A Philadelphia Pennsylvania Mortgage Deed is a legal document that outlines the terms and conditions of a mortgage loan for a property located in Philadelphia, Pennsylvania. This deed serves as evidence of a borrower's obligation to repay the loan and gives the lender a security interest in the property until the debt is fully paid. The Philadelphia Pennsylvania Mortgage Deed typically includes pertinent information such as the names of the borrower and lender, the property's legal description, the loan amount, the repayment terms, and the interest rate. This document is signed by both parties and then recorded with the Philadelphia County Recorder of Deeds to establish a public record of the mortgage. There are different types of Philadelphia Pennsylvania Mortgage Deeds, each serving a specific purpose: 1. General Mortgage Deed: This is the most common type of mortgage deed used in Philadelphia. It conveys a security interest in the property to the lender and establishes the terms and conditions of the loan. 2. Refinance Mortgage Deed: This type of mortgage deed is used when an existing mortgage is refinanced to obtain better loan terms. It replaces the original mortgage deed with updated loan details. 3. Second Mortgage Deed: A second mortgage deed is used when a borrower wants to take out a new loan on a property with an existing mortgage. This deed creates a second lien on the property, subordinate to the first mortgage. 4. Home Equity Line of Credit (HELOT) Deed: HELOT deeds are used specifically for home equity lines of credit, which allow borrowers to access funds by using their property as collateral. These deeds establish the terms and conditions of the HELOT. 5. Mortgage Assignment Deed: This type of deed is used when a mortgage loan is transferred from one lender to another. It assigns the rights and responsibilities of the original mortgage to the new lender. In summary, the Philadelphia Pennsylvania Mortgage Deed is a vital legal document that outlines the terms and conditions of a mortgage loan in Philadelphia. It serves as evidence of the borrower's obligation and the lender's security interest in the property. Various types of mortgage deeds exist, including general mortgage deeds, refinance mortgage deeds, second mortgage deeds, HELOT deeds, and mortgage assignment deeds.

