Travis Texas Checklist — Key Employee Life Insurance: A Comprehensive Overview Travis Texas Checklist — Key Employee Life Insurance is a vital form of protection that businesses in Travis, Texas should consider for their key employees. This type of life insurance provides financial security and peace of mind for both the employer and the employee, ensuring that the company remains stable in the event of an unexpected loss. There are several types of Travis Texas Checklist — Key Employee Life Insurance available, each tailored to meet specific business needs. Let's delve into some different types: 1. Traditional Key Employee Life Insurance: This is the most common form of key employee life insurance, covering a single person and offering a predetermined benefit amount payable to the employer in the event of the employee's death. The benefit can help cover financial losses, recruitment and training expenses for finding a replacement, and other costs associated with the sudden loss of a key employee. 2. Group Key Employee Life Insurance: Designed for businesses with multiple key employees, this variant offers coverage to a group of individuals rather than just one. It provides a collective benefit that can be shared among the key employees' beneficiaries, minimizing any potential financial strain on the company and ensuring the continuation of operations. 3. Split-Dollar Key Employee Life Insurance: This unique form of key employee insurance involves an agreement between the employer and the employee to split the premium costs and death benefit. It offers flexibility, as the contributions and benefits can be customized based on the company's financial capacity and the employee's needs. 4. Key Person Replacement Insurance: While not strictly classified as life insurance, this type of coverage is closely related. Key Person Replacement Insurance aims to provide funds to recruit, hire, and train a new employee to fill the void left by the loss of a key employee. It ensures that the business can continue its operations smoothly while searching for a suitable replacement. Key Employee Life Insurance is crucial for businesses in Travis, Texas, as it protects against the financial impact of losing a key staff member. By having this coverage in place, businesses can mitigate potential risks, endure unexpected challenges, and maintain stability during challenging times. If you are a business owner or employer in Travis, Texas, it is essential to consult with experienced insurance professionals to determine which type of Key Employee Life Insurance is best suited for your unique needs. Properly assessing your requirements will help you choose the right coverage and ensure your business's long-term success.

Travis Texas Checklist - Key Employee Life Insurance

Description

How to fill out Travis Texas Checklist - Key Employee Life Insurance?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Travis Checklist - Key Employee Life Insurance, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any tasks related to paperwork execution straightforward.

Here's how you can purchase and download Travis Checklist - Key Employee Life Insurance.

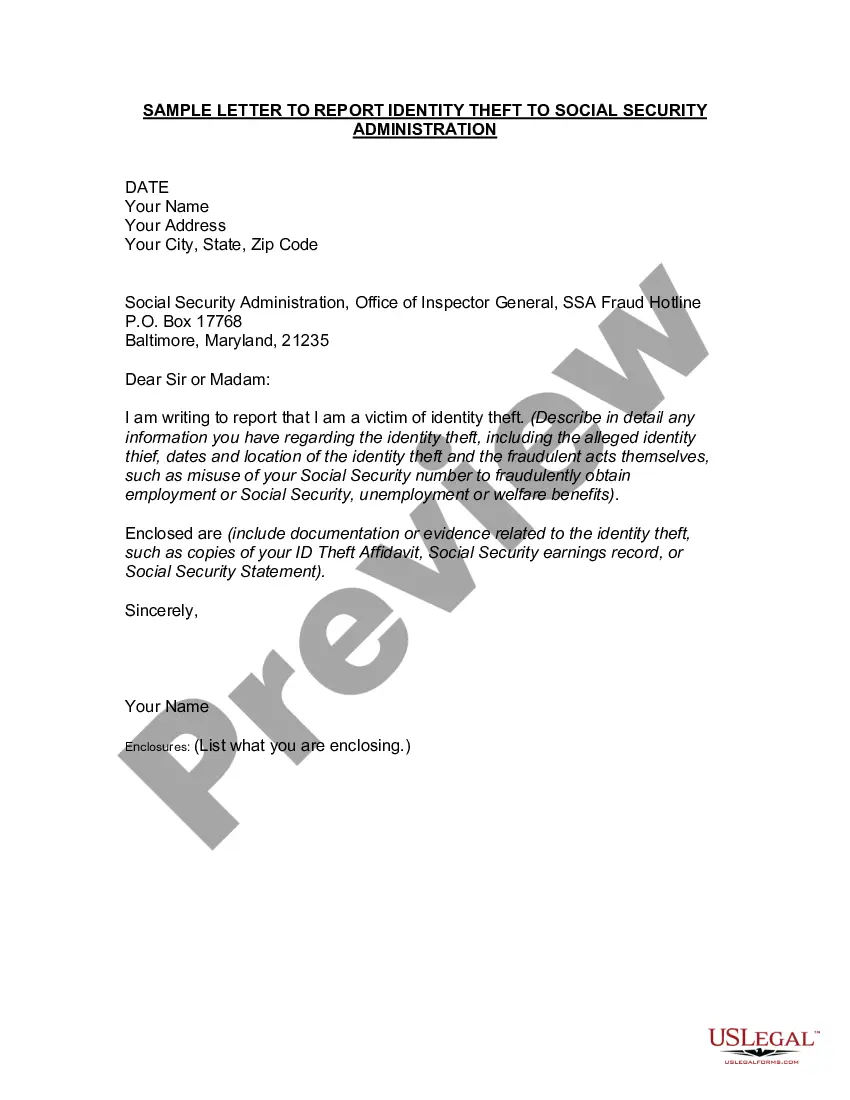

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Check the related document templates or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Travis Checklist - Key Employee Life Insurance.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Travis Checklist - Key Employee Life Insurance, log in to your account, and download it. Of course, our website can’t replace a legal professional entirely. If you need to deal with an exceptionally complicated case, we advise using the services of a lawyer to review your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-compliant documents with ease!