Nassau New York Review of Loan Application is a comprehensive evaluation process carried out by financial institutions in Nassau County, New York, to assess the eligibility and credibility of individuals or businesses applying for loans. This review is essential to mitigate risks and ensure responsible lending practices. Keywords: Nassau New York, Review of Loan Application, loan eligibility, financial institutions, Nassau County, risks, responsible lending practices. The Nassau New York Review of Loan Application involves a systematic examination of various factors to determine the borrower's creditworthiness and ability to repay the loan. Financial institutions utilize specific criteria and documentation to perform this assessment accurately. Different Types of Nassau New York Review of Loan Application: 1. Personal Loan Application Review: Financial institutions conduct a thorough analysis of individuals' credit history, income, employment stability, and other relevant factors to evaluate their ability to repay personal loans. 2. Business Loan Application Review: For businesses seeking financial support, lenders scrutinize their financial statements, business plans, cash flow projections, and creditworthiness to determine the feasibility of loan approval. 3. Mortgage Loan Application Review: Mortgage lenders evaluate applicants' credit history, income, employment stability, property value, and debt-to-income ratio to assess mortgage eligibility and determine suitable loan terms. 4. Small Business Loan Application Review: Financial institutions review small business owners' credit history, business plans, collateral, financial statements, and other relevant documents to gauge the viability of granting loans to support their growth and expansion. During the Nassau New York Review of Loan Application process, lenders analyze the applicant's credit score, debt-to-income ratio, employment history, and financial stability to minimize potential risks and assure the loan's successful repayment. This assessment assists lenders in making informed decisions and offering suitable loan terms, such as interest rates, repayment period, and loan amount. Moreover, additional verification steps may be involved, including background checks, evaluation of collateral (if applicable), and interviews with the applicants. It is crucial for loan applicants to provide accurate and complete information during the application process to facilitate the Nassau New York Review of Loan Application. Ultimately, this rigorous assessment ensures responsible lending practices, protecting both borrowers and lenders in Nassau County, New York.

Nassau New York Review of Loan Application

Description

How to fill out Nassau New York Review Of Loan Application?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Nassau Review of Loan Application, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any activities related to paperwork completion straightforward.

Here's how you can find and download Nassau Review of Loan Application.

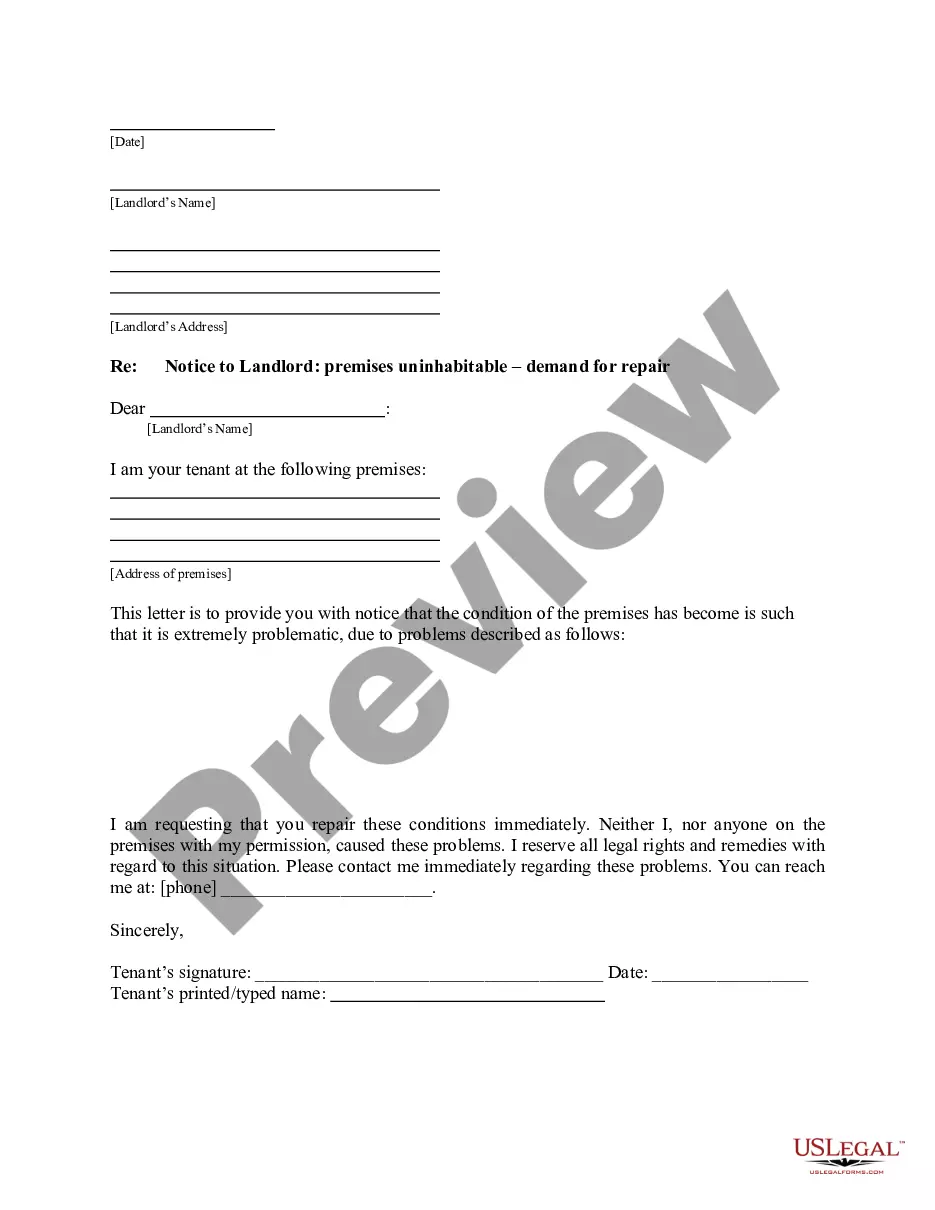

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar forms or start the search over to find the appropriate document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Nassau Review of Loan Application.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Nassau Review of Loan Application, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you need to cope with an exceptionally difficult case, we advise getting an attorney to check your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork effortlessly!