Oakland Michigan Checklist — Key Employee Life Insurance: Oakland, Michigan is a vibrant city located in Oakland County, Michigan, United States. It is a prominent suburban community known for its picturesque landscapes, thriving businesses, and excellent quality of life. As a business owner or manager, ensuring the financial security of your key employees is crucial. This is where Oakland Michigan Checklist — Key Employee Life Insurance comes into play. Key Employee Life Insurance is a specialized insurance policy designed to protect businesses in the event of an untimely loss of a key employee. These employees are vital to the success and continuity of the organization, possessing unique skills, expertise, or knowledge that is not easily replaceable. In Oakland, Michigan, businesses from various industries, such as technology, healthcare, automotive, and manufacturing, can benefit from Key Employee Life Insurance. Types of Oakland Michigan Checklist — Key Employee Life Insurance: 1. Term Life Insurance: This is the most common type of Key Employee Life Insurance. It provides coverage for a specific term, typically 10, 20, or 30 years, and pays out a death benefit to the business in the event of the key employee's untimely passing during that term. Term Life Insurance provides high coverage at an affordable premium and can be an attractive option for businesses looking for short-term protection. 2. Whole Life Insurance: Whole Life Insurance is a permanent form of Key Employee Life Insurance that provides coverage for the entire lifetime of the key employee. It not only offers a death benefit but also accumulates a cash value over time, providing additional financial protection and acting as an asset for the business. Whole Life Insurance can be a great choice for long-term protection and wealth accumulation. 3. Universal Life Insurance: Universal Life Insurance combines the flexibility of term life insurance with the cash value accumulation feature of whole life insurance. This type of Key Employee Life Insurance allows businesses to adjust the death benefit and premium payments as their needs change over time. Universal Life Insurance can provide businesses with the necessary flexibility and protection for their key employees. 4. Key Person Disability Insurance: While not specifically categorized as life insurance, Key Person Disability Insurance is worth mentioning as it covers the loss of a key employee's income in the event of a disability. This type of insurance can be crucial in maintaining the financial stability of the business and supporting the key employee's medical expenses during their recovery. In conclusion, Oakland Michigan Checklist — Key Employee Life Insurance is an essential tool for businesses in Oakland, Michigan, looking to protect their most valuable assets — their key employees. Whether through Term Life Insurance, Whole Life Insurance, Universal Life Insurance, or Key Person Disability Insurance, businesses can safeguard their financial future and ensure continuity even in the face of unexpected events.

