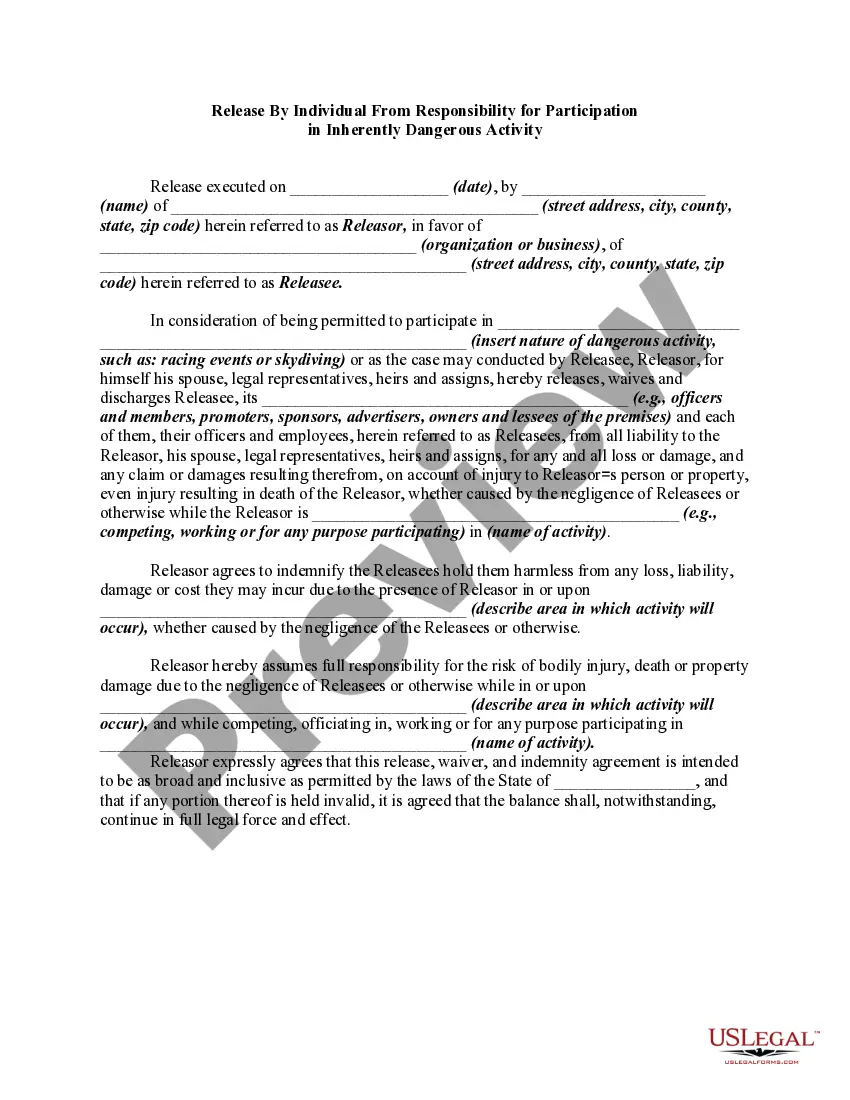

An indemnity bond provides coverage for the loss of an Obligee in the event that the Principal fails to perform according to standards agreed upon between the Obligee and the Principal. A surety is a person obligated by a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the surety's performance will first try to collect or obtain performance from the debtor before trying to collect from the surety. A surety is often found, for example, when someone is required to post a bond to secure a promise.

