Contra Costa California Authorization to Release Credit Information is a legal document that allows an individual or entity to request and obtain a person's credit information from credit bureaus, financial institutions, and other credit reporting agencies. This authorization is crucial when individuals or organizations need to assess an individual's creditworthiness, review their financial history, or make informed decisions regarding credit-related matters. The Contra Costa California Authorization to Release Credit Information is typically used by various entities, including lenders, landlords, employers, insurance companies, and other authorized organizations. By obtaining this consent, these entities can review an individual's credit report, credit score, payment history, outstanding debts, and other relevant financial information. This authorization form provides specific details about the purpose of obtaining the credit information, ensuring that the disclosed information is strictly used for legitimate and lawful purposes. The individual granting consent must provide their full name, contact information, and social security number to correctly identify and access the desired credit report. Additionally, the form may include checkboxes or sections to specify the duration of consent, limitations on the type and extent of information that can be accessed, and any specific entities authorized to receive the credit information. This ensures that personal financial data is not misused or shared with unauthorized parties. While there may not be different types of Contra Costa California Authorization to Release Credit Information documents, variations may exist based on the purpose or specific requirements of the requesting party. For example, a rental property application might include a specific Contra Costa California Authorization to Release Credit Information form for potential tenants, whereas a loan application may require a unique form tailored to the financial institution's needs. To conclude, the Contra Costa California Authorization to Release Credit Information is a vital document that allows authorized entities to access an individual's credit information. It guarantees that the disclosed information is handled responsibly, maintains the individual's privacy rights, and helps decision-makers make informed choices based on an individual's financial history.

Contra Costa California Authorization to Release Credit Information

Description

How to fill out Contra Costa California Authorization To Release Credit Information?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business purpose utilized in your region, including the Contra Costa Authorization to Release Credit Information.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Contra Costa Authorization to Release Credit Information will be accessible for further use in the My Forms tab of your profile.

