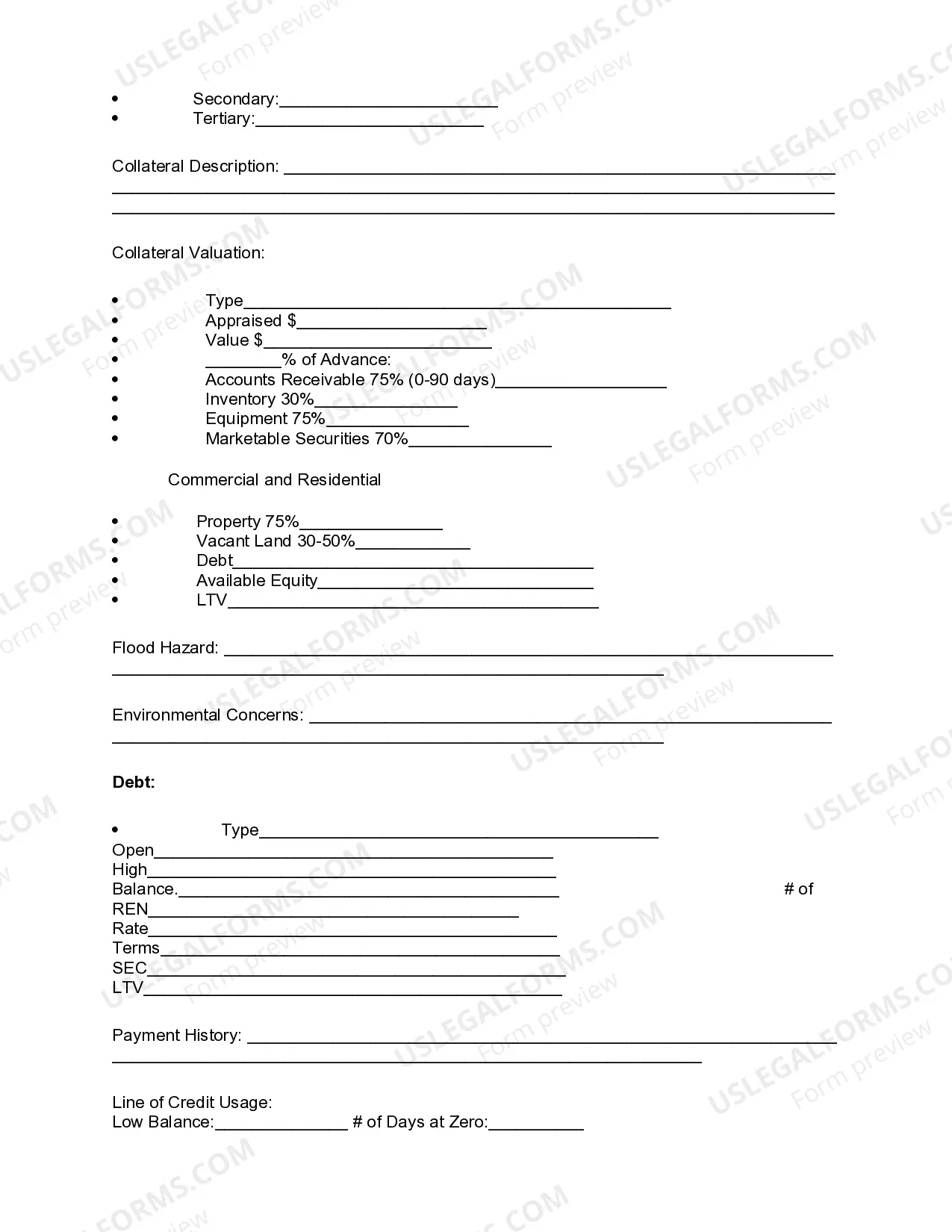

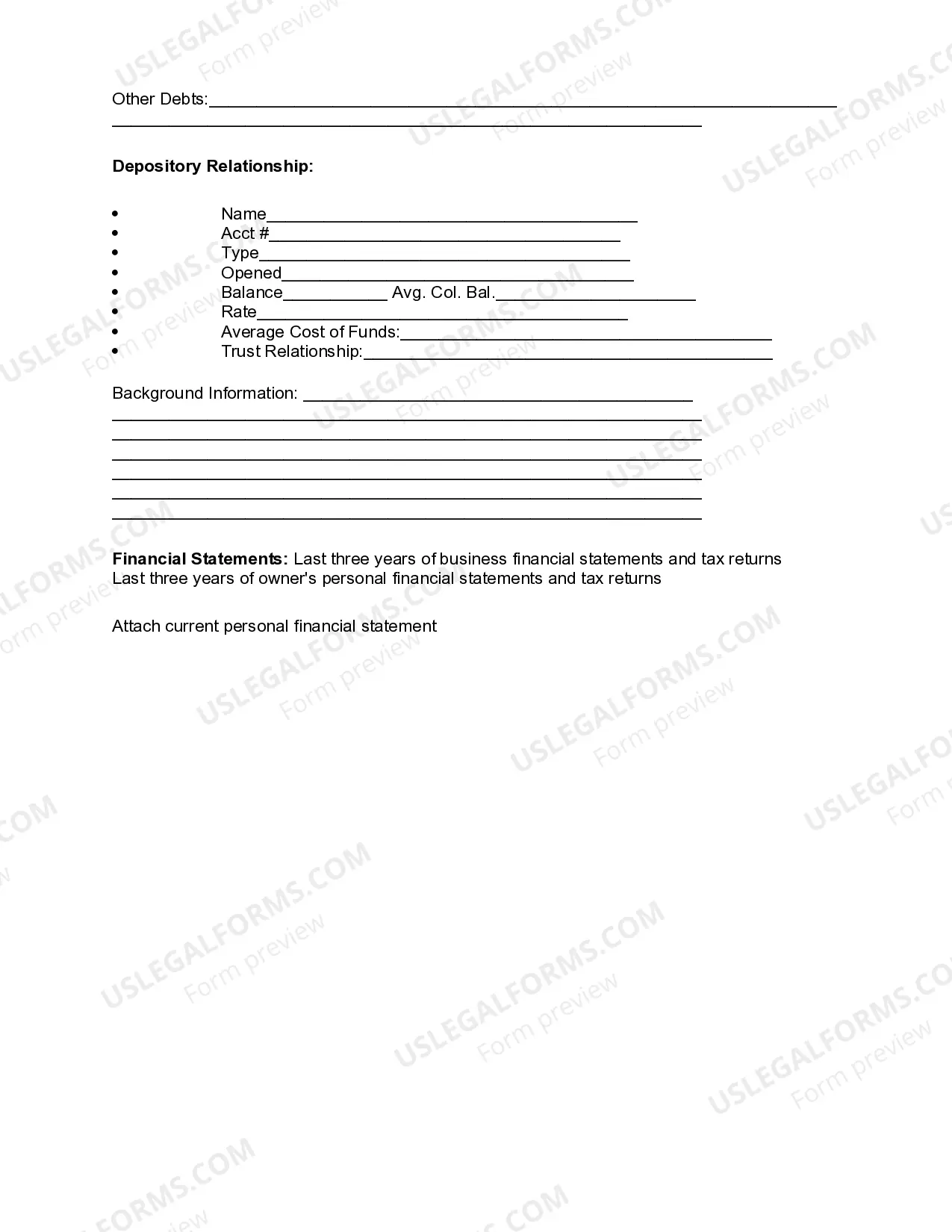

Chicago is a bustling city located in the state of Illinois. It is known for its diverse culture, iconic landmarks, and vibrant neighborhoods. With a rich history and a thriving economy, Chicago offers numerous opportunities for residents and visitors alike. In terms of loan applications in Chicago, there are several types of review processes that individuals or businesses may undergo. These include: 1. Mortgage Loan Application Review: This type of loan application is specific to individuals who seek financing for purchasing or refinancing a property in Chicago. Lenders carefully scrutinize factors such as credit history, income, employment stability, and property valuation to determine the borrower's capacity to repay the loan. 2. Personal Loan Application Review: Personal loans are unsecured loans that individuals can use for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Lenders evaluate factors like credit score, income, and debt-to-income ratio to determine the applicant's eligibility for the loan. 3. Business Loan Application Review: Entrepreneurs and small business owners in Chicago often apply for business loans to fund their operations, expand their businesses, or invest in new ventures. Lenders assess factors such as the business's financial statements, creditworthiness, business plan, and industry outlook to determine the loan's viability. Regardless of the loan type, the review process for loan applications in Chicago typically involves thorough evaluation and analysis to mitigate risks for both lenders and borrowers. Lenders assess the applicant's creditworthiness, financial stability, and ability to repay the loan based on various factors. Financial institutions may verify income, employment history, credit reports, and collateral (if applicable) to make informed lending decisions. It is crucial for loan applicants in Chicago to provide accurate and complete information to expedite the application review process. Failing to do so may result in delays or even rejection of the loan application. Additionally, applicants should research and approach reputable lenders to ensure a transparent and favorable lending experience. In summary, Chicago offers a wide range of loan application opportunities for individuals and businesses. The review processes for various loan types, such as mortgage loans, personal loans, and business loans, involve careful examination of financial factors to determine eligibility. Applicants should diligently provide accurate information and collaborate with reputable lenders to ensure a smooth loan application process in Chicago, Illinois.

Chicago Illinois Review of Loan Application

Description

How to fill out Chicago Illinois Review Of Loan Application?

Do you need to quickly create a legally-binding Chicago Review of Loan Application or probably any other document to handle your own or corporate matters? You can select one of the two options: contact a legal advisor to write a valid document for you or create it entirely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you receive neatly written legal documents without having to pay sky-high fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-compliant document templates, including Chicago Review of Loan Application and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, double-check if the Chicago Review of Loan Application is adapted to your state's or county's regulations.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the search again if the template isn’t what you were looking for by using the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Chicago Review of Loan Application template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the templates we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!