A Kings New York Mutual Confidential Disclosure Agreement (CDA), also known as a Non-Disclosure Agreement (NDA), is a legal contract that ensures the protection of sensitive and confidential information shared between parties involved. This agreement establishes the terms and conditions under which the disclosed information may be utilized or shared, while maintaining its confidentiality. The Kings New York Mutual CDA is designed to safeguard proprietary knowledge, trade secrets, client information, business strategies, and any other confidential data considered valuable by the parties involved. By signing this agreement, both parties commit to preserving the confidentiality of the disclosed information and preventing its unauthorized disclosure or use. It is essential for businesses or individuals engaging in collaborations, partnerships, mergers, acquisitions, or any other professional relationship wherein confidential information is shared, to use a Kings New York Mutual CDA. This agreement ensures that sensitive data does not fall into the wrong hands or get exploited, which could potentially lead to financial loss, reputational damage, or legal consequences. Furthermore, the Kings New York Mutual CDA defines the scope of confidential information, outlining what is considered confidential and what is excluded from its coverage. It also specifies the obligations and responsibilities of each party, indicating how they should handle, protect, and restrict the use of the disclosed information during and after the business relationship. Different types of Kings New York Mutual Confidential Disclosure Agreements may exist depending on the specific circumstances or industry. For instance, there may be variations for technology companies, healthcare providers, financial institutions, or even educational institutions, as each may have unique requirements and considerations regarding confidentiality. However, the core principles and objectives of protecting sensitive information remain consistent across all types of Kings New York Mutual CDs. In summary, a Kings New York Mutual Confidential Disclosure Agreement is a legally binding contract that ensures the safeguarding of confidential information shared between parties. It establishes the terms and conditions of the agreement, defines the scope of confidentiality, and outlines the rights and obligations of the parties involved. Utilizing a Kings New York Mutual CDA is crucial to prevent the unauthorized disclosure or misuse of valuable business information and to maintain trust and confidentiality in professional relationships.

