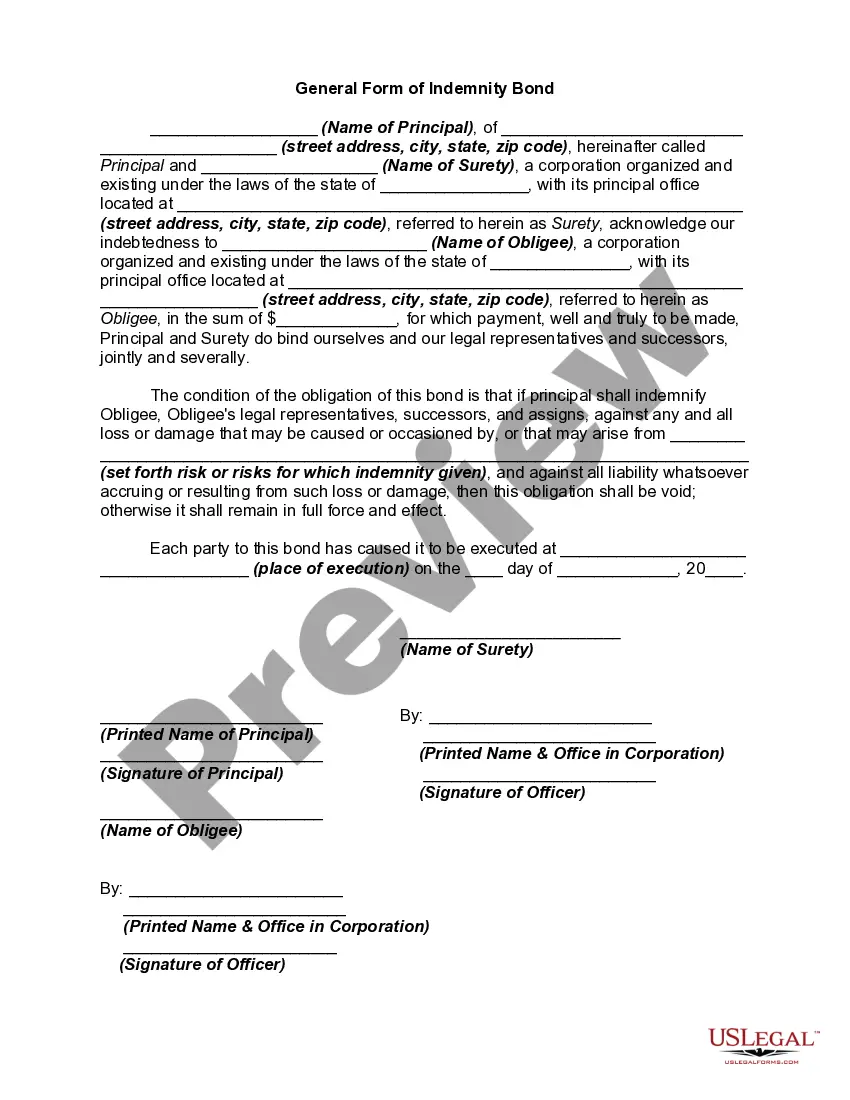

An indemnity bond provides coverage for the loss of an Obligee in the event that the Principal fails to perform according to standards agreed upon between the Obligee and the Principal. A surety is a person obligated by a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the surety's performance will first try to collect or obtain performance from the debtor before trying to collect from the surety. A surety is often found, for example, when someone is required to post a bond to secure a promise.

