A Mecklenburg North Carolina Mortgage Note is a legal document that serves as evidence of a debt between a borrower and a lender in a mortgage transaction. It outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any other specific clauses agreed upon by both parties. Mecklenburg County, located in North Carolina, is one of the most populous counties in the state and encompasses the city of Charlotte. As such, the mortgage note used in Mecklenburg County follows the state-specific laws and regulations governing mortgage transactions in North Carolina. There are several types of Mecklenburg North Carolina Mortgage Notes that borrowers and lenders may encounter, such as: 1. Fixed-rate Mortgage Note: This type of mortgage note establishes a fixed interest rate for the entire loan term. The interest rate remains constant, providing borrowers with predictable monthly payments. 2. Adjustable-rate Mortgage Note (ARM): An ARM Mortgage Note features an interest rate that may change over time, typically after an initial fixed-rate period. The adjustment is based on an index that fluctuates with market conditions, allowing the interest rate to increase or decrease. 3. Balloon Mortgage Note: A Balloon Note allows borrowers to make smaller monthly payments for a specified period, often between five and seven years. However, at the end of this period, the borrower must pay off the remaining balance in a lump sum known as a balloon payment. 4. Interest-only Mortgage Note: With an interest-only note, borrowers are only required to pay the interest portion of the loan for a specific period, typically during the initial years of the loan term. After that, the borrower must begin making principal and interest payments. It is important for both borrowers and lenders in Mecklenburg County to thoroughly understand the details and terms outlined in the Mortgage Note. It serves as a legally binding contract that governs the repayment of the loan, ensuring both parties are aware of their rights and obligations throughout the mortgage transaction. Disclaimer: This is for informational purposes only and should not be considered as legal or financial advice. Consult with a professional attorney or financial advisor for specific guidance related to Mecklenburg North Carolina Mortgage Notes.

