The Hennepin Minnesota Business Deductions Checklist is an essential tool for businesses operating within Hennepin County to ensure they are maximizing their tax deductions and compliance with state and federal laws. This checklist provides a detailed overview of the different business deductions available and serves as a comprehensive guide for business owners, accountants, and tax professionals. Some key keywords relevant to the Hennepin Minnesota Business Deductions Checklist may include: 1. Hennepin County: Referring to the county located in the state of Minnesota where businesses must adhere to specific tax regulations and guidelines. 2. Business Deductions: These are allowable expenses that can be deducted from the business's taxable income, reducing the amount of tax owed. A wide range of deductible expenses may be included, such as office supplies, advertising expenses, employee wages, and travel expenses. 3. Tax Compliance: This term refers to the process of adhering to the tax laws and regulations set forth by the relevant tax authorities, in this case, Hennepin County and the state of Minnesota. 4. Tax Deductions: These are specific expenses that a business can subtract from its taxable income, resulting in a lower tax liability. Deductible expenses may vary depending on the nature of the business and relevant tax regulations. 5. Checklists: A checklist is a tool used to systematically organize and track tasks or steps to be completed. In the context of business deductions, a checklist ensures that all necessary expenses eligible for deductions are accounted for to minimize tax liability. Different types of Hennepin Minnesota Business Deductions Checklists may include: 1. General Business Deductions Checklist: This type of checklist outlines the most common deductible expenses across various industries, such as advertising, travel, and office supplies. 2. Industry-Specific Deductions Checklist: Some businesses may have unique expenses and deductions specific to their industry, such as research and development costs for technology companies or specialized equipment deductions for manufacturing businesses. 3. Startup Business Deductions Checklist: Startups often have different deductible expenses during their initial phases, such as incorporation fees, costs associated with market research, and recruitment expenses. 4. Employee-related Deductions Checklist: This checklist focuses on deductions related to employee compensation, benefits, and other associated expenses, including salaries, health insurance premiums, retirement plans, and travel allowances. 5. Property-related Deductions Checklist: For businesses that own or lease property, this checklist covers deductions related to rent/mortgage payments, property taxes, maintenance and repairs, and depreciation. Overall, the Hennepin Minnesota Business Deductions Checklist is a valuable resource for businesses in Hennepin County, helping them identify and claim all eligible deductions while staying in full compliance with tax laws and regulations.

