Maricopa Arizona Mortgage Deed: Comprehensive Overview and Various Types A Maricopa Arizona Mortgage Deed is a legal document that serves as evidence of a mortgage agreement between a borrower and a lender in the Maricopa County, Arizona area. It outlines the terms, conditions, and obligations related to the loan securing a property. Keywords: Maricopa Arizona Mortgage Deed, legal document, mortgage agreement, borrower, lender, Maricopa County, Arizona, terms, conditions, obligations, property This mortgage deed is an important part of the real estate transaction process when purchasing a home or property in Maricopa County. It provides security to the lender by granting them a lien or claim on the property in exchange for the loan funds provided to the borrower. The mortgage deed is typically recorded in the county's public records, making it a legally binding document. In Maricopa County, Arizona, there are different types of Mortgage Deeds that vary in the terms and conditions outlined. These types include: 1. Conventional Mortgage Deed: This is the most common type of mortgage deed and is issued by private lenders such as banks or financial institutions. It follows the guidelines set by Fannie Mae or Freddie Mac, two government-sponsored enterprises. 2. FHA Mortgage Deed: This type of mortgage deed is insured by the Federal Housing Administration (FHA). It is specifically designed to provide easier access to homeownership for individuals with lower credit scores or a smaller down payment. 3. VA Mortgage Deed: The Department of Veterans Affairs (VA) guarantees this type of mortgage deed for qualifying veterans, active-duty service members, and their families. It offers favorable terms and conditions, such as lower interest rates and zero down payment options. 4. USDA Mortgage Deed: The United States Department of Agriculture (USDA) backs this mortgage deed, which is aimed at helping individuals in rural areas become homeowners. It offers low-interest rates and does not require a down payment in some cases. These various types of Mortgage Deeds were designed to cater to different borrower needs and circumstances, making homeownership more accessible and affordable for a wide range of individuals in Maricopa County, Arizona. Ultimately, a Maricopa Arizona Mortgage Deed is a critical legal document that outlines the obligations and rights of the borrower and lender in a mortgage agreement. It provides security and establishes a lien on the property, ensuring repayment of the loan based on the specified terms and conditions.

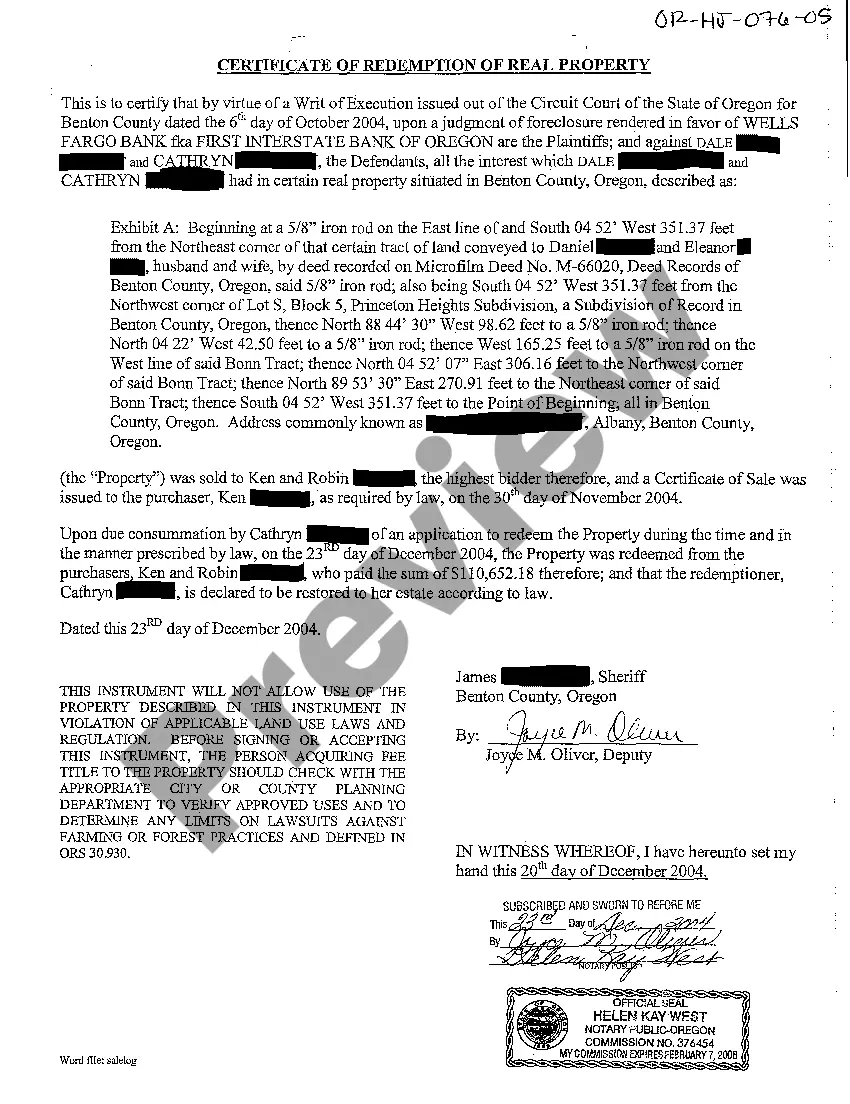

Maricopa Arizona Mortgage Deed

Description

How to fill out Maricopa Arizona Mortgage Deed?

If you need to get a trustworthy legal paperwork supplier to obtain the Maricopa Mortgage Deed, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support team make it simple to get and execute various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse Maricopa Mortgage Deed, either by a keyword or by the state/county the form is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Maricopa Mortgage Deed template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less expensive and more affordable. Set up your first business, arrange your advance care planning, create a real estate agreement, or execute the Maricopa Mortgage Deed - all from the convenience of your sofa.

Sign up for US Legal Forms now!