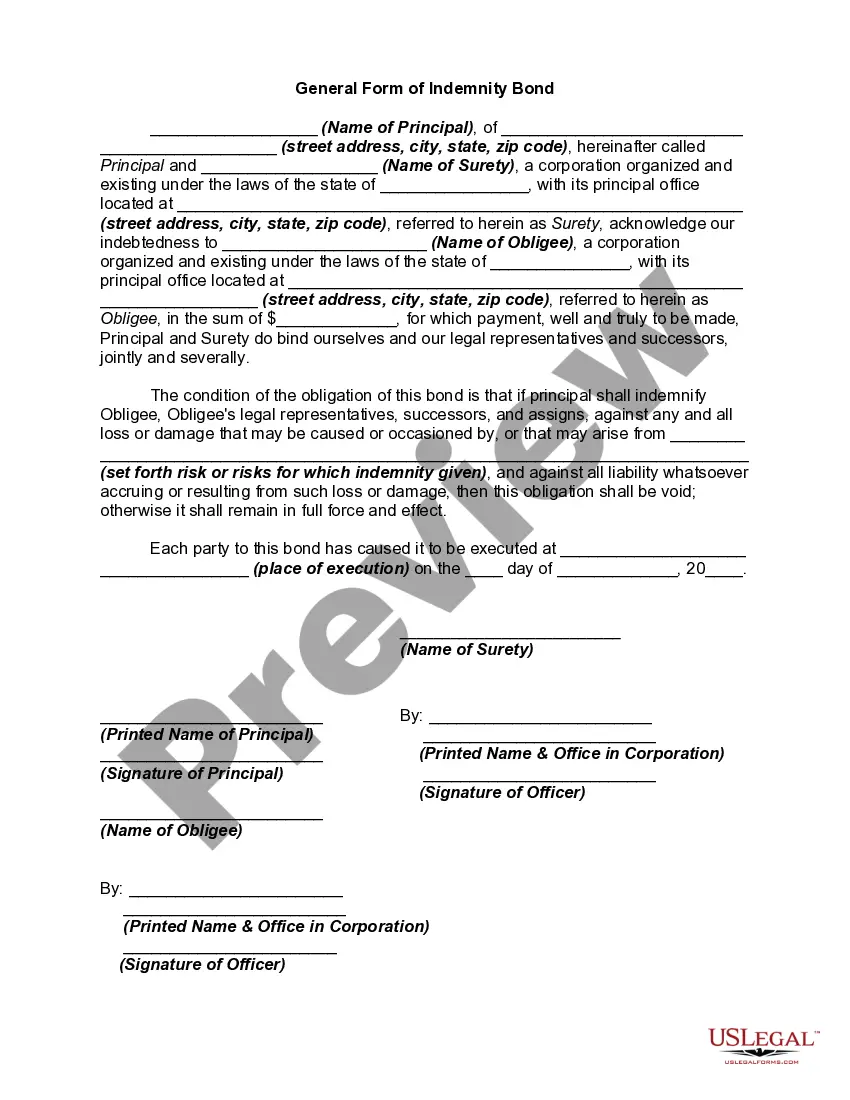

Dallas, Texas — General Form of Indemnity Bond is a legally binding document that serves as a contractual agreement between two parties, typically referred to as the "obliged" and the "obliged." This bond is designed to protect the obliged from any potential financial losses or damages incurred due to the actions or non-performance of the obliged. The Dallas, Texas General Form of Indemnity Bond provides a significant level of assurance and security to the obliged as it guarantees that the obliged will fulfill their contractual obligations and compensate for any losses that may arise. This bond ensures that the obliged will be financially protected in case the obliged fails to meet their obligations. This type of bond is commonly used in various industries and contracts, including construction projects, government contracts, licensing agreements, and many others. It offers financial protection that helps mitigate risks and provides peace of mind to both parties involved. There are different types of Dallas, Texas General Form of Indemnity Bonds, including: 1. Performance Bonds: This bond guarantees that the obliged will complete the contracted work or services according to the agreed-upon terms and conditions. 2. Payment Bonds: This type of bond ensures that all subcontractors and suppliers involved in the project will be paid promptly and fairly by the obliged. 3. Bid Bonds: A bid bond guarantees that the obliged, who is submitting a bid for a particular project, will enter into a contract if the bid is accepted and will provide the necessary performance and payment bonds. 4. License and Permit Bonds: These bonds are required by governmental agencies to ensure that the obliged (such as a contractor or business owner) complies with all laws, regulations, and licensing requirements specific to their industry. 5. Court Bonds: Court bonds, including appeal bonds, fiduciary bonds, and injunction bonds, are typically required in legal proceedings to guarantee the payment of fines, costs, and judgments. Obtaining a Dallas, Texas General Form of Indemnity Bond is a critical step in various business transactions, as it provides financial protection and helps foster trust between the obliged and the obliged. It is essential to consult with a reputable surety bond provider or an attorney experienced in bond matters to ensure that the bond is properly executed and meets all legal requirements.