Travis Texas Business Deductions Checklist is a comprehensive tool that helps business owners in Travis County, Texas, accurately track and maximize their tax-deductible expenses. This checklist is specifically designed to cater to the unique tax regulations and requirements of businesses operating in Travis County, ensuring that all potential deductions are considered. The Travis Texas Business Deductions Checklist covers various categories of deductible expenses, allowing businesses to efficiently organize their financial records and claim legitimate deductions. Some key categories covered in the checklist include: 1. Travel and Transportation Expense: This section includes deductions related to travel, such as airfare, lodging, meals, and transportation expenses incurred while conducting business activities outside of Travis County. 2. Office and Equipment Expense: Businesses can claim deductions for expenditure on office supplies, equipment, and furniture, as well as expenses related to the maintenance and repair of their workspaces. 3. Advertising and Marketing Expense: This category encompasses deductions for advertising campaigns, promotional materials, website development, and marketing expenses aimed at attracting customers and improving brand visibility. 4. Professional Services Expense: Business owners can claim deductions for fees paid to accountants, consultants, attorneys, or other professionals hired to help with specific aspects of their operations, such as legal advice, tax preparation, or financial consulting. 5. Insurance Expense: This section covers deductions for various insurance policies relevant to business operations, including liability insurance, property insurance, and workers' compensation insurance. 6. Employee Benefits and Wages Expense: Deductions can be claimed for expenses associated with employee compensation, such as salaries, wages, bonuses, payroll taxes, and contributions to employee benefit plans. 7. Repairs and Maintenance Expense: Businesses can deduct expenses incurred for the routine maintenance, repair, or servicing of their assets, such as equipment, vehicles, or property. 8. Utilities and Communication Expense: This category includes deductions for expenses related to utilities like electricity, gas, water, telephone services, and internet connectivity used solely for business purposes. These are some main categories covered by the Travis Texas Business Deductions Checklist. By utilizing this tool, businesses can ensure they don't miss out on any potential deductions come tax time, providing them with financial relief and the ability to reinvest those savings into growing their business further.

Travis Texas Business Deductions Checklist

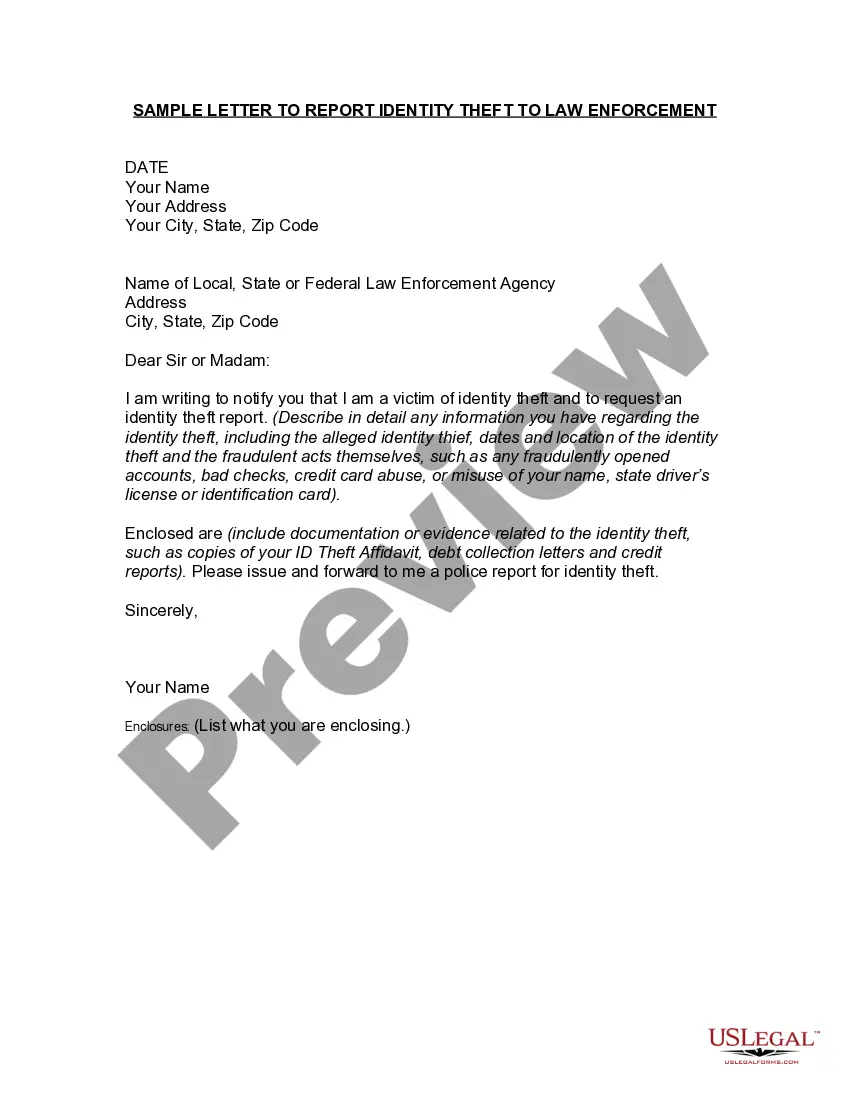

Description

How to fill out Travis Texas Business Deductions Checklist?

Creating forms, like Travis Business Deductions Checklist, to manage your legal affairs is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for a variety of scenarios and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Travis Business Deductions Checklist template. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before downloading Travis Business Deductions Checklist:

- Make sure that your form is specific to your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Travis Business Deductions Checklist isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our service and download the form.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!