Oakland Michigan Checklist - Key Employee Life Insurance

Description

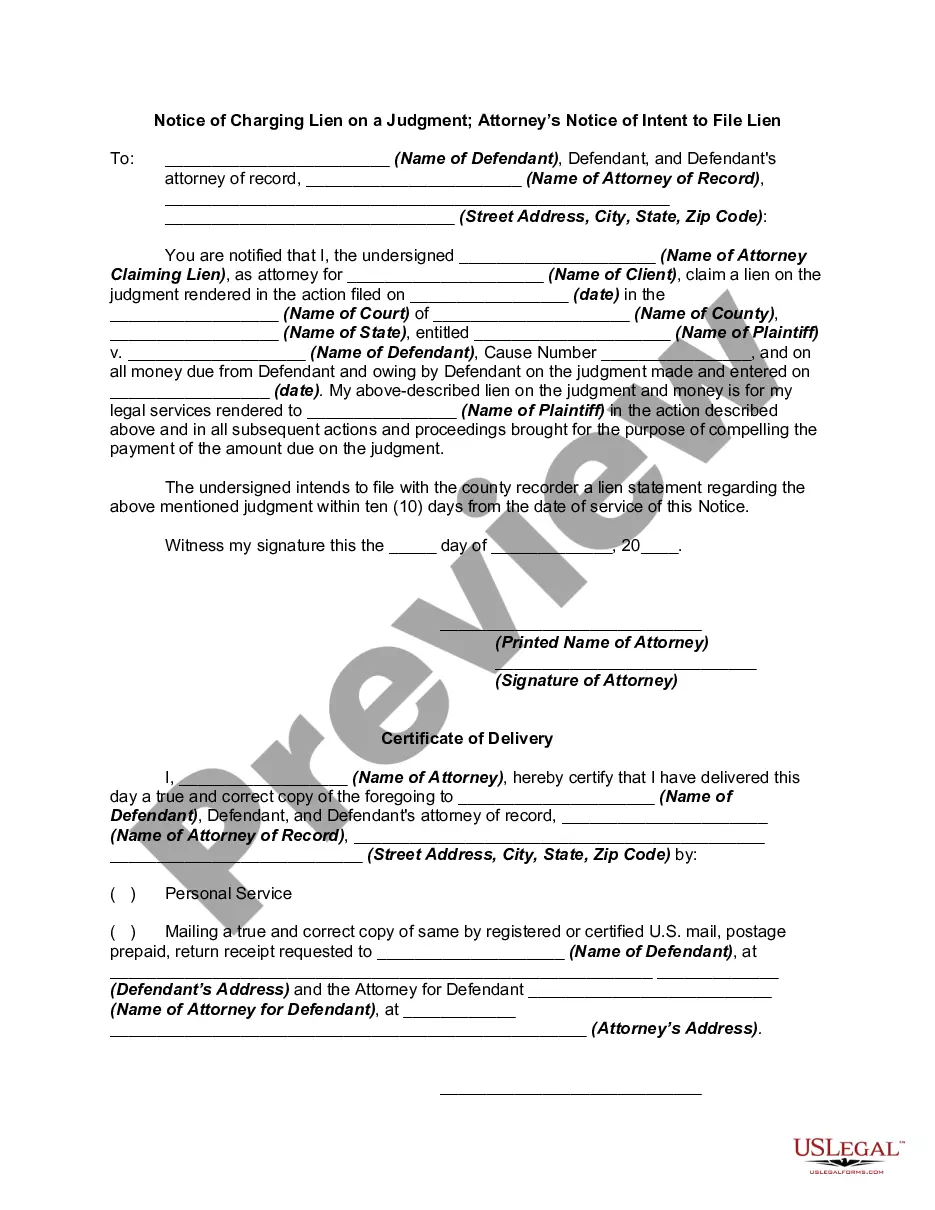

How to fill out Oakland Michigan Checklist - Key Employee Life Insurance?

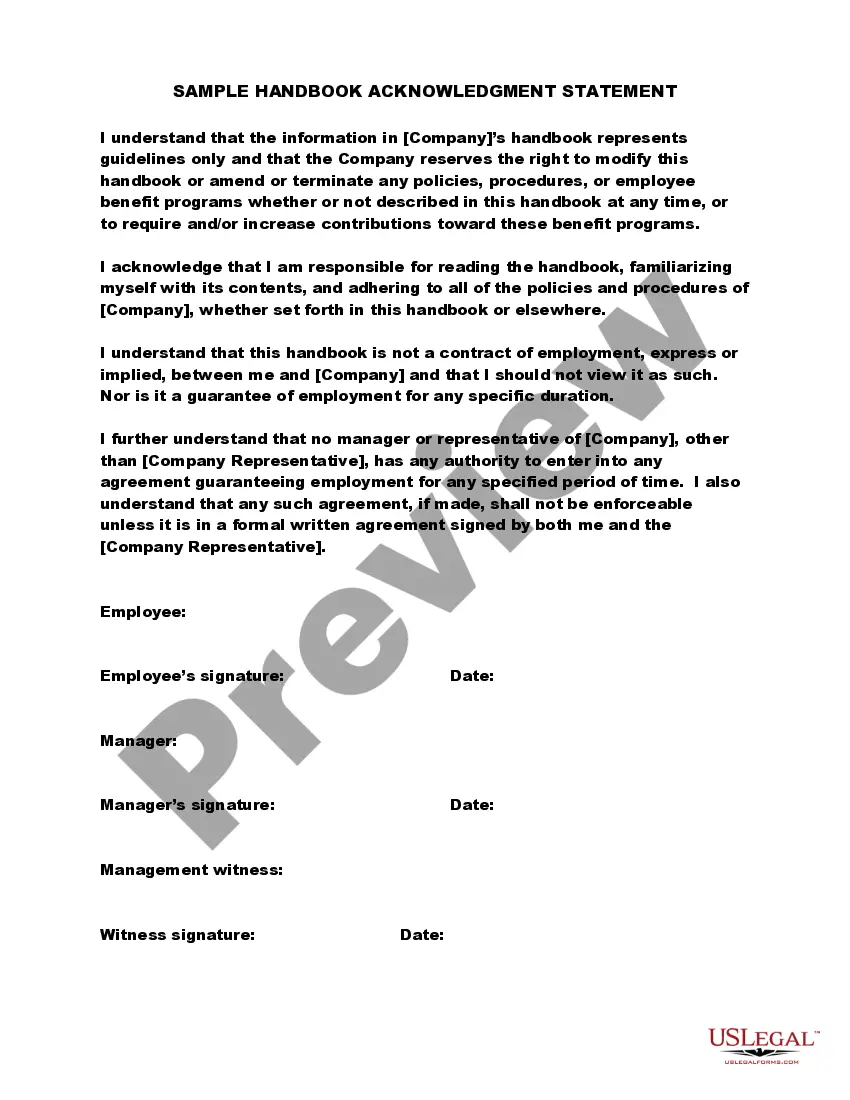

If you need to get a reliable legal document provider to get the Oakland Checklist - Key Employee Life Insurance, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support team make it simple to locate and complete different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to search or browse Oakland Checklist - Key Employee Life Insurance, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Oakland Checklist - Key Employee Life Insurance template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less expensive and more affordable. Set up your first company, arrange your advance care planning, draft a real estate agreement, or complete the Oakland Checklist - Key Employee Life Insurance - all from the convenience of your home.

Sign up for US Legal Forms now!