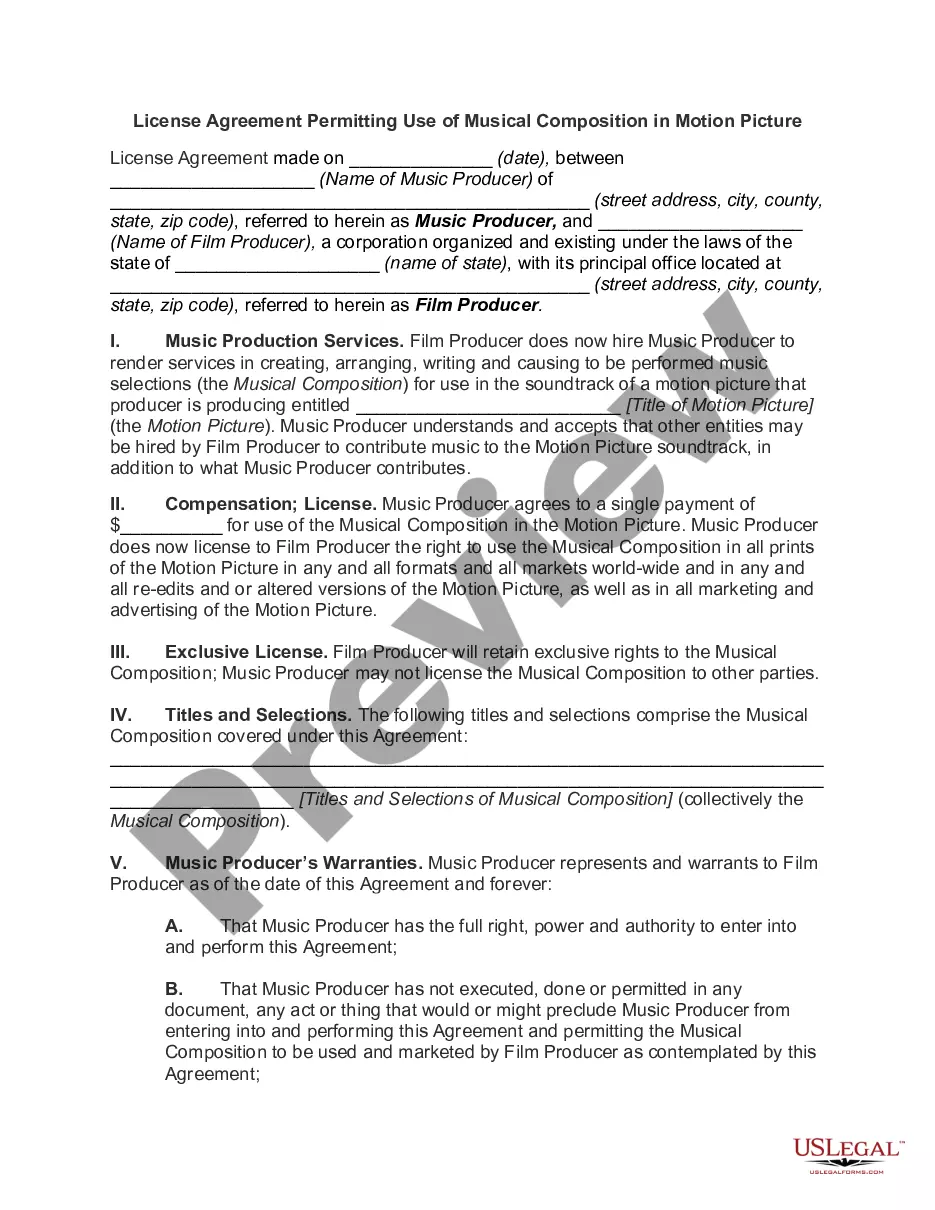

Mecklenburg North Carolina Mortgage Note

Description

How to fill out Mecklenburg North Carolina Mortgage Note?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Mecklenburg Mortgage Note meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, gathered by states and areas of use. Aside from the Mecklenburg Mortgage Note, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Mecklenburg Mortgage Note:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Mecklenburg Mortgage Note.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

All real estate records are public records and are available for inspection between the hours of 8 a.m. and 5 p.m. Monday through Friday. The Register of Deeds Office is located in the County and Courts Office Building, 720 East Fourth Street, Charlotte, NC 28202.

The public is able to access documents, such as deeds, birth and death certificates, military discharge records, and others through the register of deeds. There may be a fee to access or copy public records through the register of deeds.

All Federal court records are available online at PACER.gov, an electronic public access service that is overseen by the Administrative Office of the United States Courts. This includes all Federal civil court cases, criminal charges, as well as bankruptcies. In all, there are over 500 million documents on PACER.

Go to your county's website and search for tax maps or real property records. Go to: . Click on ?Access to Local Geospatial Data in NC?.

Any person has the right to inspect, examine and get copies of public records.

I want to get a copy of the deed to my land. How can I do that? Go to your Register of Deeds Office and look at the document there. Find your Register of Deeds in: Your phone book under county government.Look it up online. Many counties have their real property (land) records online. Go to the county website.

Residents within Mecklenburg County can dial 311. If outside the county, please dial 704-336-7600.

All real estate records are public records and are available for inspection between the hours of 8 a.m. and 5 p.m. Monday through Friday. The Register of Deeds Office is located in the County and Courts Office Building, 720 East Fourth Street, Charlotte, NC 28202.

?Please contact us at 704-432-9300 if you have any questions.

For information related to arrests, inmates, or warrants, please visit the Mecklenburg County Sheriff's Office website or call the information line at 704-336-8100....The following inquiries can be accessed online: arrest inquiries. civil inquiries. inmate inquiries. warrant inquiries.

More info

Before you may begin transferring ownership of the vessel, he must pay a registration fee to the county clerk. This application is not required for a vessel in storage or any vessel that is awaiting registration because the vehicle is considered to be in storage and is not being used by the owner. The Division cannot assist in any transaction that includes any vehicle that has remained in storage indefinitely and requires the owner to get regular or periodic payments from the owner. This application is not required for an instrument that is in the possession of a third party (see section 2(2.6) above in this title). If the vessel has been on the water for over 6 months, the transfer of ownership will be completed at the County Office Building. A transfer of ownership for a vessel owned in North Carolina by a person who is not a North Carolina resident or a person other than the owner if the vessel is registered on North Carolina plates.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.