Kings New York Mutual Confidential Disclosure Agreement

Description

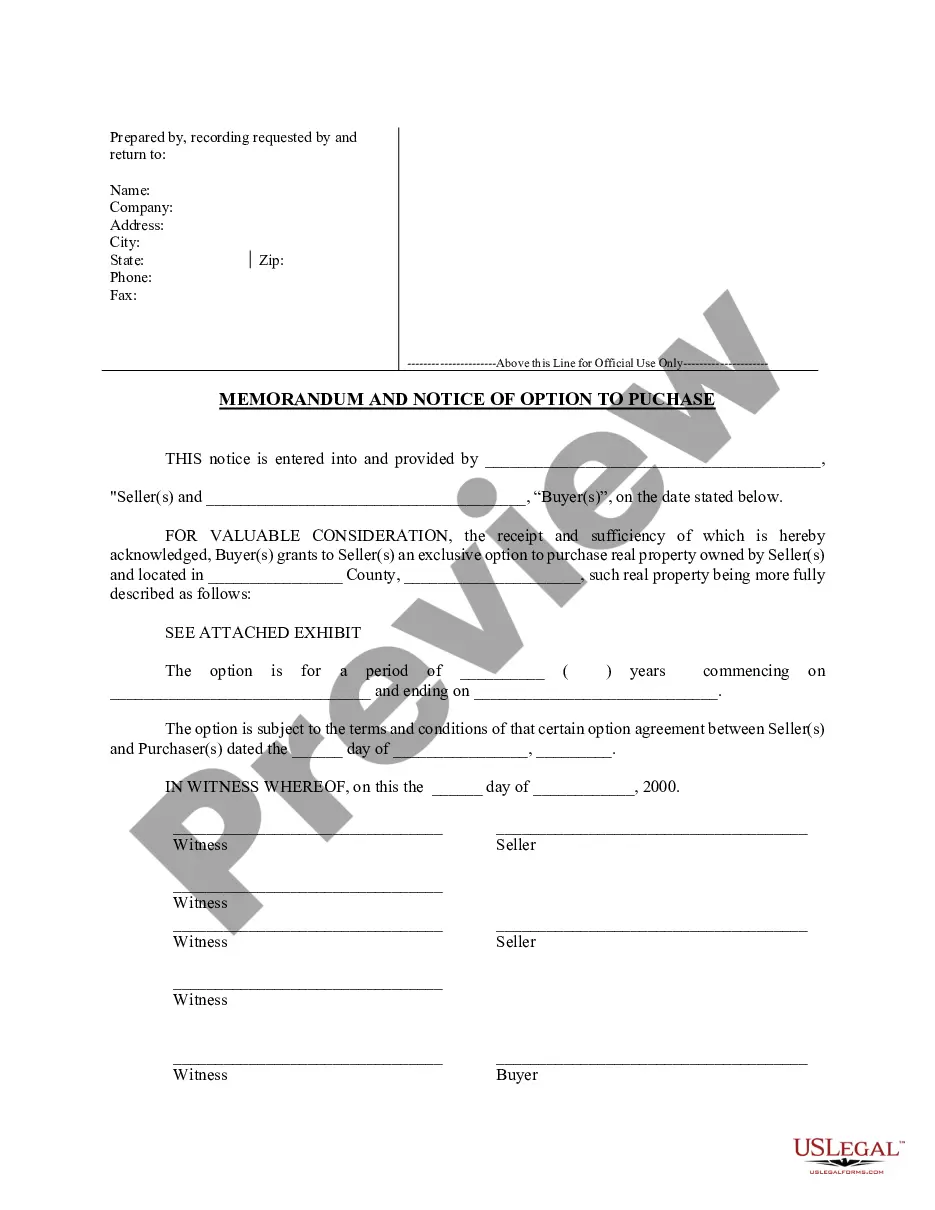

How to fill out Kings New York Mutual Confidential Disclosure Agreement?

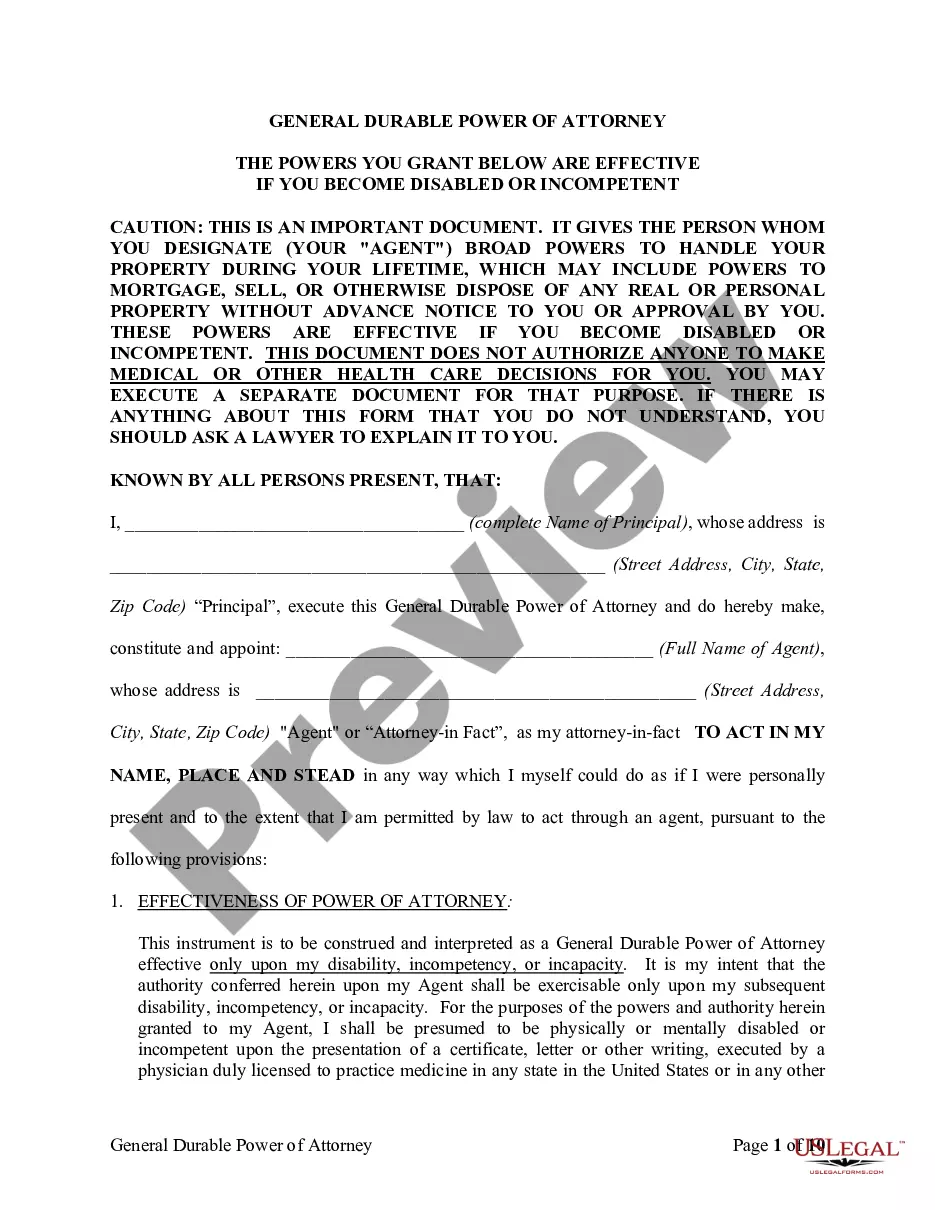

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Kings Mutual Confidential Disclosure Agreement, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the current version of the Kings Mutual Confidential Disclosure Agreement, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Kings Mutual Confidential Disclosure Agreement:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Kings Mutual Confidential Disclosure Agreement and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!