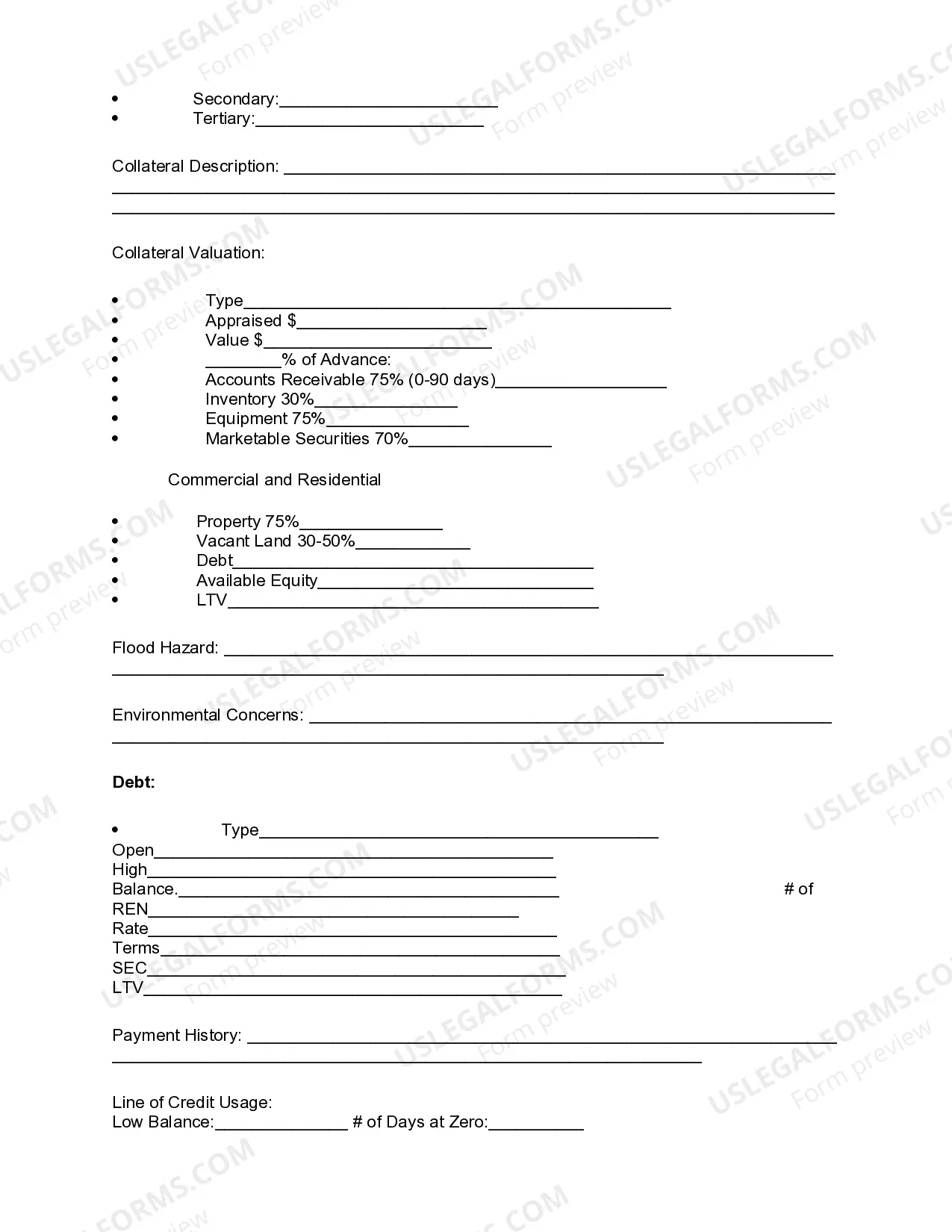

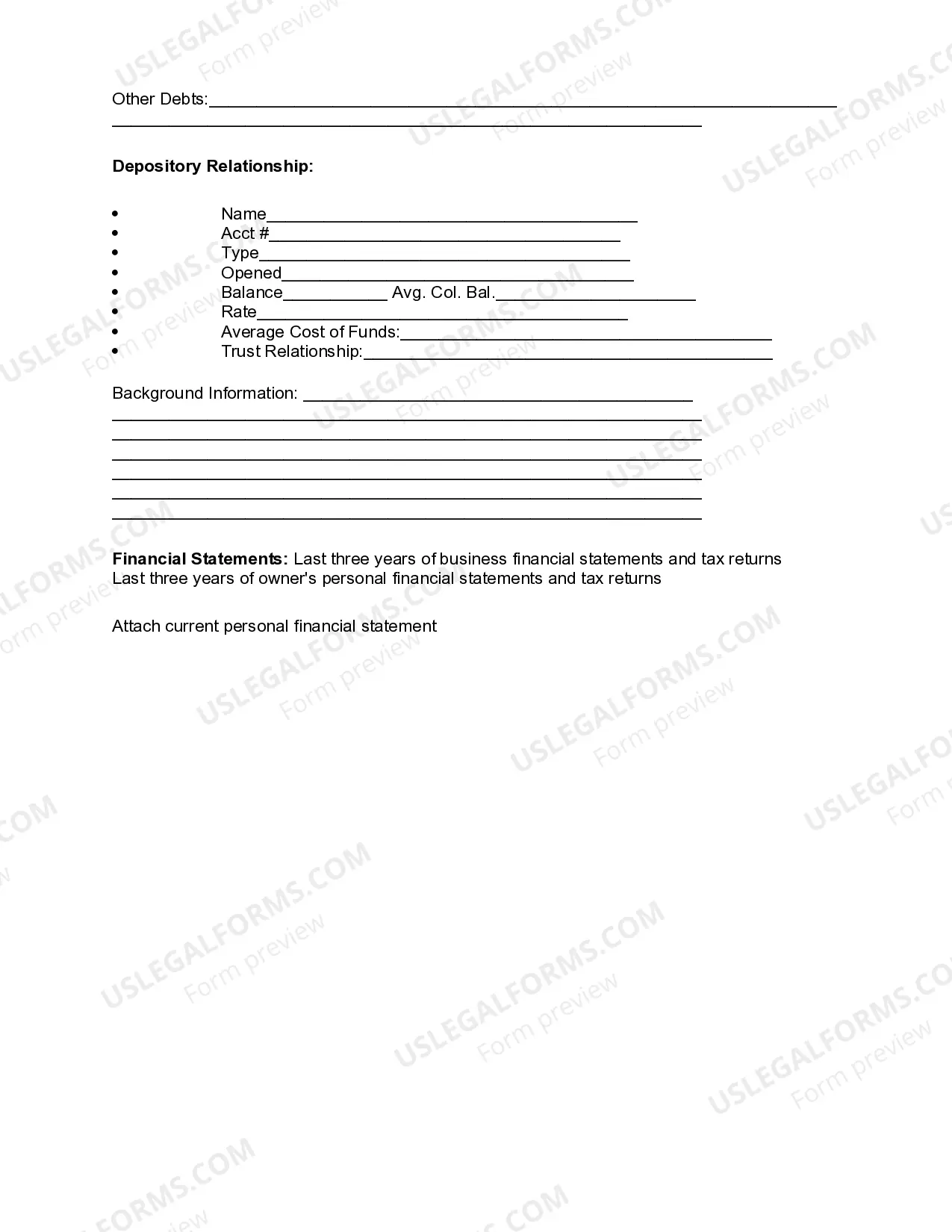

Are you thinking of applying for a loan in Phoenix, Arizona? Before you start the loan application process, it is crucial to understand what Phoenix Arizona Review of Loan Application entails. This detailed description will guide you through the process, including the various types of loan applications available. Phoenix, Arizona, is a vibrant city known for its booming economy, rich history, and favorable living conditions. Whether you are a resident or planning to move to the Valley of the Sun, there might come a time when you need financial help to achieve your goals, whether it's purchasing a new home, starting a business, or funding other projects. In such cases, a loan application becomes essential. Review of Loan Application in Phoenix, Arizona, involves a thorough assessment of the applicant's financial details and creditworthiness. Lenders require this to determine the risk associated with lending money and ensure that the borrower has the means to repay the loan. There are several types of loan applications offered in Phoenix, Arizona, catering to diverse needs and purposes: 1. Mortgage Loan Application: Homebuyers in Phoenix looking to finance a home purchase will need to complete a mortgage loan application. This type of loan application requires extensive documentation, including income verification, credit history, employment details, and property information. Lenders review these documents to assess the borrower's eligibility and determine the loan amount for which they qualify. 2. Personal Loan Application: Individuals in need of immediate funds for personal reasons, such as consolidating debt, paying medical bills, or financing a wedding, can apply for a personal loan. These loans are usually unsecured, meaning no collateral is required. The review process involves evaluating the applicant's credit score, income, employment status, and other relevant factors. 3. Business Loan Application: Entrepreneurs or business owners seeking financial assistance to start, expand, or manage their businesses can apply for a business loan. Lenders review these applications to assess the viability of the business, analyze financial projections, and evaluate the borrower's creditworthiness. Business loan applications may vary depending on the type of loan, such as startup loans, equipment financing, or lines of credit. 4. Auto Loan Application: If you're planning to buy a car in Phoenix, you might consider an auto loan. Auto loan applications generally require information about the desired vehicle, personal details, employment history, and creditworthiness. Lenders review this information to determine the loan amount, interest rate, and repayment terms. When applying for any of these loan types in Phoenix, Arizona, ensure you provide accurate and up-to-date information. In addition, it is essential to have a good credit score, stable income, and a reasonable debt-to-income ratio to increase your chances of receiving loan approval. The lenders will review your application meticulously to assess your credit history, employment stability, and financial capacity to repay the loan. In conclusion, Phoenix, Arizona, provides various loan application options to meet the financial needs of its residents. Whether you require a mortgage loan, personal loan, business loan, or auto loan, understanding the review process and the associated factors will help you present a compelling case to lenders. Stay organized, provide accurate information, and be prepared to demonstrate your creditworthiness to maximize your chances of loan approval.

