Santa Clara California Business Deductions Checklist helps local businesses in Santa Clara, California, identify and maximize their eligible tax deductions. By utilizing this comprehensive checklist, businesses can ensure they are taking advantage of all available deductions, resulting in potential significant tax savings. It is crucial for entrepreneurs, small business owners, and self-employed individuals to review this checklist to ensure they are properly incorporating deductions into their tax returns. The Santa Clara California Business Deductions Checklist covers a wide range of categories and expenses that could potentially be deductible. It includes keywords such as business expenses, tax deductions, Santa Clara County, California tax laws, eligible write-offs, and more. This checklist is designed to be an essential tool for any Santa Clara-based entrepreneur or business owner who wants to reduce their tax liability. The different types of Santa Clara California Business Deductions Checklists may vary based on the business structure and industry. Here are a few examples: 1. Santa Clara California Sole Proprietor Business Deductions Checklist: Specifically designed for sole proprietors, this checklist outlines deductions relevant to their business type, such as home office expenses, advertising costs, travel expenses, and professional service fees. 2. Santa Clara California LLC Business Deductions Checklist: Tailored for limited liability companies (LCS), this checklist emphasizes deductible expenses unique to LCS, including employee salaries, rental expenses, membership fees, and operating costs. 3. Santa Clara California Freelancer Business Deductions Checklist: Freelancers and independent contractors can benefit from this checklist, which focuses on deductions applicable to their specific line of work, such as equipment purchases, software licenses, marketing expenses, and professional development costs. 4. Santa Clara California Retail Business Deductions Checklist: Targeting retail businesses operating in Santa Clara County, this checklist highlights deductions related to inventory, marketing campaigns, equipment upgrades, employee training, and lease costs. 5. Santa Clara California Restaurant Business Deductions Checklist: Catering to the restaurant industry, this checklist delves into deductions specific to food establishments, including ingredients, kitchen supplies, employee uniforms, menu development, and licensing fees. These examples demonstrate how Santa Clara California Business Deductions Checklists can provide tailored guidance to various business types, ensuring that entrepreneurs in Santa Clara County can fully leverage the tax benefits available to their specific industry.

Santa Clara California Business Deductions Checklist

Description

How to fill out Santa Clara California Business Deductions Checklist?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

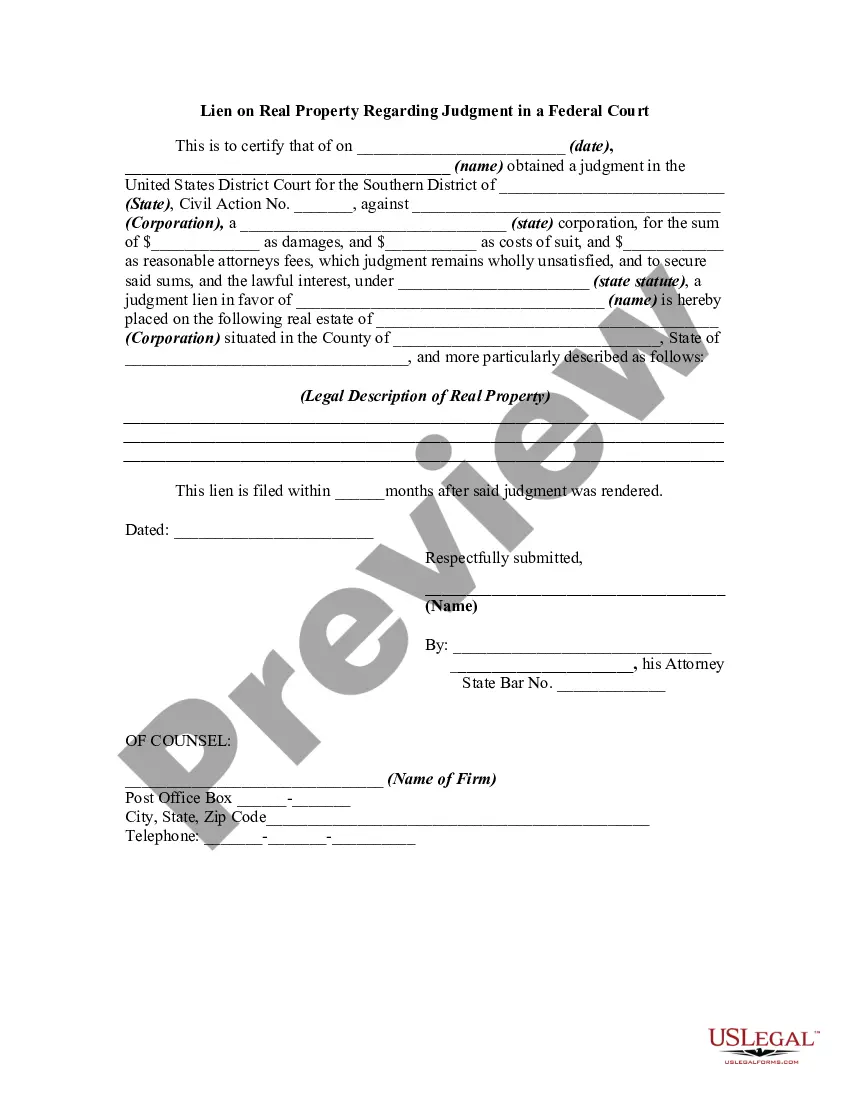

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business objective utilized in your county, including the Santa Clara Business Deductions Checklist.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Santa Clara Business Deductions Checklist will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Santa Clara Business Deductions Checklist:

- Make sure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Santa Clara Business Deductions Checklist on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!