Mecklenburg North Carolina Checklist — Health and Disability Insurance: Introduction: Mecklenburg County in North Carolina is a thriving region with a growing population. Within this county, residents are recommended to understand the importance of having comprehensive health and disability insurance coverage. This detailed checklist will provide an overview of the key factors to consider when evaluating and selecting health and disability insurance plans in Mecklenburg County. 1. Health Insurance: Health insurance plays a crucial role in ensuring residents' access to quality healthcare services. It is essential to conduct thorough research to identify the most suitable health insurance plans available in Mecklenburg County. Key factors to consider include: a. Provider Networks: Determine whether the insurance plan has a broad network of healthcare providers, including primary care physicians, specialists, hospitals, and clinics in Mecklenburg County. b. Coverage Options: Understand the extent of coverage provided, including hospitalization, prescription medications, preventive care, mental health services, and maternity care. c. Premiums and Deductibles: Compare and evaluate premium costs and deductibles to find a plan that aligns with your budget. d. Co-pays and Out-of-Pocket Expenses: Determine the amount of co-pays and out-of-pocket expenses associated with doctor visits, medications, or emergency services. e. Additional Benefits: Some insurance plans may offer additional benefits such as dental, vision, or alternative therapies. Assess these options based on your personal requirements. 2. Disability Insurance: Disability insurance is crucial to protect individuals in the event of a disability preventing them from working and earning income. Consider these key aspects when choosing disability insurance: a. Short-Term vs. Long-Term Disability coverage: Determine whether the disability insurance plan offers short-term disability benefits (for temporary disabilities) or long-term disability benefits (for extended periods of disability). b. Coverage Percentage: Understand the percentage of income replacement provided by the disability insurance plan. c. Waiting Period: Determine the waiting period before the insurance benefits kick in. Consider your financial capabilities during this waiting period and choose accordingly. d. Own-Occupation vs. Any-Occupation: Different disability insurance plans offer coverage based on either the individual's current occupation (own-occupation) or any occupation. Clarify which type of coverage suits your needs. e. Additional Riders: Explore any additional riders available, such as cost-of-living adjustment (COLA) or residual disability benefits. Types of Health and Disability Insurance Plans in Mecklenburg County: Mecklenburg County offers a variety of health and disability insurance plans to cater to diverse needs. Some notable types include: 1. Employer-Sponsored Insurance: Many Mecklenburg County residents may access health and disability insurance through their employers, often called group insurance plans. 2. Individual Health Insurance Plans: These plans are available for purchase directly from insurance providers or through the Health Insurance Marketplace, offering individual and family coverage options. 3. Medicaid and Medicare: Low-income individuals and seniors in Mecklenburg County may qualify for government-funded health insurance programs like Medicaid and Medicare. 4. Short-Term and Long-Term Disability Insurance: Residents can explore standalone disability insurance plans that provide coverage for temporary and long-term disabilities. Conclusion: Choosing the right health and disability insurance plan in Mecklenburg County, North Carolina, is essential for individuals and families seeking comprehensive healthcare coverage and financial protection against disabilities. By following this checklist and considering the specific types of insurance plans available in the region, residents can make informed decisions tailored to their unique needs and circumstances.

Mecklenburg North Carolina Checklist - Health and Disability Insurance

Description

How to fill out Mecklenburg North Carolina Checklist - Health And Disability Insurance?

