Los Angeles California Business Deductions Checklist: A Comprehensive Guide for Tax Filings When it comes to managing your business finances in Los Angeles, California, it's crucial to maximize your deductions to minimize your tax liabilities. The Los Angeles California Business Deductions Checklist is a valuable tool to ensure you don't miss out on any eligible tax deductions specific to the region. By utilizing this helpful guide, businesses can effectively plan their finances while staying compliant with local and state tax regulations. Key Points: 1. Understanding Business Deductions in Los Angeles, California: — Start by grasping the fundamental concepts of business deductions in Los Angeles. — Explore different types of deductions allowed by Los Angeles tax laws to accurately offset your taxable income. — Familiarize yourself with specific regulations and requirements unique to Los Angeles. 2. Eligible Deductions for Los Angeles Businesses: — The checklist covers a comprehensive range of deductions for various industries and business types. — Identify deductions related to office expenses, rent, utilities, repairs, and maintenance. — Explore potential deductions for employee wages, benefits, and training expenses. — Evaluate eligibility for deductions regarding insurance premiums, professional services, business travel, and entertainment expenses. — Ensure you are aware of depreciation deductions for your business assets in Los Angeles. 3. Industry-Specific Deductions: — The Los Angeles California Business Deductions Checklist offers insights into industry-specific deductions, such as manufacturing, technology, entertainment, real estate, and more. — Gain a better understanding of deductions relevant to your specific business field. — Identify any unique deductions specific to Los Angeles, which may differ from other parts of California. 4. Special Deductions and Incentives for Los Angeles Businesses: — The checklist highlights any special deductions or incentives available exclusively to businesses operating within Los Angeles. — Explore tax credits or incentives related to sustainable practices, energy efficiency, research and development, hiring and training local workforce, and more. — Stay informed about any updated regulations or new deductions introduced by local authorities. 5. Importance of Record-Keeping and Documentation: — Keeping meticulous records and proper documentation is essential for maximizing your deductions. — The checklist emphasizes the significance of maintaining accurate records for business expenses and supports your claim during tax audits. — Employ digital tools and platforms to efficiently organize and store your expense receipts, invoices, and relevant documents. Different Types of Los Angeles California Business Deductions Checklists: 1. Small Business Deductions Checklist: — Tailored for small businesses operating in Los Angeles. — Focuses on deductions that are particularly relevant and beneficial for small-scale enterprises. 2. Startup Business Deductions Checklist: — Geared towards startups and entrepreneurial ventures in Los Angeles. — Highlights deductions that are essential for newly established businesses in their early stages. 3. Large Business Deductions Checklist: — Targets medium to large-sized corporations operating in Los Angeles. — Expands on the common deductions applicable to bigger enterprises with complex financial structures. In conclusion, the Los Angeles California Business Deductions Checklist serves as an invaluable resource for businesses operating in Los Angeles. By adhering to this comprehensive guide, businesses can ensure they fully leverage tax deductions, minimize tax liabilities, and maintain compliance with local tax laws. Stay up to date with the latest deduction strategies and optimize your financial planning in Los Angeles.

Los Angeles California Business Deductions Checklist

Description

How to fill out Los Angeles California Business Deductions Checklist?

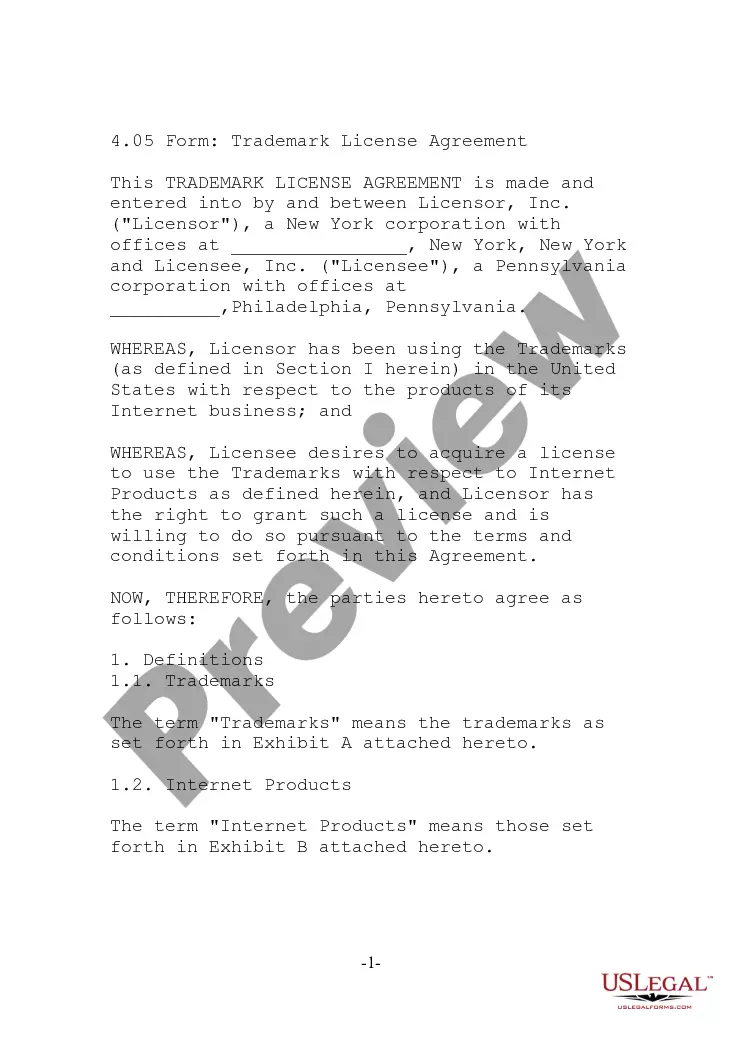

Are you looking to quickly create a legally-binding Los Angeles Business Deductions Checklist or probably any other document to take control of your own or business affairs? You can go with two options: contact a legal advisor to write a valid document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific document templates, including Los Angeles Business Deductions Checklist and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, double-check if the Los Angeles Business Deductions Checklist is tailored to your state's or county's regulations.

- In case the document has a desciption, make sure to check what it's intended for.

- Start the search over if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Los Angeles Business Deductions Checklist template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the documents we offer are reviewed by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!