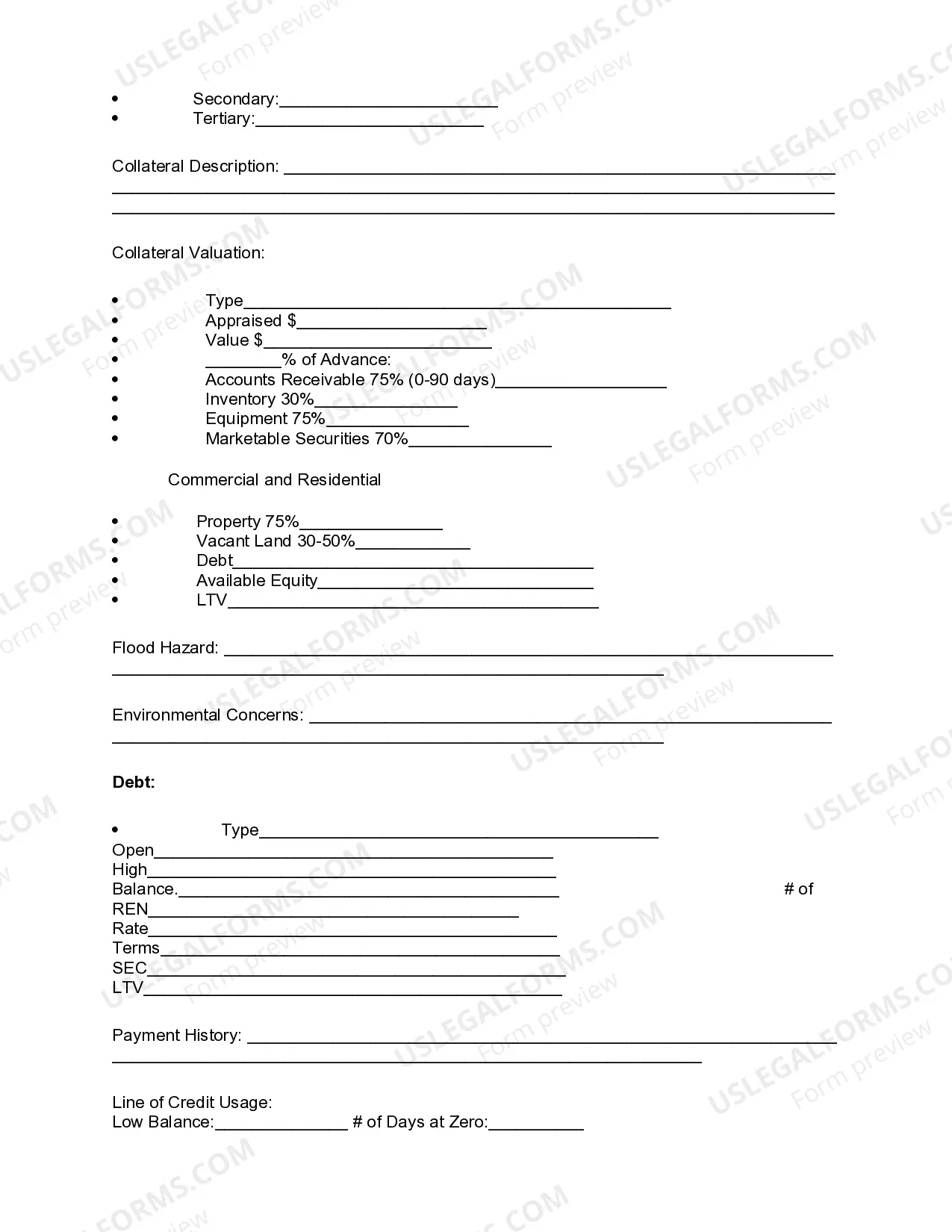

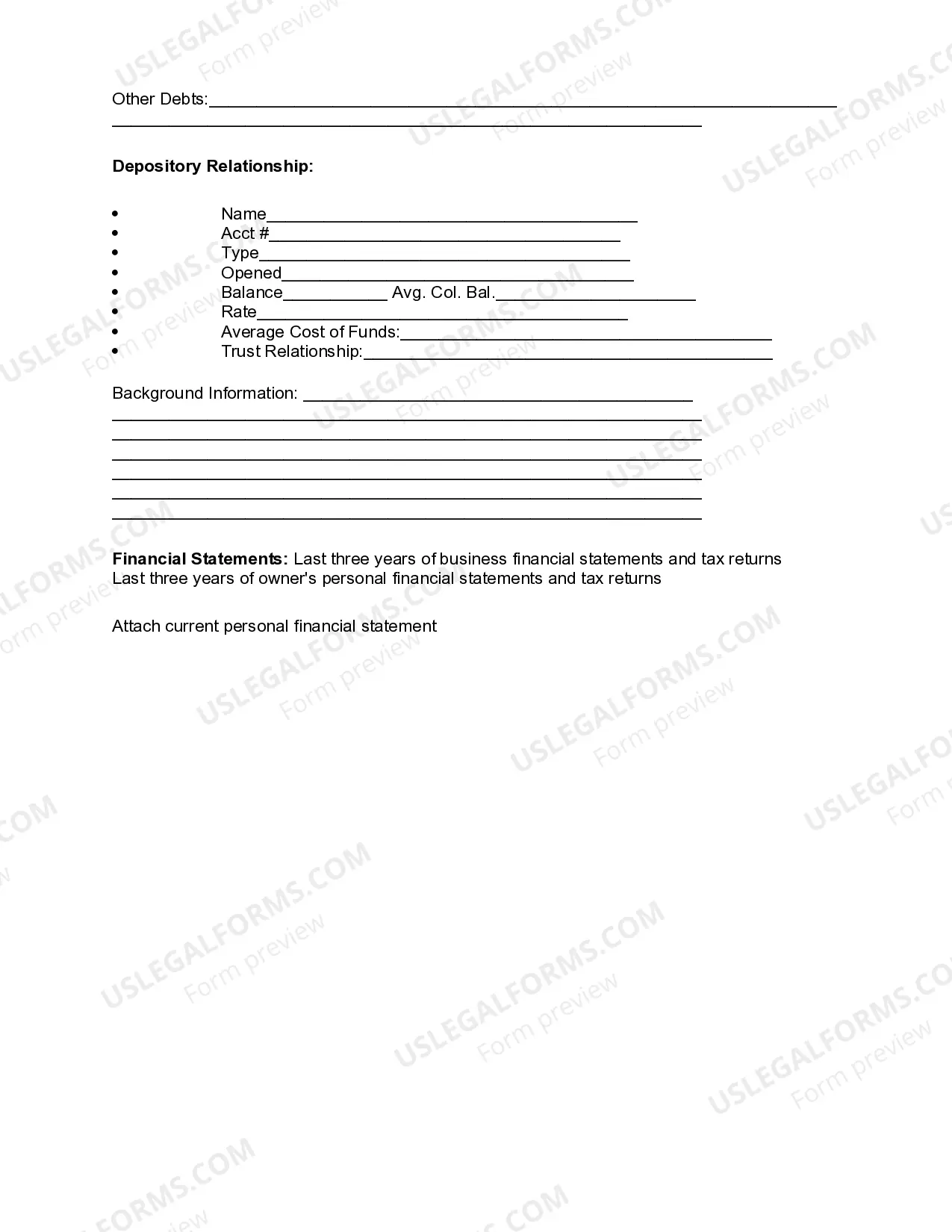

Fairfax Virginia Review of Loan Application: A Comprehensive Overview Introduction: In Fairfax, Virginia, the review of loan applications plays a crucial role in facilitating financial transactions for individuals and businesses. This article provides a detailed description of what Fairfax Virginia Review of Loan Application encompasses, covering its importance, process, and different types available. Key Factors in Fairfax Virginia Review of Loan Application: 1. Loan Application Assessment: Fairfax Virginia Review of Loan Application involves a careful evaluation of loan requests to determine applicants' creditworthiness and ability to repay the borrowed funds. It considers various aspects such as personal financial statements, credit history, income documentation, collateral, and purpose of the loan. 2. Credit Analysis: Credit analysis is a vital part of the Fairfax Virginia Review of Loan Application process. Lenders thoroughly examine an applicant's credit report, looking at their credit score, payment history, outstanding debts, and utilization ratio to assess their creditworthiness. 3. Income Verification: In this type of loan application review, lenders verify an applicant's income by analyzing tax returns, pay stubs, W-2 forms, or business financial statements. This step ensures that borrowers have a stable income source to fulfill their repayment obligations. 4. Collateral Evaluation: Some loan applications may require collateral to secure the borrowed funds. In such cases, the Fairfax Virginia Review of Loan Application includes a collateral assessment, where lenders determine the value and marketability of the proposed collateral to mitigate risks associated with non-payment. 5. Loan Purpose Assessment: Lenders review loan applications to understand the purpose behind the borrowing request. This assessment helps ensure that the funds will be utilized for reasonable and legal purposes, aligning with the loan's terms and conditions. Different Types of Fairfax Virginia Review of Loan Application: 1. Mortgage Loan Application Review: This review specializes in mortgage loans, considering factors such as the applicant's credit score, income stability, property appraisal, down payment, and debt-to-income ratio. 