Sacramento California Credit Memo is a financial document often used by businesses to provide customers with credit for returned or cancelled goods, services, or to resolve billing discrepancies. This document states the amount to be credited and provides an explanation for the credit issued. Keywords: Sacramento, California, credit memo, financial document, businesses, customers, credit, returned goods, cancelled goods, billing discrepancies, amount credited, explanation. There are different types of Sacramento California Credit Memo based on the purpose and circumstances they are issued for. These may include: 1. Sales Return Credit Memo: This type of credit memo is issued to customers who return purchased goods due to reasons such as defects, incorrect product, or dissatisfaction. The memo states the credited amount and the reason for the return. 2. Service Credit Memo: Service-based businesses may issue credit memos to customers who are dissatisfied with the services provided. This memo outlines the amount credited and the specific reasons for the credit issuance, such as an incomplete service or subpar quality. 3. Billing Error Credit Memo: Sometimes, errors can occur in the billing process, resulting in overcharging or incorrect invoicing. In such cases, a credit memo is issued to rectify the mistake and provide customers with the correct amount owed. 4. Credit Memo for Discounts: Businesses may issue credit memos when providing customers with discounts, either as part of a promotion or as a gesture of goodwill. These memos detail the discount amount and the reason for the reduced price. 5. Credit Memo for Late or Delayed Deliveries: If a business fails to deliver goods or services within the agreed-upon timeframe, a credit memo may be issued to compensate customers for the inconvenience caused by the delay. In summary, the Sacramento California Credit Memo is a financial document used by businesses to provide credits for various circumstances, including returned goods, billing errors, service dissatisfaction, discounts, and delayed deliveries. Each type of credit memo serves a specific purpose and includes relevant information for the customer and business to resolve financial matters accurately and transparently.

Sacramento California Credit Memo

Description

How to fill out Sacramento California Credit Memo?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Sacramento Credit Memo, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Sacramento Credit Memo from the My Forms tab.

For new users, it's necessary to make several more steps to get the Sacramento Credit Memo:

