to fill out Chicago Illinois Return Authorization Form?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the Chicago Return Authorization Form.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Chicago Return Authorization Form will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Chicago Return Authorization Form:

- Ensure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Chicago Return Authorization Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Your check stubs or letter should include the following information: your name, your Social Security number, tax year, amount of Illinois Income Tax withheld, and. total wages.

You must ? attach one copy to your tax return, and ? mail a second copy to the Illinois Department of Revenue, P.O. Box 19029, Springfield, Illinois 62794-9029.

The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government - the same way that Value Added Tax (VAT) is paid in many countries.

What should I attach to my IL-1040 if I cannot obtain copies of my W-2 forms? your name, your Social Security number, tax year, amount of Illinois Income Tax withheld, and. total wages.

A complete copy of the federal ??return with accompanying schedules must follow when Form 1 or 1-NPR is filed. Copies should include the complete federal form and all the supporting documents.

To file a City of Chicago tax return via our web site please visit . All you need is your IRIS (Integrated Revenue Information System) account number and your unique PIN to begin the filing process.

Most states require you to mail in a copy of your Federal Return with your state return.

Although it can vary (slightly) by state, generally speaking the state filing instructions invariably say to attach pages 1 and 2 of your Form 1040 (or 1040A), or just the first page of your Form 1040EZ.

You must ? attach one copy to your tax return, and ? mail a second copy to the Illinois Department of Revenue, P.O. Box 19029, Springfield, Illinois 62794-9029.

Attach copies of Income Forms W-2s, 1099s, and other income documents to the front of your Form 1040. You should send your Tax Return through the US Postal Service with a method for delivery tracking. This way, you will know when the IRS receives your Tax Return.