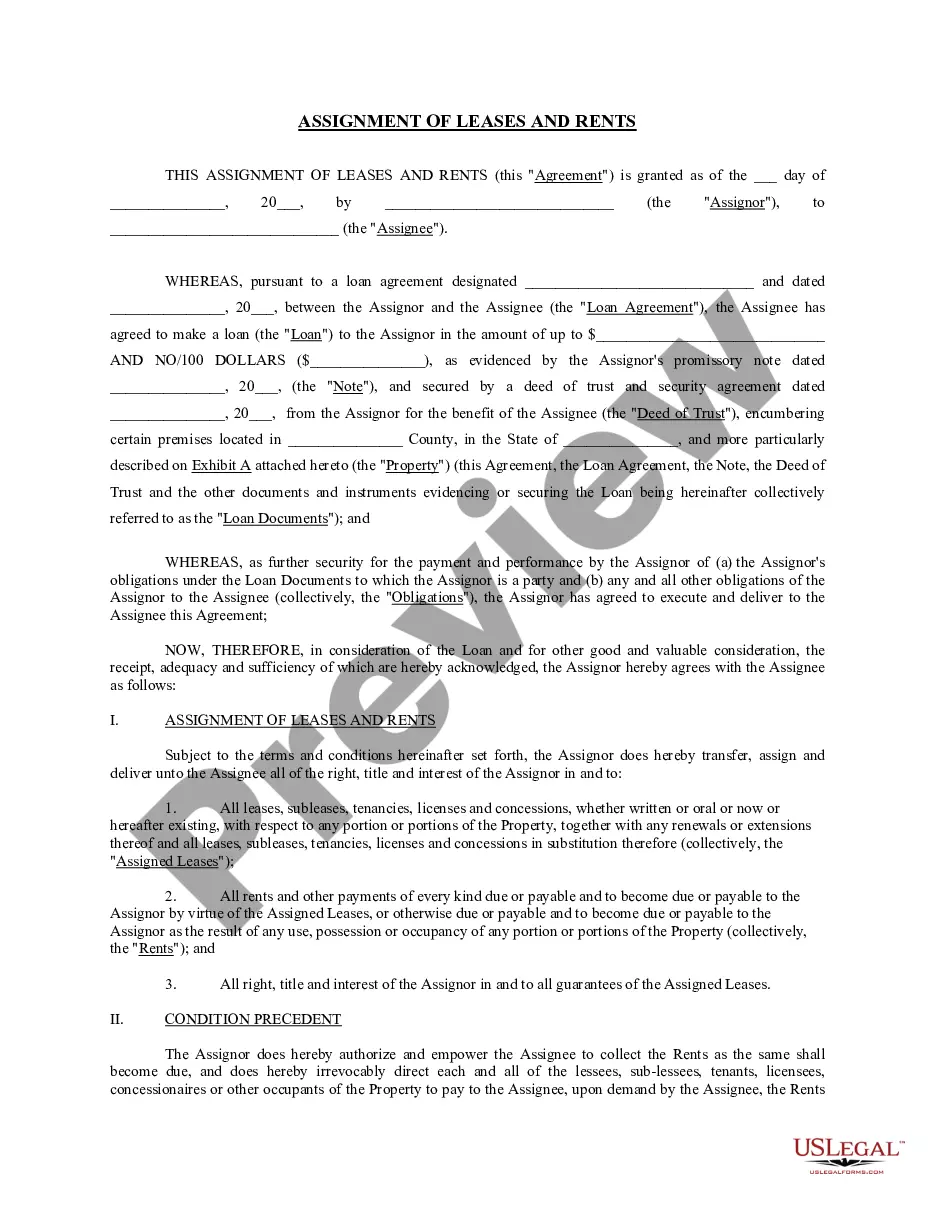

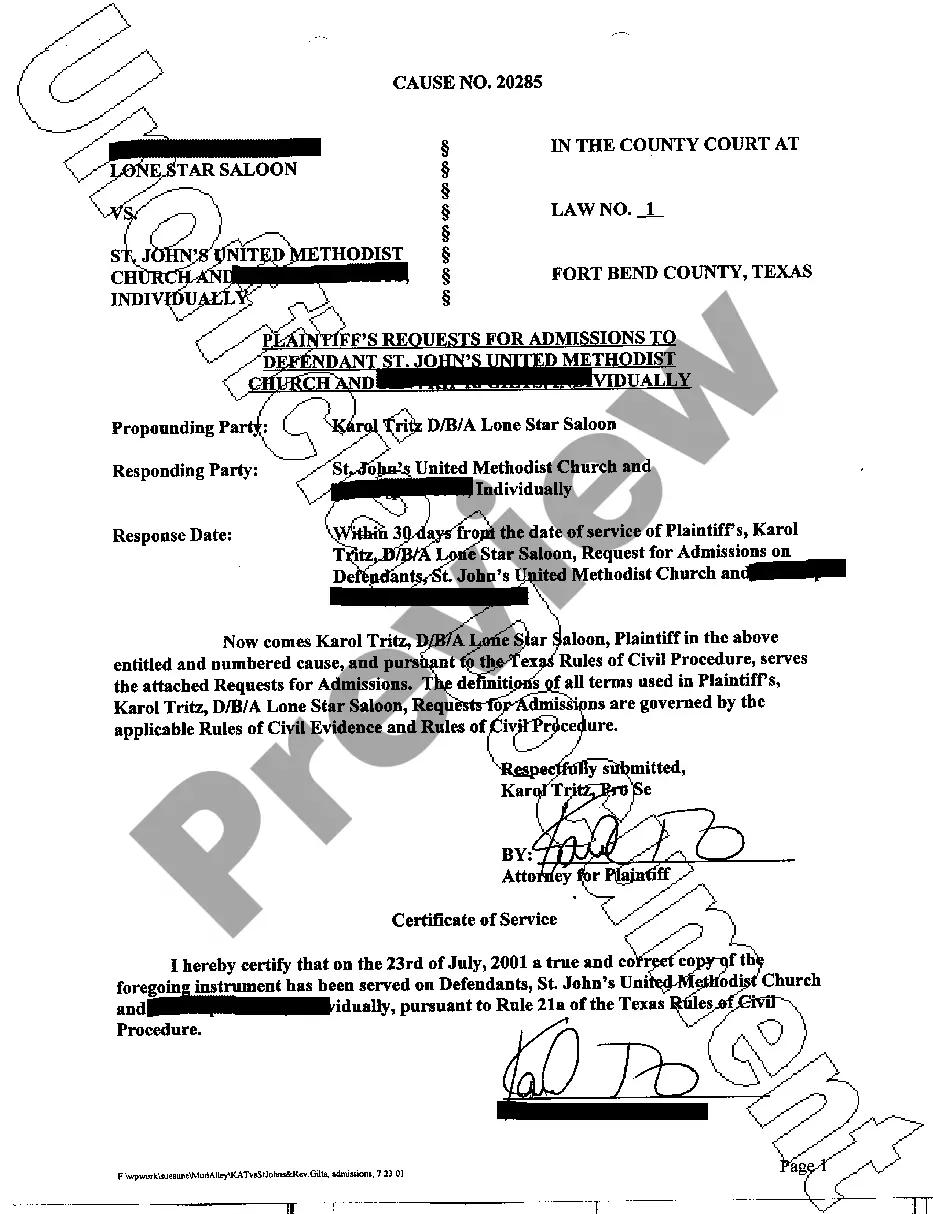

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Mecklenburg Checklist - Health and Disability Insurance.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Mecklenburg Checklist - Health and Disability Insurance will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Mecklenburg Checklist - Health and Disability Insurance:

- Make sure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Mecklenburg Checklist - Health and Disability Insurance on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!