The Riverside California Authorization to Release Credit Information is a legal document that allows authorized individuals or organizations to request and obtain a consumer's credit information. This document is essential for various financial transactions, such as applying for a mortgage, loan, credit card, or rental agreement. It grants permission to access the consumer's credit history, credit score, borrowing and repayment patterns, outstanding debt, and other relevant financial data. By providing this authorization, individuals in Riverside, California, allow financial institutions, landlords, potential employers, or credit bureaus to access their credit information from credit reporting agencies. These agencies gather and maintain credit data on individuals, which plays a crucial role in determining their creditworthiness and financial reliability. The Riverside California Authorization to Release Credit Information is a standard form used universally, but it may have several specific variations depending on the nature of the transaction. For instance, in the case of a mortgage or loan application, there might be a specific authorization form designed for mortgage lenders or banks. Similarly, when renting a property, landlords may have their own customized credit release authorization, which focuses on evaluating the tenant's financial capacity to pay rent promptly. Common keywords associated with Riverside California Authorization to Release Credit Information include: 1. Credit Information 2. Credit History 3. Credit Score 4. Credit Reporting Agencies 5. Financial Data 6. Creditworthiness 7. Lending Institutions 8. Landlords 9. Potential Employers 10. Mortgage Application 11. Loan Application 12. Rental Agreement 13. Credit Release Authorization 14. Borrowing Patterns 15. Repayment Patterns 16. Outstanding Debt 17. Credit Bureaus Overall, the Riverside California Authorization to Release Credit Information is a crucial legal document that allows individuals and organizations to access an individual's credit information for determining their financial reliability and suitability for various financial transactions.

Riverside California Authorization to Release Credit Information

Description

How to fill out Riverside California Authorization To Release Credit Information?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Riverside Authorization to Release Credit Information is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Riverside Authorization to Release Credit Information. Follow the guidelines below:

- Make sure the sample fulfills your individual needs and state law regulations.

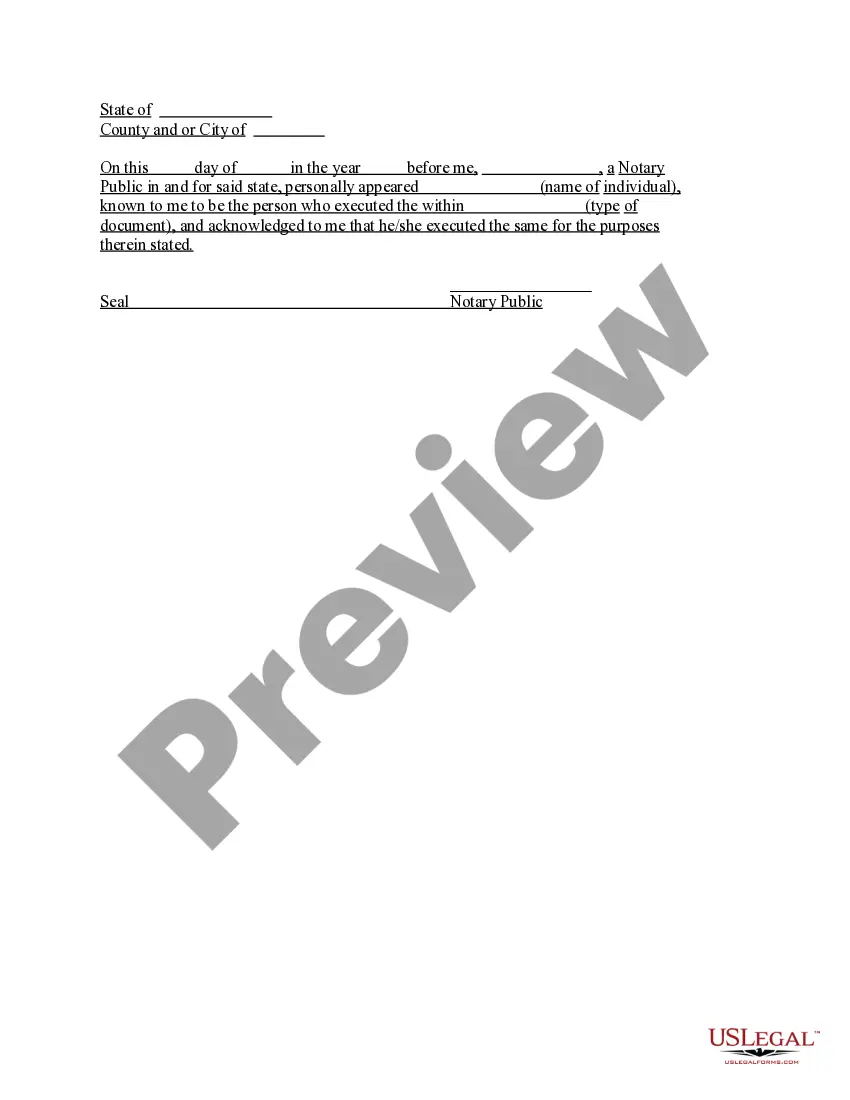

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Riverside Authorization to Release Credit Information in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!