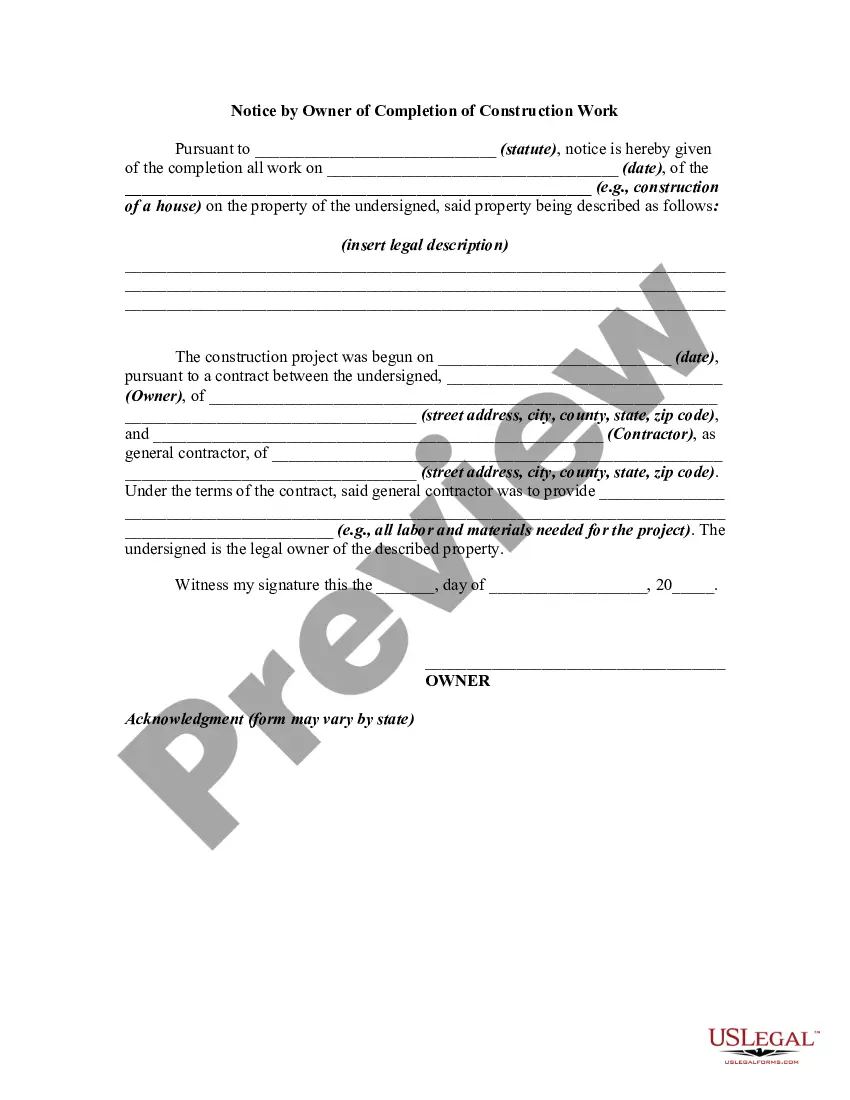

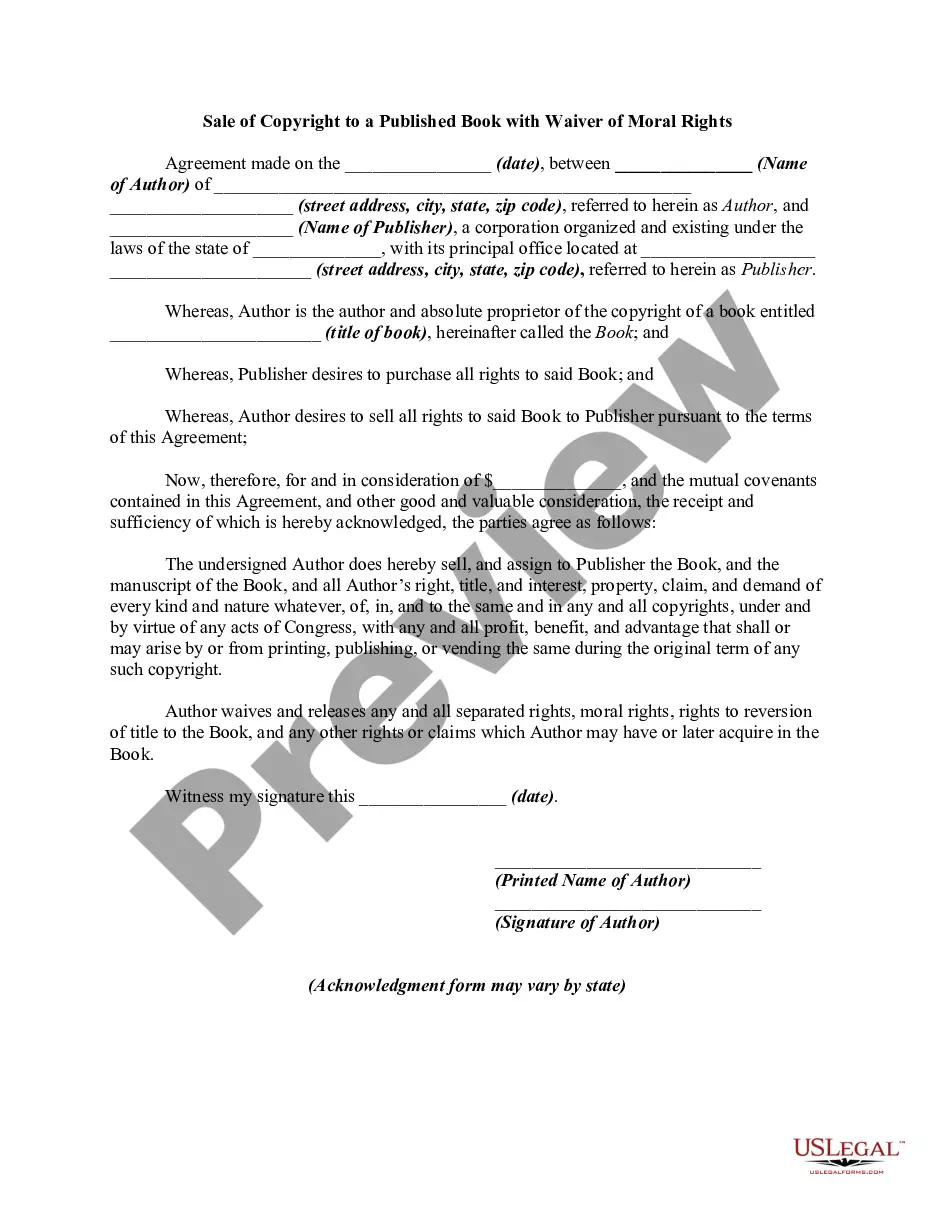

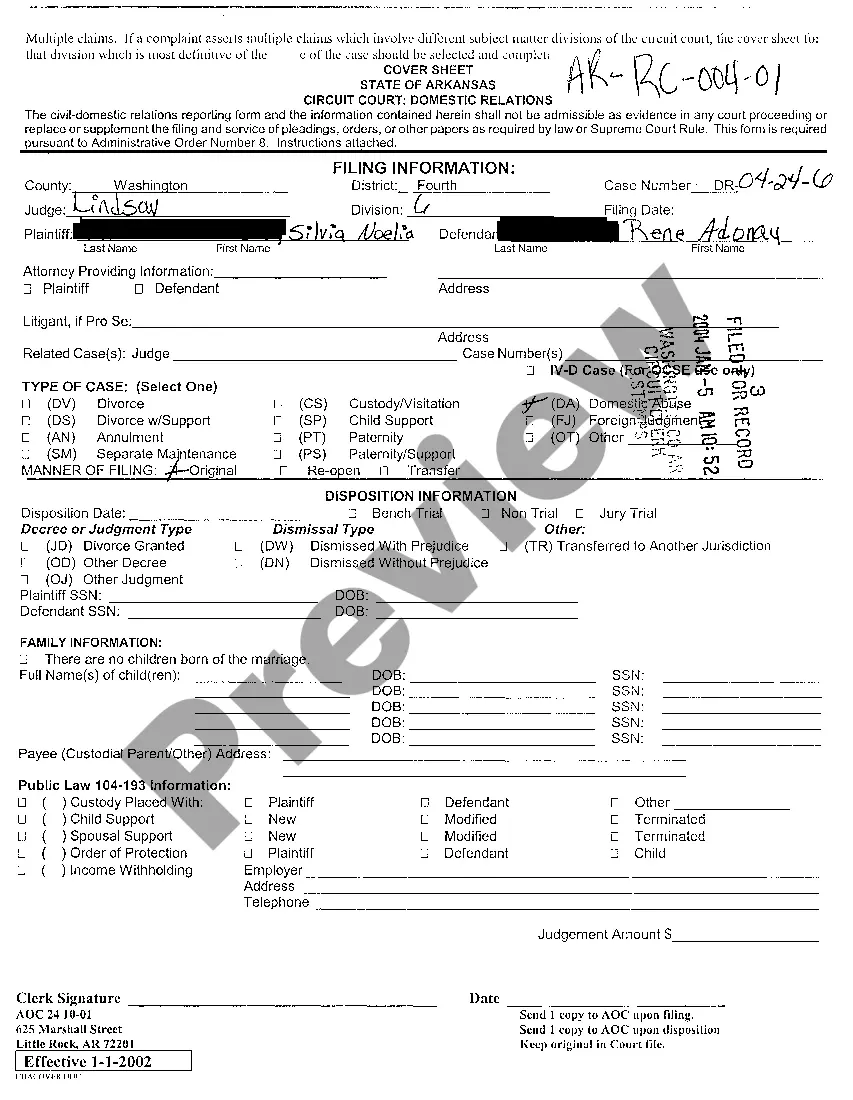

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!