Phoenix Arizona Review of Loan Application

Description

How to fill out Phoenix Arizona Review Of Loan Application?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Phoenix Review of Loan Application, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Phoenix Review of Loan Application from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Phoenix Review of Loan Application:

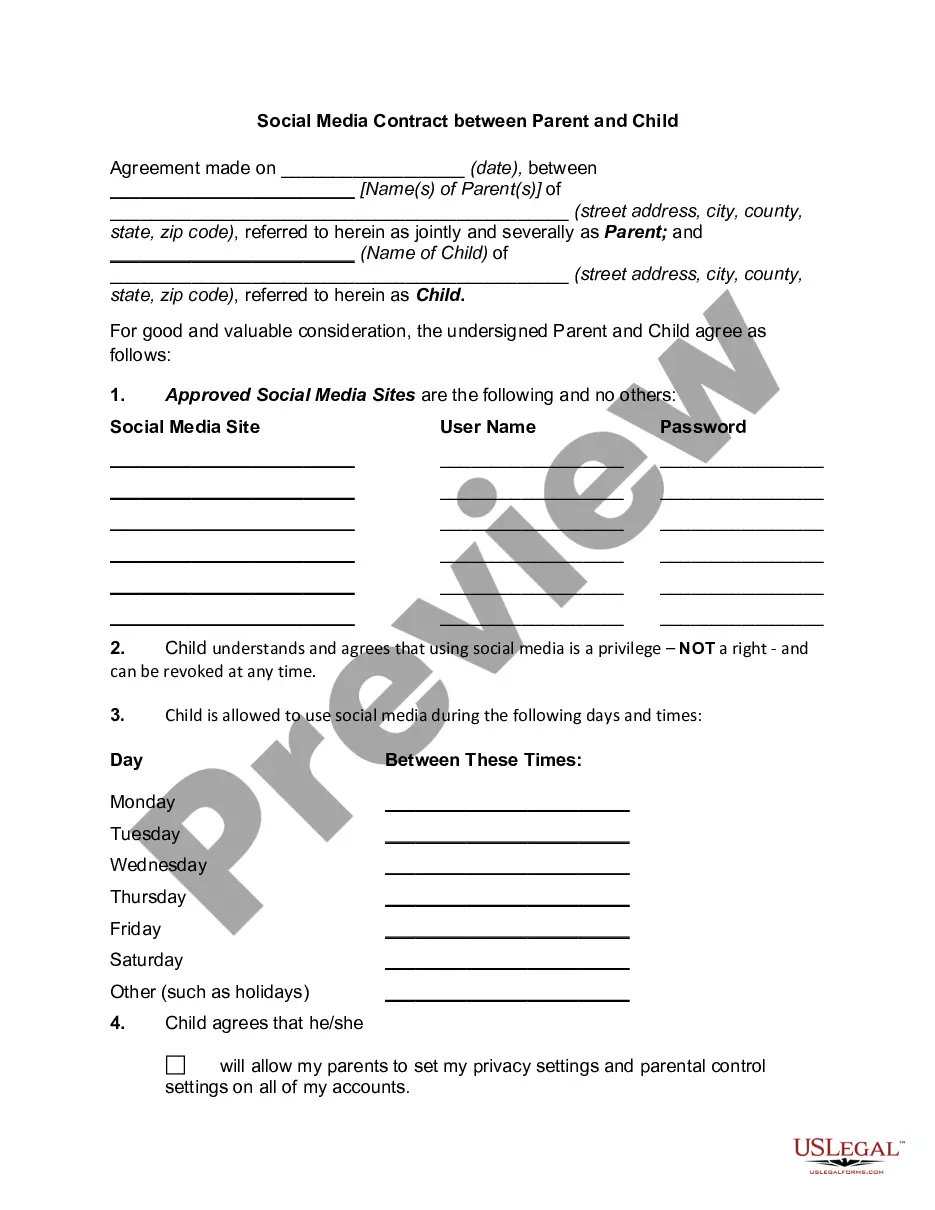

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!