Harris Texas Checklist — Health and Disability Insurance: Everything You Need to Know If you are a resident of Harris County, Texas, and want to ensure that you have adequate health and disability insurance coverage, this detailed checklist will provide you with the essential information needed to make an informed decision. Understanding the various types of insurance available to you is crucial, so read on to discover the different options and their benefits. 1. Health Insurance: — Individual Health Insurance: This type of coverage is purchased directly by individuals or families, providing protection against medical expenses and ensuring access to quality healthcare services. — Group Health Insurance: Typically offered by employers, this insurance plan covers a group of people and often carries lower premiums due to shared risk. — Medicare: A federally funded program designed for individuals aged 65 and older, offering different comprehensive coverage options. — Medicaid: A government program providing health coverage for low-income individuals and families. — Affordable Care Act (ACA) Plans: Insurance plans available through the Health Insurance Marketplace, offering different coverage levels and subsidized options based on income. 2. Disability Insurance: — Short-Term Disability Insurance: Provides income replacement for a limited duration (a few weeks to several months) when you are unable to work due to illness, injury, or pregnancy complications. — Long-Term Disability Insurance: Offers income protection for an extended period, often until retirement age, if you are unable to work due to a severe disability or illness. Harris Texas Checklist — Health and Disability Insurance Key Considerations: 1. Assess Your Needs: Determine the level of health and disability coverage you require based on your individual circumstances, such as age, overall health, family size, and any pre-existing conditions. 2. Research Providers: Compare different insurance providers in Harris County, Texas, and consider their reputation, customer service, network coverage, and pricing options. 3. Evaluate Coverage Options: Thoroughly review each insurance plan's benefits, coverage limits, deductibles, co-payments, and out-of-pocket maximums to ensure they align with your specific needs. 4. Network Coverage: Check that your preferred healthcare providers, hospitals, and specialists are included in the insurance plan's network to avoid unexpected costs or disruptions in care. 5. Prescription Drug Coverage: It is essential to understand the availability and limitations of prescription drug coverage, as well as any costs associated with medications you regularly take. 6. Review Policy Exclusions: Familiarize yourself with policy exclusions and limitations for pre-existing conditions, mental health coverage, maternity care, dental, vision, and other specific services that matter to you. 7. Cost and Affordability: Compare premiums, deductibles, and out-of-pocket expenses for all insurance plans to find the most cost-effective option while ensuring adequate coverage. 8. Seek Professional Advice: Consider consulting with a licensed insurance agent or broker who can assist you in navigating the complex process of selecting health and disability insurance policies. By following this comprehensive Harris Texas Checklist — Health and Disability Insurance, you can confidently make informed decisions while protecting yourself and your loved ones from unexpected medical expenses and income loss. Remember to regularly review and update your coverage as your needs change over time.

Harris Texas Checklist - Health and Disability Insurance

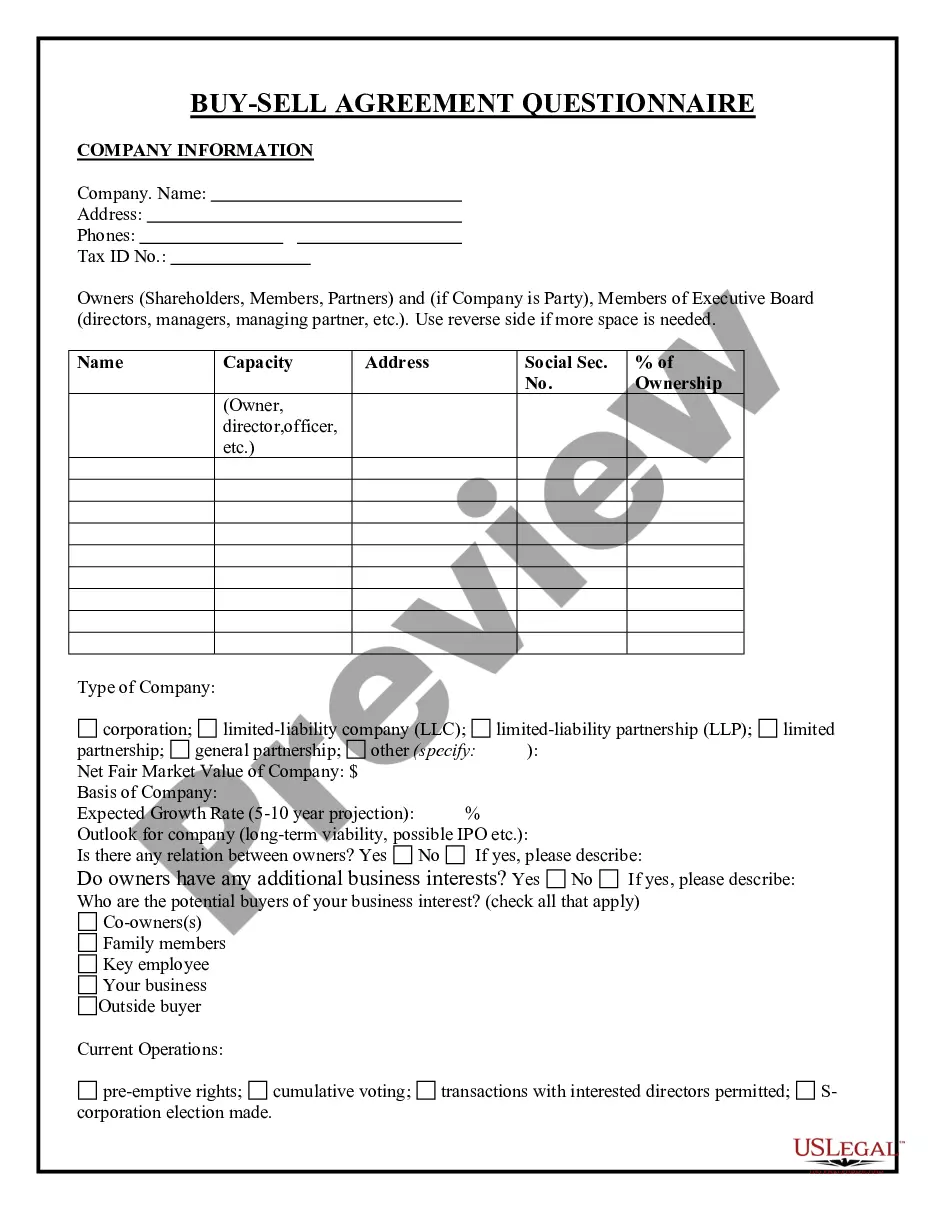

Description

How to fill out Harris Texas Checklist - Health And Disability Insurance?

Preparing papers for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Harris Checklist - Health and Disability Insurance without professional assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Harris Checklist - Health and Disability Insurance by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Harris Checklist - Health and Disability Insurance:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!