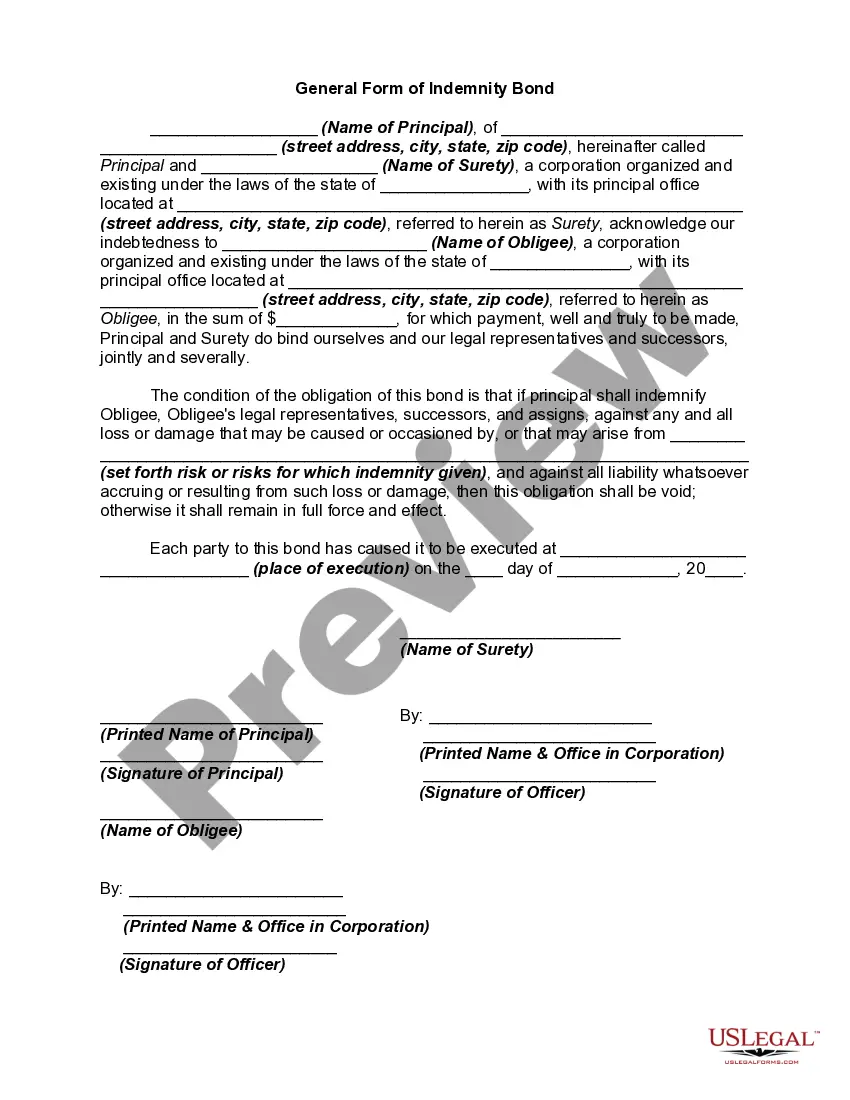

An indemnity bond provides coverage for the loss of an Obligee in the event that the Principal fails to perform according to standards agreed upon between the Obligee and the Principal. A surety is a person obligated by a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the surety's performance will first try to collect or obtain performance from the debtor before trying to collect from the surety. A surety is often found, for example, when someone is required to post a bond to secure a promise.

The Bexar Texas General Form of Indemnity Bond is a legally binding agreement that provides protection against financial loss or damage caused by a party's actions or failures to act. This type of bond is commonly used in various industries and sectors to ensure compliance with legal obligations and safeguard the interests of parties involved in a transaction or business relationship. Keywords: Bexar Texas, general form, indemnity bond, detailed description, legal agreement, protection, financial loss, damage, compliance, business relationship. There are several types of Bexar Texas General Form of Indemnity Bonds, each serving a specific purpose: 1. Contractor's Indemnity Bond: This bond is required in construction projects to guarantee that contractors will fulfill their contractual obligations. It protects project owners from financial loss if the contractor fails to complete the project or breaches the terms of the agreement. 2. Public Official Indemnity Bond: Public officials, such as judges, elected representatives, or government employees, may be required to obtain this bond to provide indemnity to the public against any financial loss resulting from their actions or decisions that are deemed negligent, dishonest, or fraudulent. 3. Notary Public Indemnity Bond: In Bexar Texas, notaries public often need to furnish this bond to protect the public from any financial harm caused by errors or fraudulent acts during the notarization process. 4. Fiduciary Indemnity Bond: This bond is typically required when an individual assumes fiduciary responsibilities, such as acting as a trustee, executor, or administrator of an estate. It protects beneficiaries from any potential financial loss resulting from the fiduciary's misconduct or mismanagement of assets. 5. License and Permit Indemnity Bond: Some professions or businesses in Bexar Texas may need to obtain this bond to ensure compliance with local regulations and protect the public from financial harm. Examples include contractors, auto dealerships, healthcare providers, and alcohol vendors. In conclusion, the Bexar Texas General Form of Indemnity Bond is a vital legal tool that provides financial protection and ensures compliance. Its various types cater to the unique needs of different industries and professions within Bexar Texas.The Bexar Texas General Form of Indemnity Bond is a legally binding agreement that provides protection against financial loss or damage caused by a party's actions or failures to act. This type of bond is commonly used in various industries and sectors to ensure compliance with legal obligations and safeguard the interests of parties involved in a transaction or business relationship. Keywords: Bexar Texas, general form, indemnity bond, detailed description, legal agreement, protection, financial loss, damage, compliance, business relationship. There are several types of Bexar Texas General Form of Indemnity Bonds, each serving a specific purpose: 1. Contractor's Indemnity Bond: This bond is required in construction projects to guarantee that contractors will fulfill their contractual obligations. It protects project owners from financial loss if the contractor fails to complete the project or breaches the terms of the agreement. 2. Public Official Indemnity Bond: Public officials, such as judges, elected representatives, or government employees, may be required to obtain this bond to provide indemnity to the public against any financial loss resulting from their actions or decisions that are deemed negligent, dishonest, or fraudulent. 3. Notary Public Indemnity Bond: In Bexar Texas, notaries public often need to furnish this bond to protect the public from any financial harm caused by errors or fraudulent acts during the notarization process. 4. Fiduciary Indemnity Bond: This bond is typically required when an individual assumes fiduciary responsibilities, such as acting as a trustee, executor, or administrator of an estate. It protects beneficiaries from any potential financial loss resulting from the fiduciary's misconduct or mismanagement of assets. 5. License and Permit Indemnity Bond: Some professions or businesses in Bexar Texas may need to obtain this bond to ensure compliance with local regulations and protect the public from financial harm. Examples include contractors, auto dealerships, healthcare providers, and alcohol vendors. In conclusion, the Bexar Texas General Form of Indemnity Bond is a vital legal tool that provides financial protection and ensures compliance. Its various types cater to the unique needs of different industries and professions within Bexar Texas.