This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Orange California Loan Application - Review or Checklist Form for Loan Secured by Real Property

Description

How to fill out Orange California Loan Application - Review Or Checklist Form For Loan Secured By Real Property?

Creating forms, like Orange Loan Application - Review or Checklist Form for Loan Secured by Real Property, to manage your legal matters is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for various scenarios and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Orange Loan Application - Review or Checklist Form for Loan Secured by Real Property template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before downloading Orange Loan Application - Review or Checklist Form for Loan Secured by Real Property:

- Make sure that your form is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Orange Loan Application - Review or Checklist Form for Loan Secured by Real Property isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our service and download the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can try and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Every lender has unique eligibility and application requirements, but lenders often look for the same basic documentation such as personal and business credit reports, bank statements, financial statements and your business plan.

If any of the basic loan terms are not what you are expecting, ask questions and be wary. Double-check the loan amount, loan type, loan term, interest rate, monthly payment amount, whether there is a prepayment penalty, whether you are paying points or receiving credits, and other key details.

Personal loan documents your lender may require Loan application. Each lender will have its own application to initiate the loan process, and this application can look different from lender to lender.Proof of identity.Employer and income verification.Proof of address.

Loan Checklist means a list delivered to the Custodian in connection with delivery of a Loan to the Custodian that identifies the items contained in the related Loan File.

Loan documents are documents provided and requested by lenders for the purpose of providing a loan. They are typically statements of personal and financial information of the borrower to approve a loan. These documents are used by the lenders to evaluate whether or not they will provide you with a loan.

