Bronx, New York Key Employee Life Insurance Checklist: Are you a business owner in the Bronx, New York, looking to protect the key employees of your company? Key Employee Life Insurance can provide financial security for your business in case of an unforeseen event. Use this checklist to understand the important factors and various types of Key Employee Life Insurance available in the Bronx: 1. Determine the importance of key employees: Identify the crucial individuals within your organization whose expertise, skills, or relationships are vital for the success of your business. 2. Assess the financial impact of losing a key employee: Consider the potential loss of revenue, increased costs, or decline in business value that may result from the absence or loss of a critical employee. 3. Review existing employee benefit plans: Examine your current plans to ensure they cover key employees adequately. Often, regular life insurance plans may not be sufficient to protect the business in the event of a key employee's death or disability. 4. Choose the right type of Key Employee Life Insurance: a. Key Person Life Insurance: This policy provides financial assistance to the company in case of the loss of a key employee. The business is the beneficiary of the policy and receives a payout to cover expenses or fund a recruiting process for a replacement. b. Key Employee Disability Insurance: Similar to Key Person Life Insurance, this coverage provides financial support in the event of a key employee's disability or inability to work. It can help cover expenses and bridge the revenue gap during the employee's absence. c. Split-Dollar Life Insurance: This type of policy allows an employer to share the costs and benefits of life insurance with a key employee. It can be an effective tool to retain valuable talent and provide death benefits to their beneficiaries. 5. Calculate the required coverage amount: Evaluate the financial value that would need to be replaced in case of a key employee's absence. This amount should consider factors like lost revenue, recruitment costs, training expenses, and the time required for the new employee to reach the same level of productivity. 6. Compare insurance providers: Research and consult with reputable insurance companies in the Bronx, New York, specializing in Key Employee Life Insurance. Look for expertise in this specific field and consider their track record, customer reviews, and financial stability. 7. Understand policy exclusions and limitations: Review the policies carefully, paying attention to clauses related to pre-existing conditions, waiting periods, exclusions, and cancellation terms. Ensure you are fully aware of the coverage scope and any specific conditions that may impact claims. 8. Seek advice from a professional insurance agent: Engage with a knowledgeable insurance agent who can guide you through the process, help you assess risks, and find the most appropriate Key Employee Life Insurance policies to match your business needs in the Bronx, New York. Protecting your business from the potential loss of a key employee is crucial for its long-term success. By understanding the importance of Key Employee Life Insurance and following this checklist, you can make informed decisions that ensure financial stability and safeguard the future of your Bronx-based company.

Bronx New York Checklist - Key Employee Life Insurance

Description

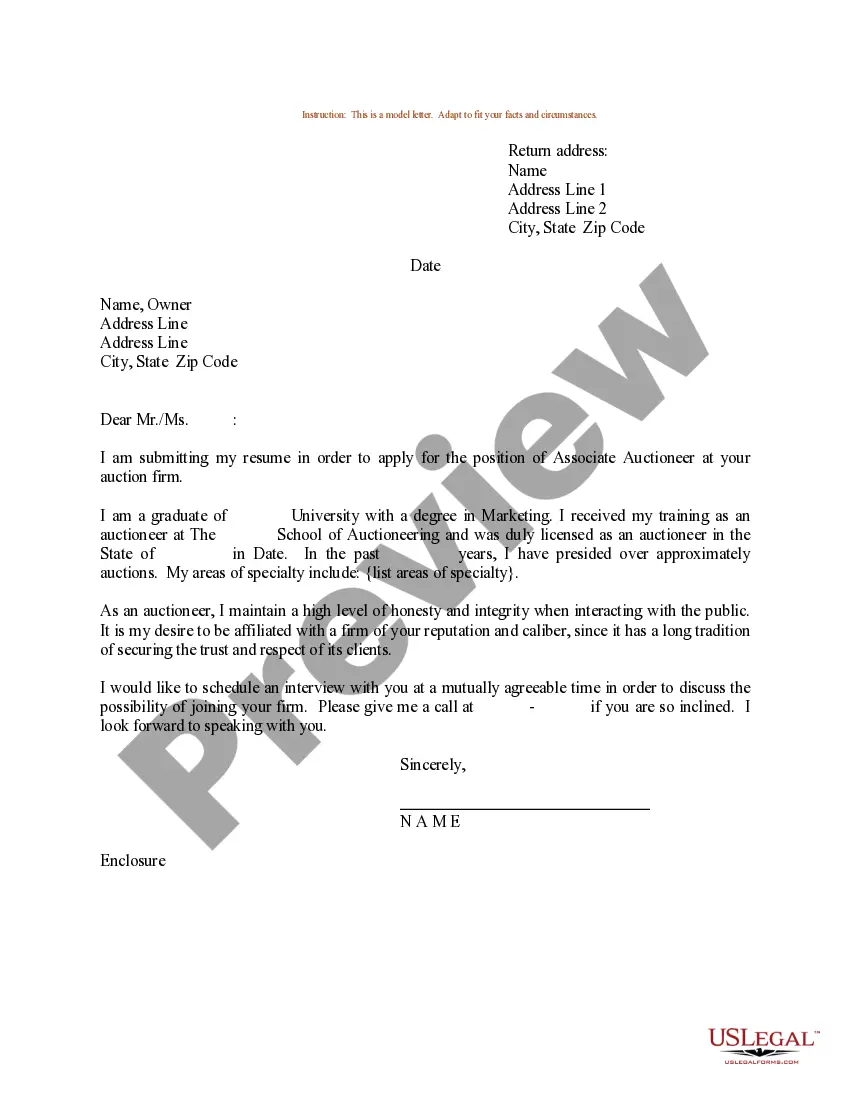

How to fill out Bronx New York Checklist - Key Employee Life Insurance?

Draftwing forms, like Bronx Checklist - Key Employee Life Insurance, to take care of your legal matters is a tough and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for various scenarios and life situations. We make sure each document is compliant with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Bronx Checklist - Key Employee Life Insurance template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Bronx Checklist - Key Employee Life Insurance:

- Ensure that your document is compliant with your state/county since the rules for creating legal documents may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Bronx Checklist - Key Employee Life Insurance isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start utilizing our service and download the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!