Chicago Illinois Mortgage Note

Description

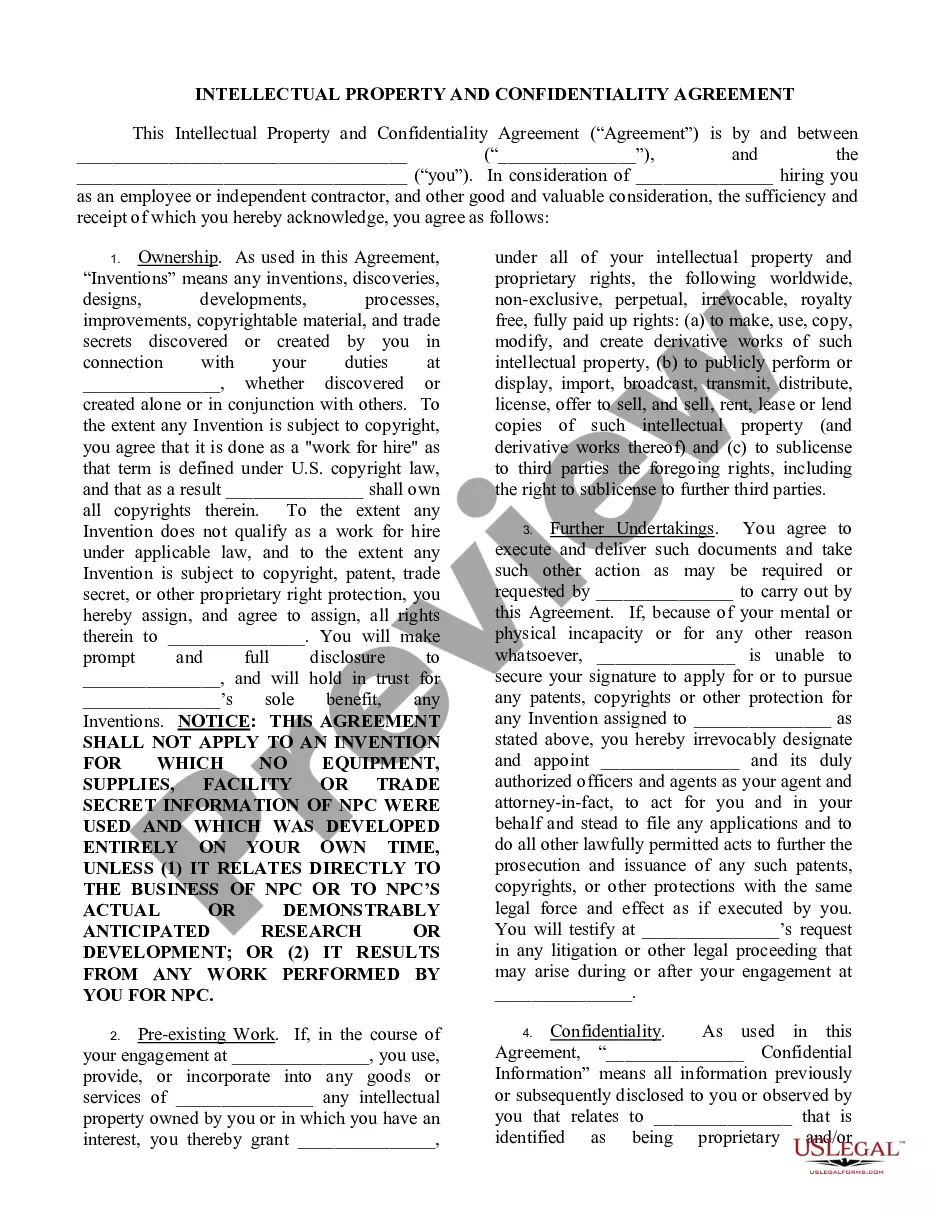

How to fill out Mortgage Note?

Navigating legal documents is essential in the modern era.

Nonetheless, you don’t always have to seek expert assistance to create some of them from the beginning, such as Chicago Mortgage Note, using a service like US Legal Forms.

US Legal Forms offers more than 85,000 templates to choose from across various categories, including living wills, property documents, and divorce records.

Select your option, choose a suitable payment method, and procure Chicago Mortgage Note.

Choose to store the form template in any accessible format.

- All forms are categorized by their applicable state, simplifying the search process.

- You can also access informational resources and guides on the site to facilitate any tasks related to document preparation.

- Here’s how to find and acquire Chicago Mortgage Note.

- Review the document's preview and outline (when available) to grasp the essential details of what you’ll receive after acquiring the document.

- Verify that the template you select is relevant to your state/county/region as state laws may influence the validity of certain documents.

- Look through the related forms or restart the search to discover the right file.

- Click Buy now and set up your account. If you already possess one, opt to sign in.

Form popularity

FAQ

Yes, mortgage notes typically become public records once they are recorded with the local county clerk's office. This means anyone can access them upon request, although some information may require proof of association with the property. If you need to find a Chicago Illinois Mortgage Note, checking the public records at your local office can be a good starting point.

You can obtain a mortgage note by contacting your lender directly for a copy. If you are unable to secure it from them, consider checking your local county clerk's office, where mortgage notes may be filed. Using platforms such as USLegalForms can also simplify the process; they provide resources and information on how to properly secure your Chicago Illinois Mortgage Note.

The holder of your mortgage note is often your lender or the financial institution that issued the mortgage. However, if your mortgage has been sold or transferred, the current holder may change. To find out who holds your Chicago Illinois Mortgage Note, you can contact your original lender or check public records through your county clerk’s office.

To obtain a copy of your original mortgage note, you should start by contacting your lender or mortgage servicer. They typically maintain records of all mortgage documents, including your Chicago Illinois Mortgage Note. If your lender is unable to provide a copy, you may also check with the county recorder's office where the property is located.

Yes, a mortgage note is required for closing a real estate transaction. This document confirms the buyer's commitment to the mortgage and outlines the terms of repayment. Without a Chicago Illinois Mortgage Note, the closing process cannot proceed, as it provides essential security for the lender.

A promissory note’s worth often reflects the sum of the borrowed amount plus any applicable interest. Like a mortgage note, the value can change based on payment schedules and the creditworthiness of the borrower. If you have a promissory note linked to your Chicago Illinois Mortgage Note, understanding its value is essential for managing your investments.

You can find your mortgage note in your closing documents, which you received when you purchased your property. If you cannot locate it, contact your mortgage lender for assistance. Additionally, online platforms like US Legal Forms can help guide you in obtaining necessary documentation related to your Chicago Illinois Mortgage Note.

To record a deed in Cook County, Illinois, you need to complete the appropriate forms and submit them to the Cook County Recorder of Deeds. Ensure that you have your identification and any applicable fees ready when you go to record the deed. Recording your deed is essential for securing your rights related to a Chicago Illinois Mortgage Note. This process protects your investment in the property.

When you buy a mortgage note, you essentially step into the shoes of the lender. This means you will receive the payments from the borrower per the note's terms. Investing in a Chicago Illinois Mortgage Note can provide a steady income stream, but it comes with risks that you should assess carefully. Make sure to conduct thorough due diligence before investing.

Yes, in Illinois, mortgages are recorded to provide public notice of a property lien. Recording a mortgage ensures that your interest is legally protected and visible to future buyers and creditors. This process is vital for anyone dealing with a Chicago Illinois Mortgage Note. It helps establish your rights regarding the property.