A Lima Arizona Mortgage Note is a legally binding document that serves as evidence of a debt in a real estate transaction. It outlines the terms and conditions of the loan agreement between a lender and a borrower. The mortgage note specifies the loan amount, the interest rate, the repayment schedule, and any other important terms agreed upon by both parties. In Lima, Arizona, there are several types of mortgage notes that vary based on the specific needs and circumstances of the borrower: 1. Conventional Mortgage Note: This is the most common type of mortgage note. It refers to a loan that follows the guidelines set by Fannie Mae and Freddie Mac, the largest buyers of conventional mortgages. These notes typically require a down payment, have a fixed interest rate, and a fixed term. 2. FHA Mortgage Note: FHA (Federal Housing Administration) mortgage notes are insured by the government, making them more accessible to borrowers with lower credit scores or limited financial resources. These notes often have lower down payment requirements and more flexible credit standards. 3. VA Mortgage Note: VA (Department of Veterans Affairs) mortgage notes are exclusive to military service members, veterans, and their families. These notes offer favorable terms, such as low or no down payment, flexible credit requirements, and competitive interest rates. 4. Jumbo Mortgage Note: Jumbo mortgage notes are used for loan amounts that exceed the limits set by Fannie Mae and Freddie Mac. These notes usually have higher interest rates and stricter qualification criteria due to the larger loan amount. 5. Adjustable-Rate Mortgage Note: An adjustable-rate mortgage note (ARM) features an interest rate that can change over time. Initially, it may have a fixed-rate period before converting to an adjustable rate. Borrowers may choose this option to take advantage of low-interest rates initially, but should be prepared for potential rate adjustments in the future. Regardless of the type of mortgage note, it is essential for borrowers to thoroughly review and understand the terms and obligations outlined in the document before committing to a loan. Consulting with a qualified mortgage professional or attorney can help ensure that all aspects of the mortgage note are clear and suitable for the borrower's financial situation.

Pima Arizona Mortgage Note

Description

How to fill out Pima Arizona Mortgage Note?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Pima Mortgage Note, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Pima Mortgage Note from the My Forms tab.

For new users, it's necessary to make some more steps to get the Pima Mortgage Note:

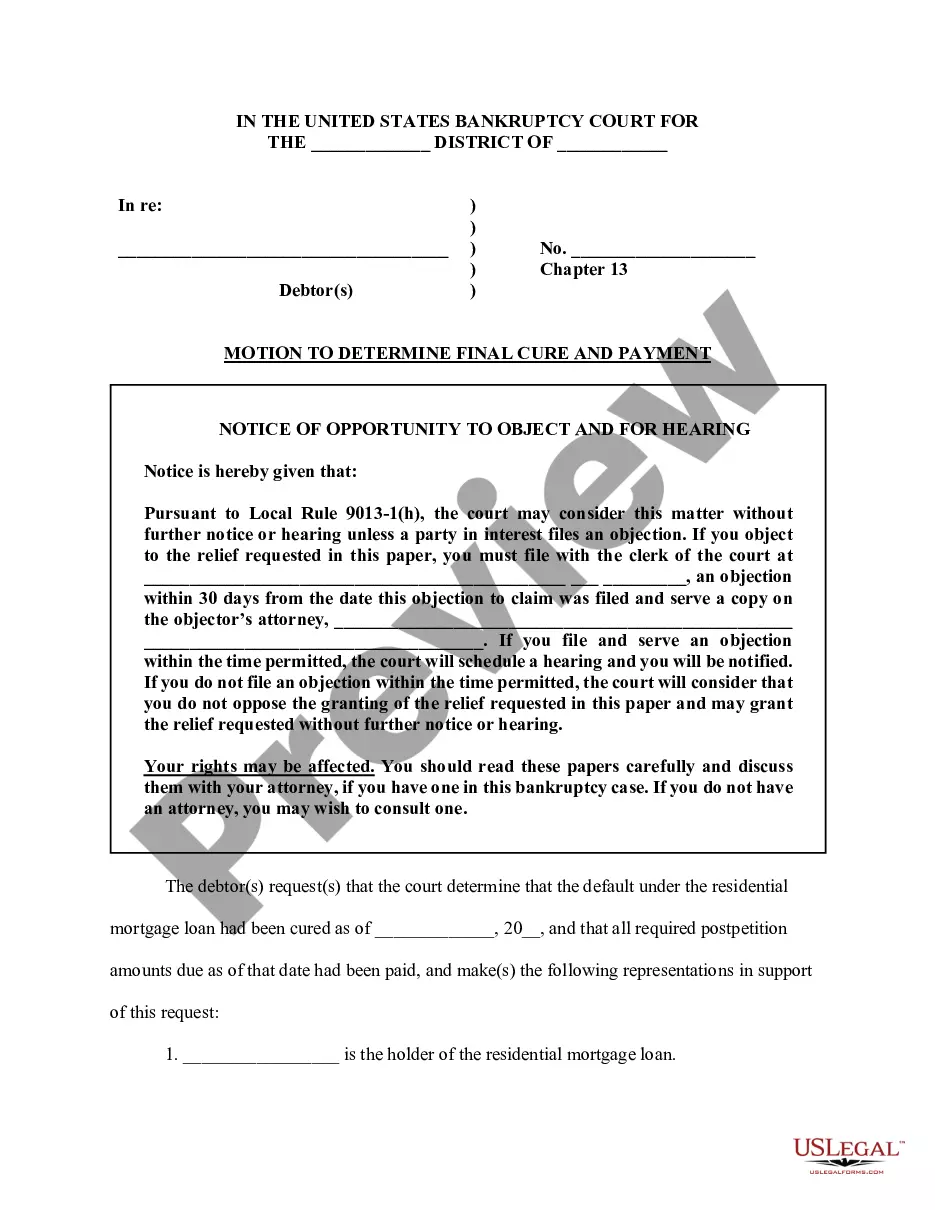

- Analyze the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!