A Dallas Texas Mortgage Note is a legal document that outlines the terms and conditions of a mortgage loan in the Dallas, Texas area. It serves as evidence of the debt owed by the borrower to the lender and sets forth the repayment terms, including the principal amount, interest rate, repayment schedule, and any additional provisions. Mortgage notes can be classified into different types based on their specific characteristics and purposes. Some common types of Dallas Texas Mortgage Notes include: 1. Fixed-rate Mortgage Note: This type of mortgage note maintains a fixed interest rate throughout the loan term, providing consistency in monthly payments. Borrowers with stable income and long-term homeownership goals often choose fixed-rate mortgages for predictability and peace of mind. 2. Adjustable-rate Mortgage Note: An adjustable-rate mortgage note features an interest rate that can change periodically according to market conditions. This type of note may offer lower initial rates and is suitable for borrowers who plan to sell or refinance the property within a specific time frame. 3. Balloon Mortgage Note: Balloon mortgage notes have a shorter-term, typically ranging from five to seven years, with lower monthly payments during the initial period. However, at the end of the term, the borrower is required to pay off the remaining balance in one lump sum payment, refinancing, or through other means. 4. Interest-only Mortgage Note: With an interest-only mortgage note, borrowers are only required to pay the interest for a specified period, usually five to ten years. After this initial period, the borrower must begin repaying both the principal and interest. This type of note may be attractive to borrowers seeking lower initial payments or expecting significant income growth in the future. 5. Second Mortgage Note: A second mortgage note is a subordinate loan taken out by the homeowner while still having an existing primary mortgage. It allows borrowers to access additional funds for various purposes such as home improvements, debt consolidation, or investment opportunities. Dallas Texas Mortgage Notes provide a crucial framework for both lenders and borrowers by clearly defining the terms and obligations of the mortgage loan. These notes offer flexibility and options to meet the diverse financial needs of homeowners in the Dallas, Texas area. Whether individuals are seeking stability, short-term affordability, or other specific requirements, there is a mortgage note type available to suit their unique circumstances and goals.

Dallas Texas Mortgage Note

Description

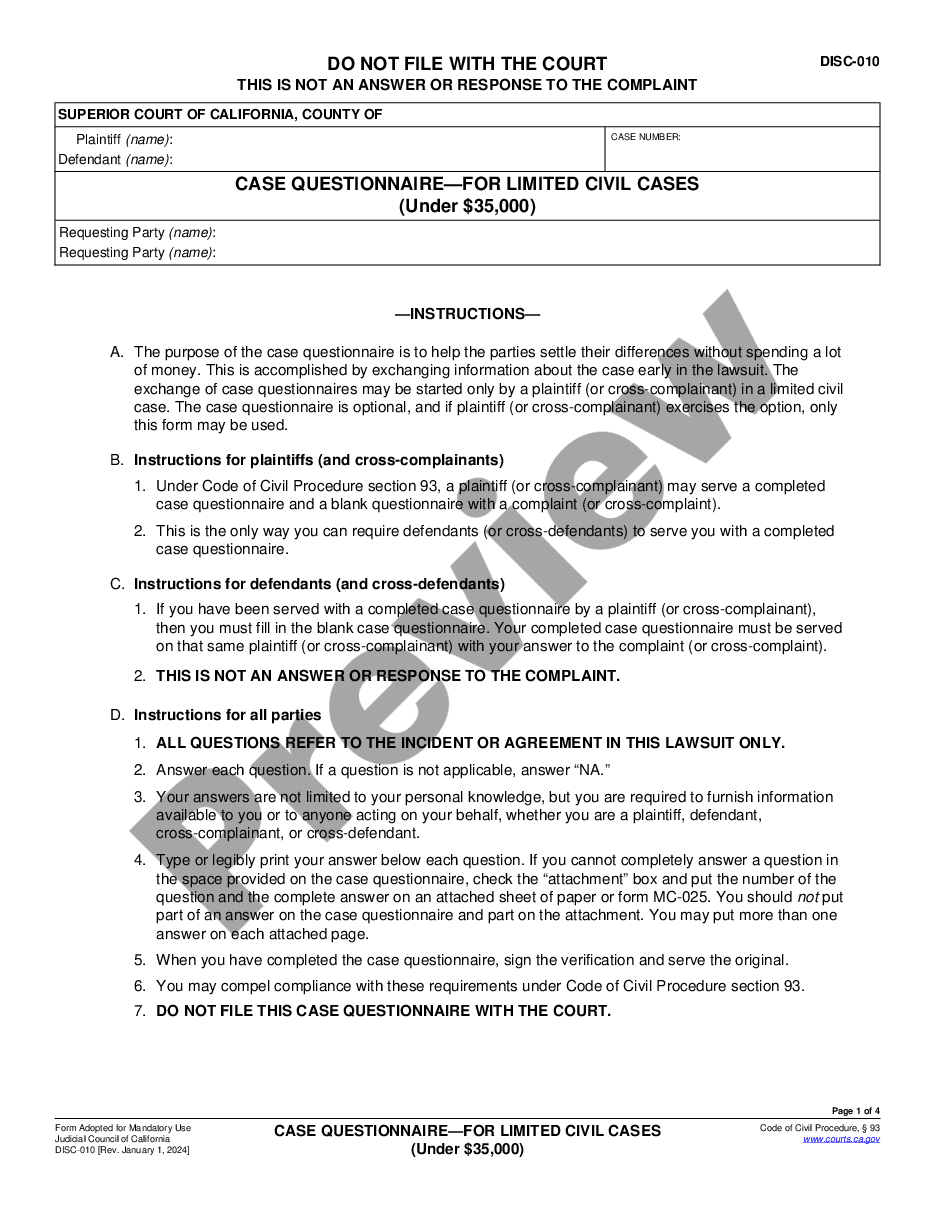

How to fill out Dallas Texas Mortgage Note?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Dallas Mortgage Note.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Dallas Mortgage Note will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Dallas Mortgage Note:

- Ensure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Dallas Mortgage Note on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Promissory notes are not usually recorded. They are enforceable even if they are not recorded. The hiring of a lawyer is an important decision that should not be based solely upon advertisements.

Dallas County Clerk. Recording Division.

If the project is located in Dallas county, then yes, you will want to record your lien with the Dallas County Clerk's office.

Your mortgage company should send you a release of lien, and it must be filed with the County Clerk 214-653-7275. If you do not receive a tax statement by mid-November, go to the Property Tax Lookup/Payment Application, or call our Customer Care 214-653-7811.

If you lose your closing papers or they get destroyed, you can obtain a copy of your mortgage note by searching the county's records or contacting the registry of deeds. It's also possible to obtain a copy from the company who services your loan (that is, the company you get billing statements from).

How can I find out if there is a lien on my property? Information concerning liens recorded against a property may be researched by the public in the County Clerk's Deed Records Department located at 101 W. Nueva, Suite B109, San Antonio, TX 78205, or visit our website.

Share on: In Texas, you cannot assume ownership of someone else's property by simply paying the balance of unpaid property taxes. However, you can purchase real estate, often at a discounted rate, at a tax foreclosure sale.

So whoever is a borrower on the Note is personally liable for paying back the debt to the lender. The Note is not recorded in the Courthouse, so the original Note is returned to the lender upon closing.

Promissory notes are usually documented and enter the public record shortly after settlement. The trustee (or lender) holds the promissory note until the debt is repaid. Once the borrower has satisfied the note's terms, the trustee will record a deed of reconveyance or stamp the recorded promissory note as paid.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount.