Salt Lake City, Utah is a vibrant and populous city nestled in the heart of the Rocky Mountains. It serves as the capital city of Utah and is renowned for its stunning natural landscapes, booming economy, and rich cultural heritage. When it comes to reviewing loan applications, Salt Lake City offers various options catered to different needs and preferences. Here are a few different types of Salt Lake Utah Review of Loan Application: 1. Mortgage Loan Application: Salt Lake City is home to a robust real estate market, and individuals and families looking to purchase a home can benefit from various mortgage loan options available. These loans are designed to help potential homeowners secure financing for their dream homes, and lenders in Salt Lake City offer competitive rates and flexible terms for mortgage loan applicants. 2. Small Business Loan Application: Salt Lake City has a thriving business community, and entrepreneurs looking to start or expand their ventures can explore small business loan options. These loans cater to the specific needs of small businesses, providing them with the necessary capital to fund operations, purchase equipment, or hire employees. Salt Lake City's supportive business environment and strong financial institutions make it an excellent location for entrepreneurs to seek small business loans. 3. Personal Loan Application: Sometimes individuals need to borrow money for personal reasons such as debt consolidation, home renovations, or unexpected expenses. Salt Lake City's financial institutions offer personal loan products that provide borrowers with the necessary funds to address their specific needs. These loans may have varying interest rates and repayment terms, allowing borrowers to choose the option that best suits their financial situation. 4. Student Loan Application: With the presence of renowned educational institutions in Salt Lake City, many students seek loans to fund their higher education. Student loan options are available to assist aspiring students in pursuing their academic goals. Salt Lake City lenders offer competitive interest rates and flexible repayment options to ensure that students have access to the education they desire. In conclusion, Salt Lake City, Utah, offers a myriad of loan options tailored to meet the diverse financial needs of its residents. Whether you're a prospective homeowner, a small business owner, an individual in need of some extra funds, or a student pursuing higher education, Salt Lake City's robust financial sector has a loan application process that can be reviewed and tailored to your specific needs.

Salt Lake Utah Review of Loan Application

Description

How to fill out Salt Lake Utah Review Of Loan Application?

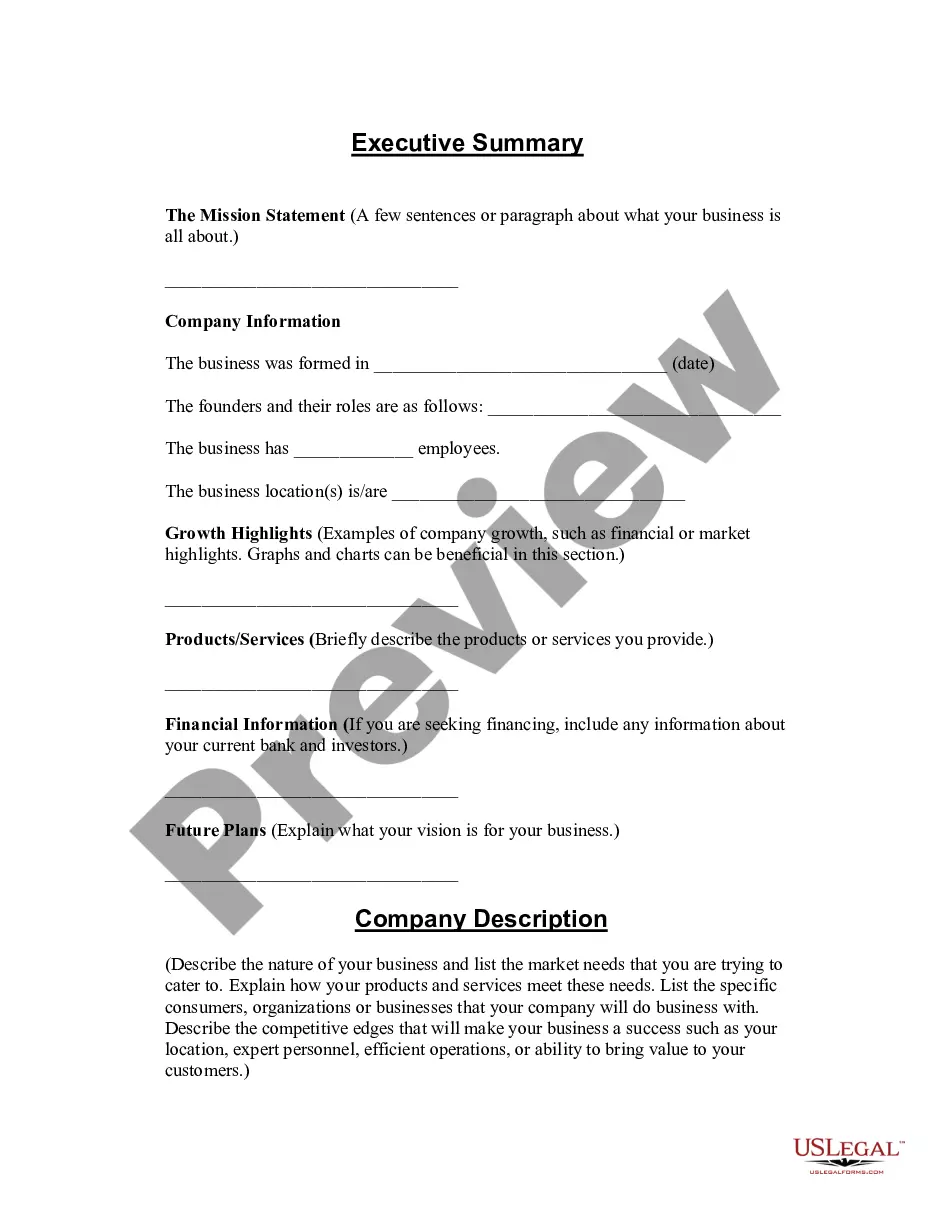

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Salt Lake Review of Loan Application suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Aside from the Salt Lake Review of Loan Application, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Salt Lake Review of Loan Application:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Salt Lake Review of Loan Application.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Online lenders: Less than 5 business days. Banks: 1-7 business days. Credit unions: 1-7 business days. Payday loans, pawn shop loans, and car title loans: Can be same day.