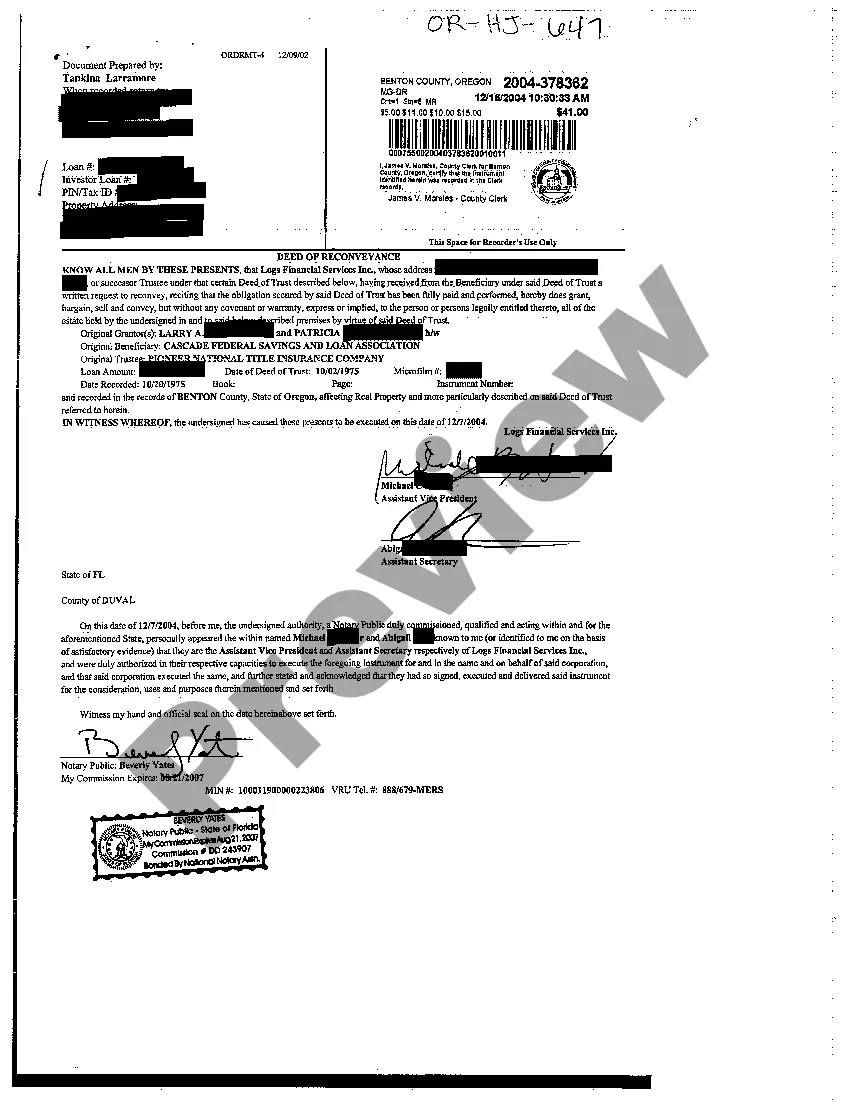

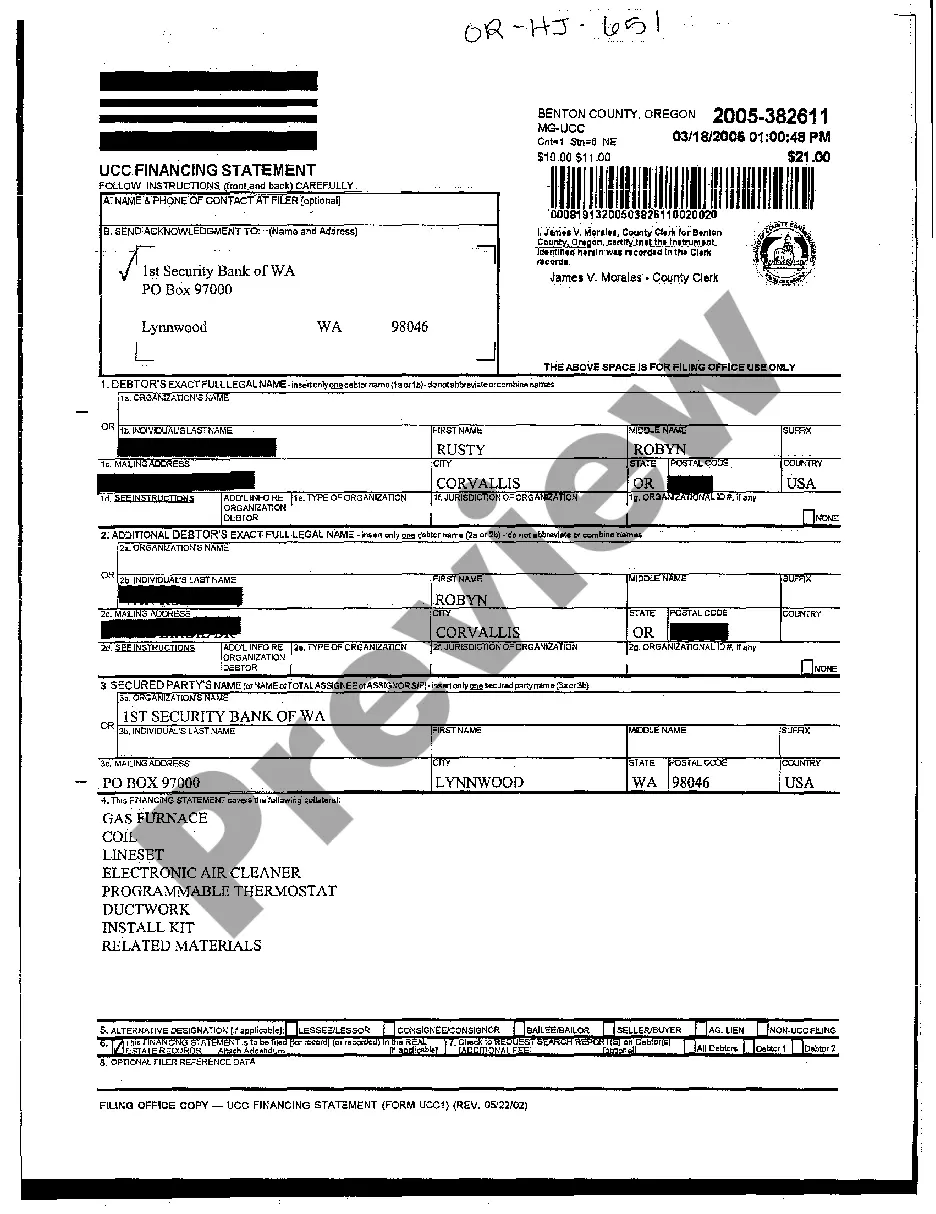

The most common documents are related to mortgages, deeds, easements, foreclosures, estoppels, leases, licenses, and fees, among other kinds of documents. The most important real estate documents list ownership, encumbrances, and lien priority.

Here are the some of the basic documents you will to get pre-approved before searching for a home: Last 30 Days Pay Stubs. Last 2 Years Complete Tax Returns with W2 and 1099 Forms. Last 2 Months Bank Statements (All Pages) Legible Copy Of Driver's License and Social Security Card.