Philadelphia Pennsylvania Mortgage Deed

Description

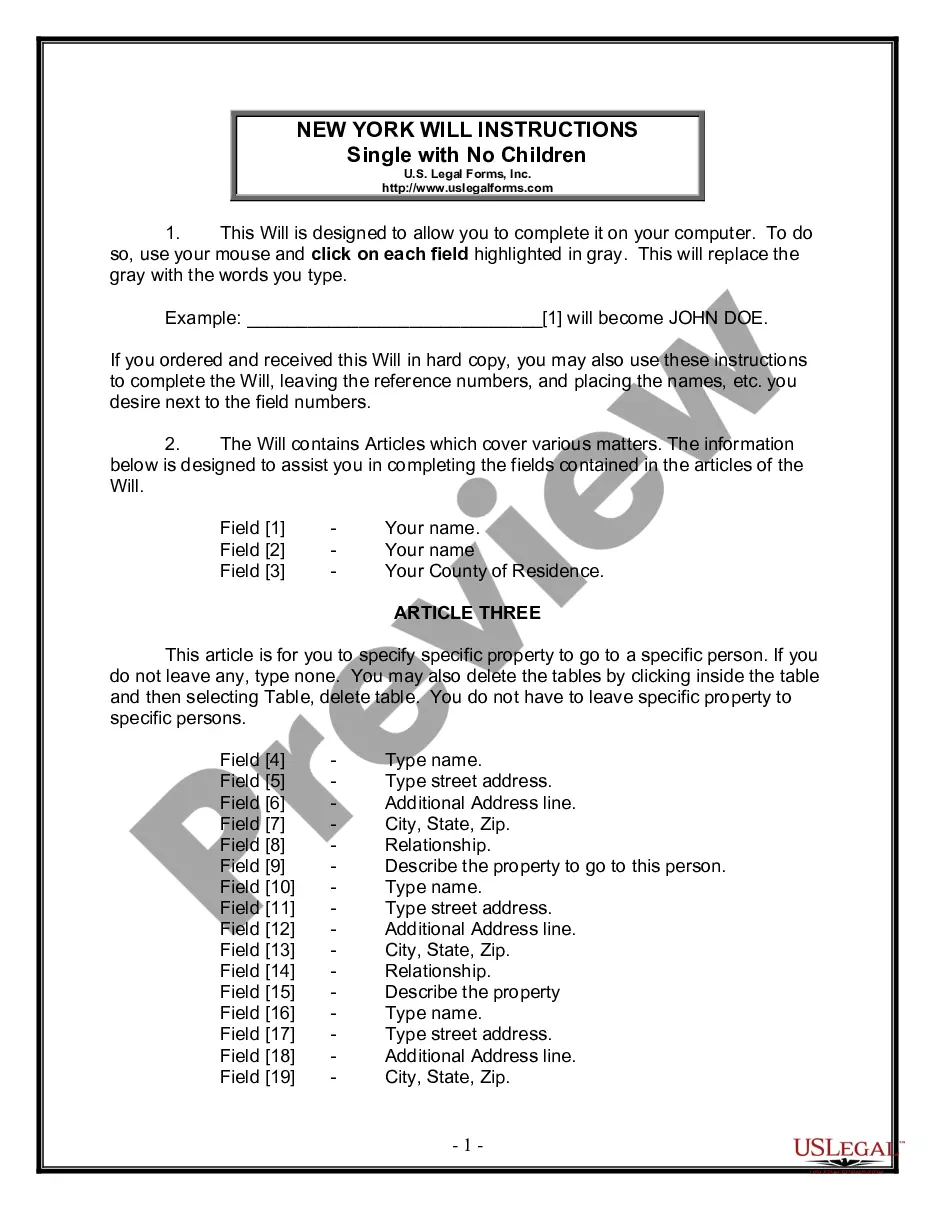

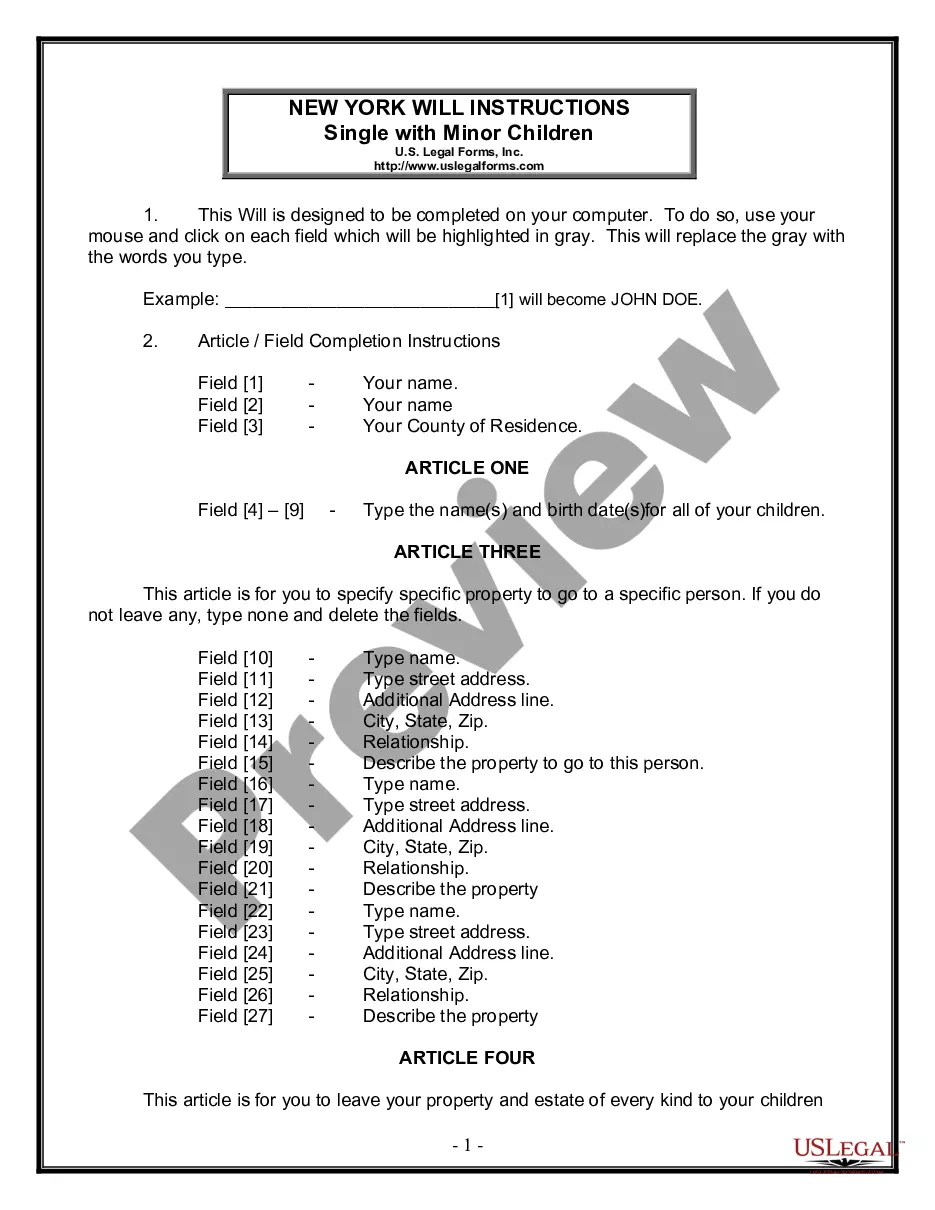

How to fill out Philadelphia Pennsylvania Mortgage Deed?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, locating a Philadelphia Mortgage Deed suiting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Aside from the Philadelphia Mortgage Deed, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Philadelphia Mortgage Deed:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Philadelphia Mortgage Deed.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!