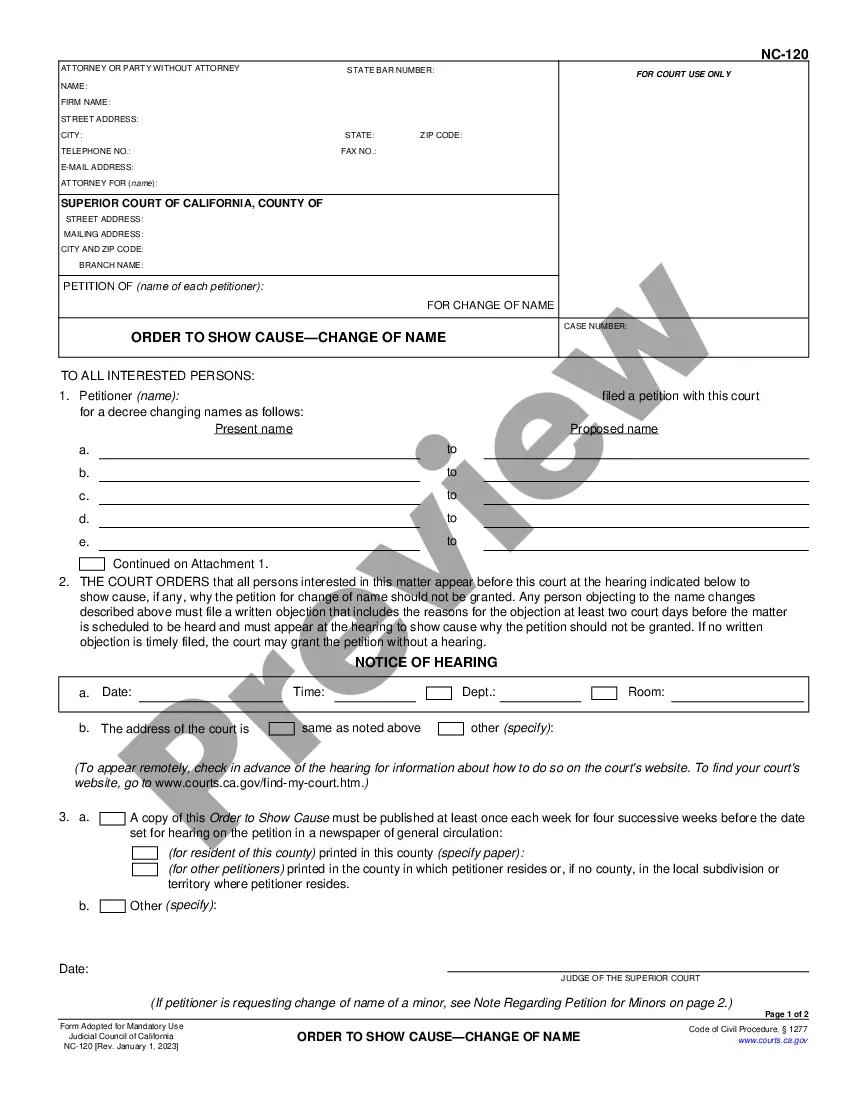

An application is defined as the submission of six pieces of information: (1) the consumer's name, (2) the consumer's income, (3) the consumer's Social Security number to obtain a credit report (or other unique identifier if the consumer has no Social Security number), (4) the property address, (5) an estimate of the

The six items are the consumer's name, income and social security number (to obtain a credit report), the property's address, an estimate of property's value and the loan amount sought.

If you're approved, you'll get a similar letter or statement, although many lenders will give you a phone call, as they want to close on the loan as quickly as possible. In the meantime, you can put your focus on other things, such as car insurance.

Tax returns. Mortgage lenders want to get the full story of your financial situation.Pay stubs, W-2s or other proof of income. Lenders may ask to see your pay stubs from the past month or so.Bank statements and other assets.Credit history.Gift letters.Photo ID.Renting history.6 tips to save for a house.

Below are the stages that are critical components of Loan Origination process : 1) Pre-Qualification Process : 2) Loan Application : 3) Application Processing : 4) Underwriting Process : 5) Credit Decision. 6) Quality Check. 7) Loan Funding.

Loan Application Form means the application form and any related materials submitted by the Borrower to the Initial Lender in connection with an application for the Loans under Division A, Title IV, Subtitle A of the CARES Act.

Loan Package means a set of Loan documents that (a) are dated or have been completed or provided no more than thirty days from the date of Lender's receipt; (b) include an Application, Credit Report, deposit and employment verifications, appraisal, Loan Estimate, Preliminary Title Report, and other Loan documents, if

Getting approved for a personal loan generally takes anywhere from one day to one week. As we mentioned above, how long it takes for a personal loan to go through depends on several factors, like your credit score. However, one of the primary factors that will affect your approval time is where you get your loan from.

In Review: Loan request is pending a final review by our Credit Department to verify certain information in the application before the loan is issued. Learn more about "In Review".