Hennepin Minnesota Business Deductions Checklist

Description

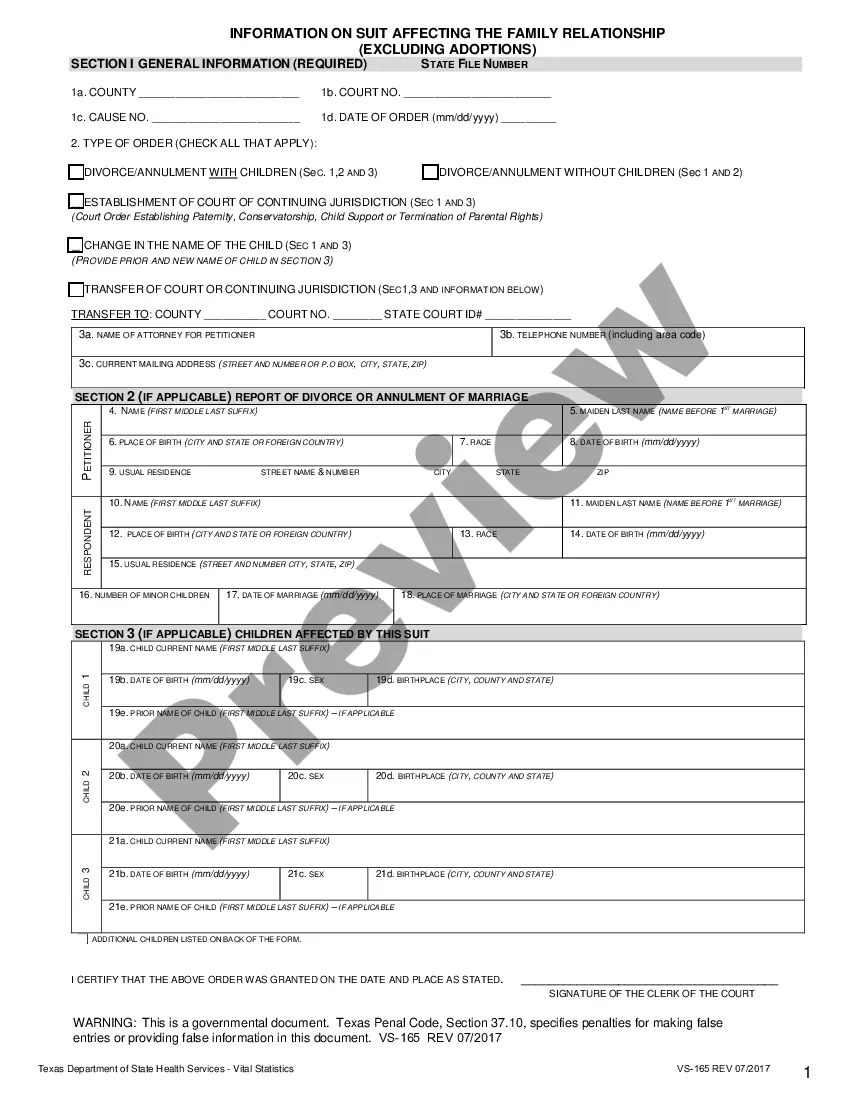

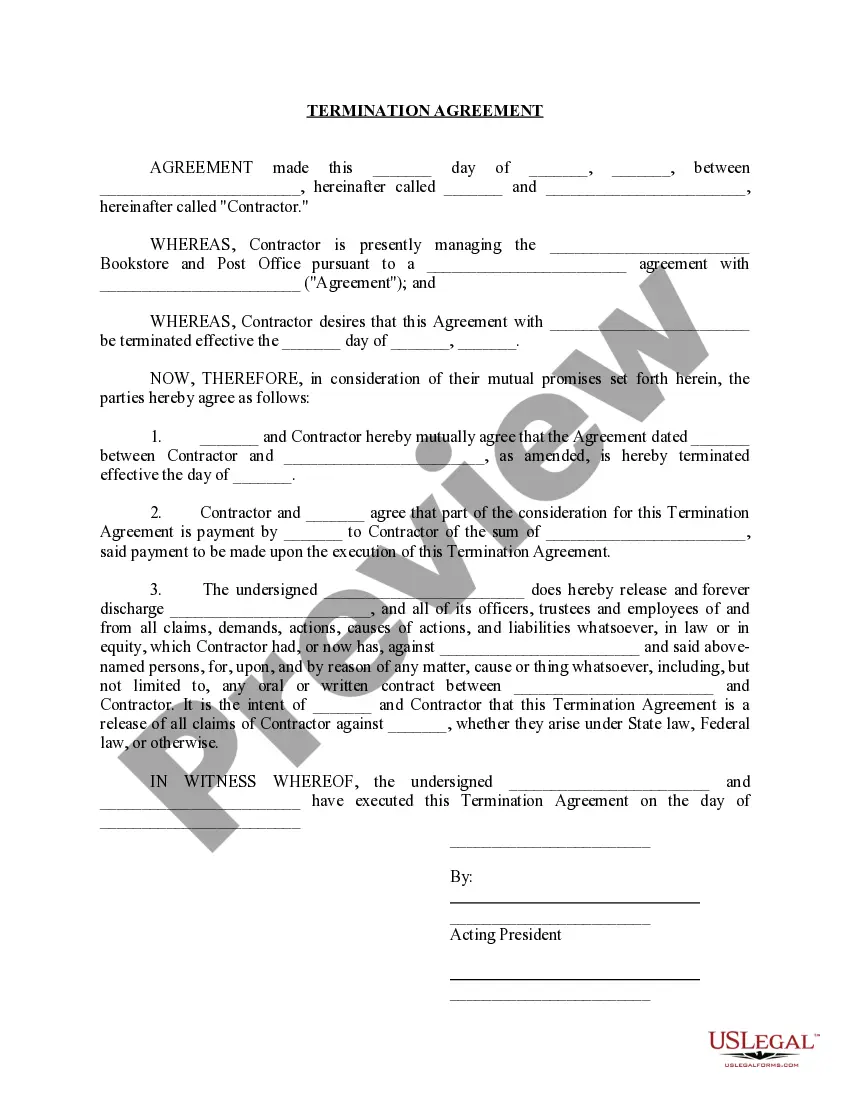

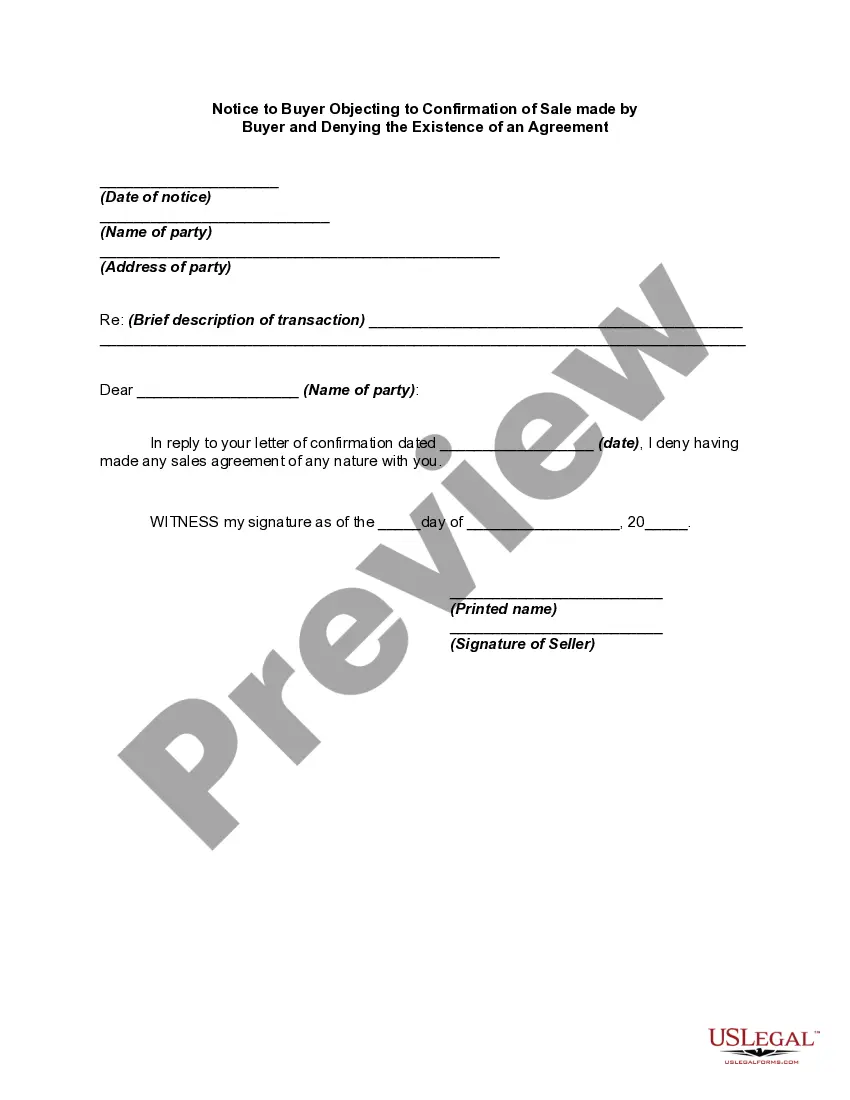

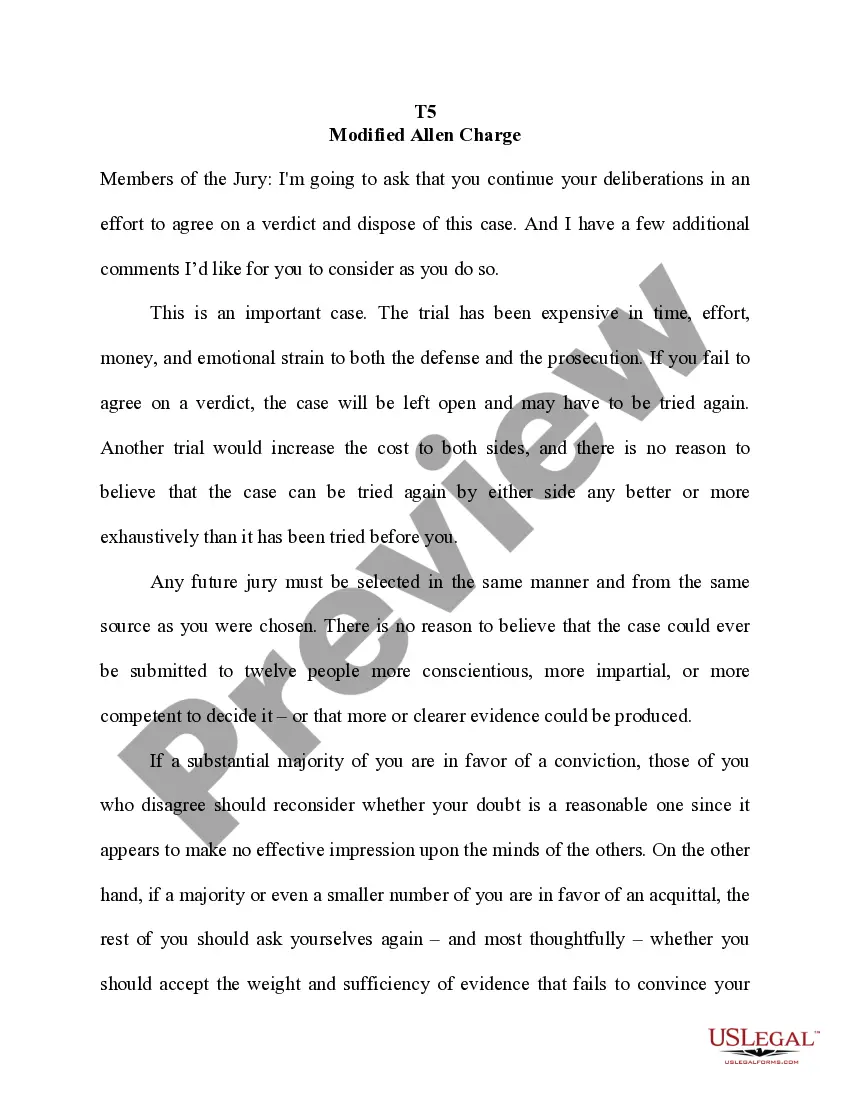

How to fill out Hennepin Minnesota Business Deductions Checklist?

Creating paperwork, like Hennepin Business Deductions Checklist, to manage your legal matters is a challenging and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms intended for a variety of scenarios and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Hennepin Business Deductions Checklist form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before downloading Hennepin Business Deductions Checklist:

- Make sure that your template is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Hennepin Business Deductions Checklist isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start utilizing our service and download the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!