2. Personal Loan Application Review: For personal loans, this review focuses on credit history, employment stability, income verification, and debt-to-income ratio to evaluate an individual's repayment ability. 3. Small Business Loan Application Review: Small businesses seeking funding are subject to specific loan application reviews. Lenders evaluate the company's financial statements, business plan, cash flow projections, and collateral to determine their creditworthiness. Conclusion: Fairfax Virginia Review of Loan Application encompasses a multifaceted process that involves analyzing various financial factors to evaluate an applicant's creditworthiness and loan repayment capacity. By conducting credit analysis, income verification, collateral evaluation, and purpose assessment, lenders can make informed decisions regarding loan approvals. Whether it is mortgage, personal, or small business loans, the Fairfax Virginia Review of Loan Application ensures a thorough examination of applications, aiding financial institutions in mitigating potential risks and maintaining efficient lending practices.

Fairfax Virginia Review of Loan Application

Description

How to fill out Fairfax Virginia Review Of Loan Application?

Are you looking to quickly create a legally-binding Fairfax Review of Loan Application or probably any other form to handle your personal or corporate matters? You can select one of the two options: hire a professional to write a valid paper for you or create it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you receive neatly written legal papers without paying unreasonable fees for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-compliant form templates, including Fairfax Review of Loan Application and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- First and foremost, carefully verify if the Fairfax Review of Loan Application is tailored to your state's or county's laws.

- In case the form comes with a desciption, make sure to verify what it's intended for.

- Start the search again if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Fairfax Review of Loan Application template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Moreover, the templates we offer are updated by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!