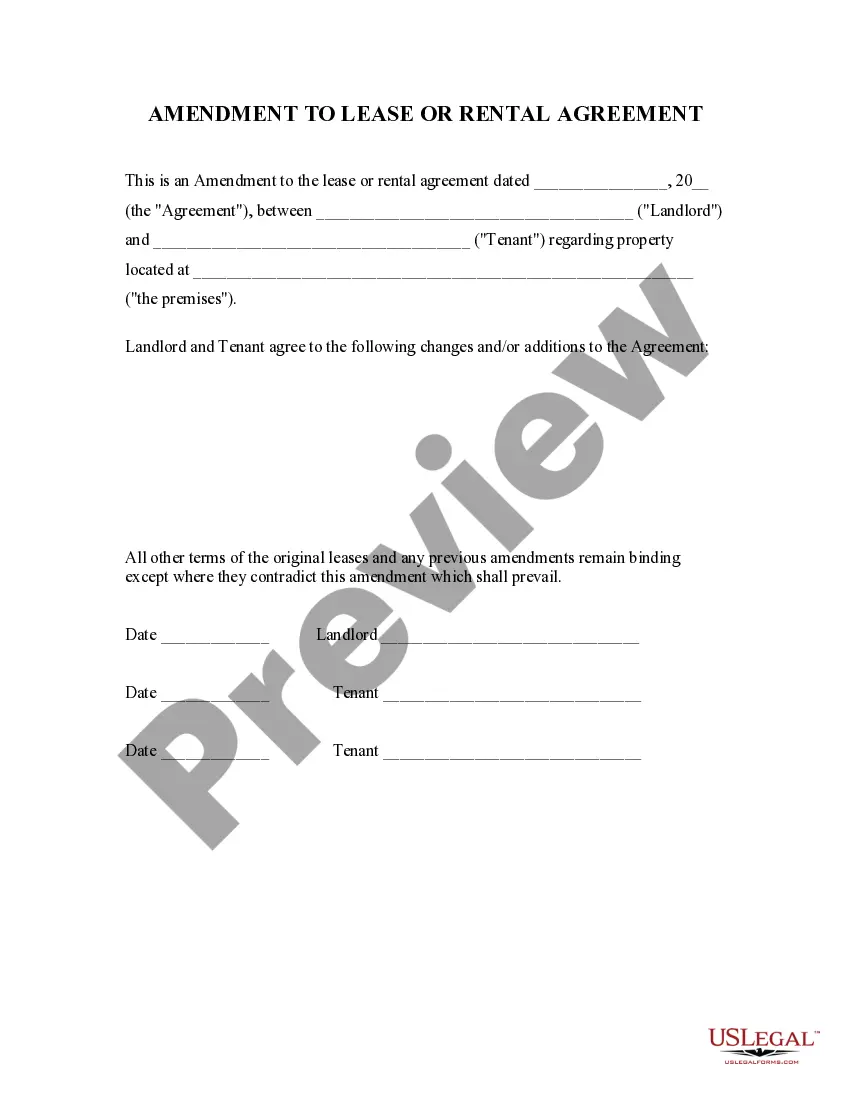

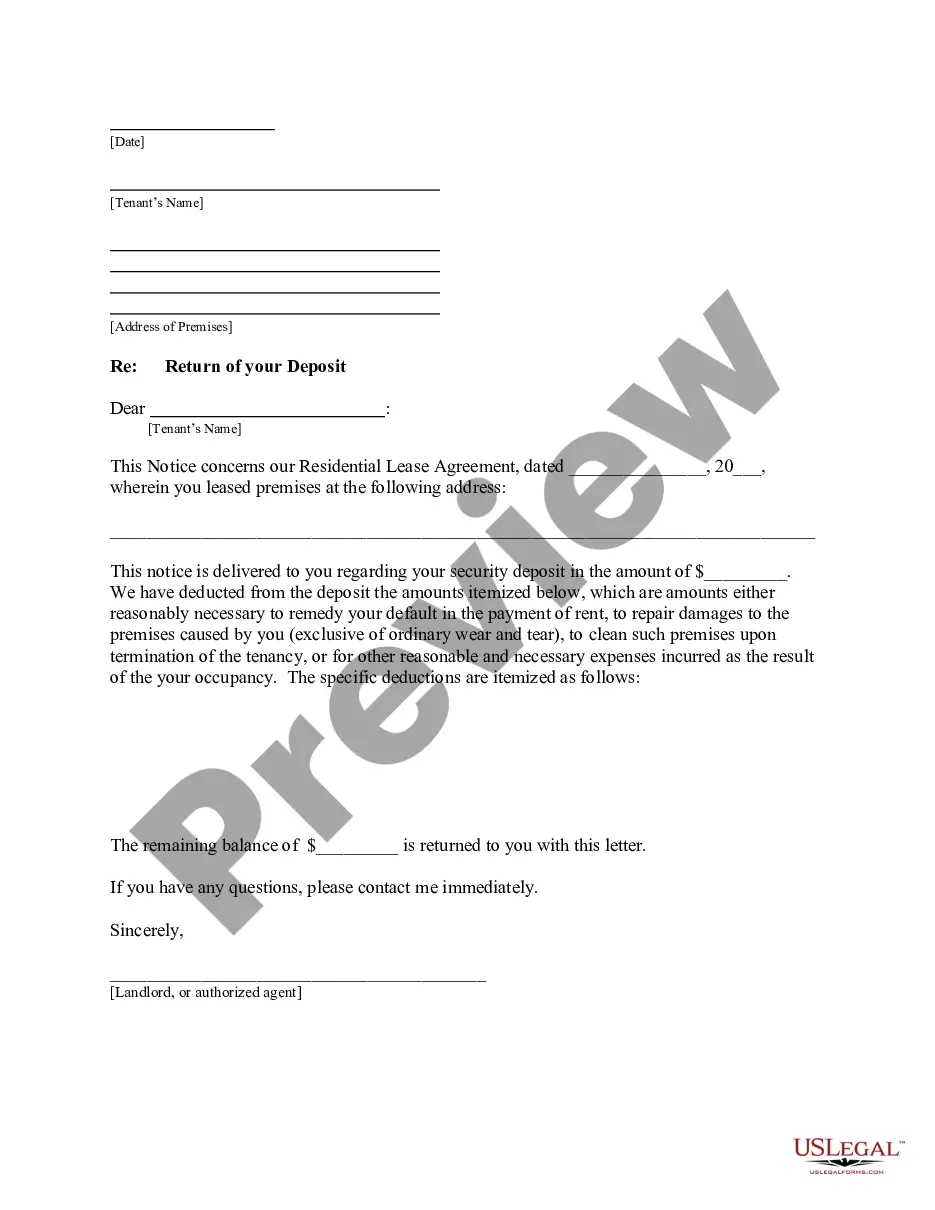

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Contra Costa Authorization to Release Credit Information:

- Make sure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Contra Costa Authorization to Release Credit Information on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Covered California offers four health plans in Contra Costa and you may choose the plan that is best for you and/or your family. The four plans are Kaiser HMO, Health Net PPO, Blue Cross PPO and Blue Shield PPO.

Medi-Cal is California's Medicaid program. This is a public health insurance program that provides free or low cost medical services for children and adults with limited income and resources.

This is a guidebook for people with disabilities and seniors who have Medi-Cal. This guidebook explains the two kinds of Medi-Cal: Regular Medi-Cal and Medi-Cal Health Plans.

Contra Costa Health Plan (CCHP) was the first federally qualified, state licensed, county sponsored HMO in the United States. CCHP has been serving the health needs of people in Contra Costa County for over 45 years, and now serves over 227,000 people.

Contra Costa Health Plan (CCHP) has a Medi/Cal contract with the California Department of Health Care Services (DHSC).

Call us toll free at 1-877-661-6230 Monday - Friday 8 a.m. to 5 p.m. We are here to help!

Contra Costa Health Plan (CCHP) was the first federally qualified, state licensed, county sponsored HMO in the United States. CCHP has been serving the health needs of people in Contra Costa County for over 45 years, and now serves over 227,000 people.

What is the difference between a Medi-Cal benefits identification card (BIC) and a CalOptima identification card (CalOptima ID)? The BIC is a card issued by the County of Orange Social Services Agency. It is used to obtain Medi-Cal covered services. The CalOptima ID card is issued by CalOptima Medi-Cal.

Contra Costa Health Plan (CCHP) has a Medi/Cal contract with the California Department of Health Care Services (DHSC).