Title: King Washington General Form of Indemnity Bond: A Comprehensive Guide and Its Types Introduction: The King Washington General Form of Indemnity Bond is a legal document that provides protection to individuals or organizations against potential financial losses or damages caused by another party's actions or failures. This comprehensive guide aims to provide a detailed description of the bond, its purpose, and the different types available. What is King Washington General Form of Indemnity Bond? The King Washington General Form of Indemnity Bond is a type of surety bond that functions as a contractual agreement between the principal (the party seeking indemnity) and the surety (the party providing indemnity). It guarantees compensation to the principal, up to the bond's limit, in the event of any unforeseen losses, damages, or liabilities arising from the actions, negligence, or contractual breaches of the other party. The bond serves as a financial safeguard, providing peace of mind and ensuring adequate compensation in case of non-performance or financial losses incurred. Keywords: King Washington General Form of Indemnity Bond, surety bond, contractual agreement, financial losses, damages, liabilities, compensation, non-performance. Types of King Washington General Form of Indemnity Bond: 1. Performance Indemnity Bond: This type of bond guarantees that the principal will fulfill certain contractual obligations, such as completing a construction project according to agreed specifications, meeting deadlines, or adhering to quality standards. It protects the obliged (the party benefiting from the bond) from financial losses resulting from the principal's non-performance. Keywords: Performance Indemnity Bond, contractual obligations, construction projects, deadlines, quality standards, non-performance, obliged. 2. Payment Indemnity Bond: A payment indemnity bond ensures that the principal will make timely payments to suppliers, subcontractors, or vendors involved in a project. It protects these beneficiaries from financial losses if the principal fails to honor their payment obligations. This bond encourages a smooth flow of funds throughout the project, promoting trust and fairness within business transactions. Keywords: Payment Indemnity Bond, timely payments, suppliers, subcontractors, vendors, financial losses, payment obligations, funds. 3. Bid Indemnity Bond: When participating in a competitive bidding process, the principal may be required to submit a bid indemnity bond to assure the client that they will enter into a contract if awarded the project. It safeguards the client from losses if the principal withdraws the bid or fails to adhere to the terms and conditions specified in the contract. Keywords: Bid Indemnity Bond, competitive bidding, client, bid withdrawal, terms and conditions. Conclusion: The King Washington General Form of Indemnity Bond is a versatile surety bond designed to protect parties from potential financial losses or damages arising from contract breaches, non-performance, or payment defaults. Understanding the various types of indemnity bonds helps individuals and organizations choose the appropriate bond based on their specific needs and circumstances. Note: The mentioned bond types are for illustrative purposes; the actual bond types and their names may vary based on jurisdiction and specific requirements.Title: King Washington General Form of Indemnity Bond: A Comprehensive Guide and Its Types Introduction: The King Washington General Form of Indemnity Bond is a legal document that provides protection to individuals or organizations against potential financial losses or damages caused by another party's actions or failures. This comprehensive guide aims to provide a detailed description of the bond, its purpose, and the different types available. What is King Washington General Form of Indemnity Bond? The King Washington General Form of Indemnity Bond is a type of surety bond that functions as a contractual agreement between the principal (the party seeking indemnity) and the surety (the party providing indemnity). It guarantees compensation to the principal, up to the bond's limit, in the event of any unforeseen losses, damages, or liabilities arising from the actions, negligence, or contractual breaches of the other party. The bond serves as a financial safeguard, providing peace of mind and ensuring adequate compensation in case of non-performance or financial losses incurred. Keywords: King Washington General Form of Indemnity Bond, surety bond, contractual agreement, financial losses, damages, liabilities, compensation, non-performance. Types of King Washington General Form of Indemnity Bond: 1. Performance Indemnity Bond: This type of bond guarantees that the principal will fulfill certain contractual obligations, such as completing a construction project according to agreed specifications, meeting deadlines, or adhering to quality standards. It protects the obliged (the party benefiting from the bond) from financial losses resulting from the principal's non-performance. Keywords: Performance Indemnity Bond, contractual obligations, construction projects, deadlines, quality standards, non-performance, obliged. 2. Payment Indemnity Bond: A payment indemnity bond ensures that the principal will make timely payments to suppliers, subcontractors, or vendors involved in a project. It protects these beneficiaries from financial losses if the principal fails to honor their payment obligations. This bond encourages a smooth flow of funds throughout the project, promoting trust and fairness within business transactions. Keywords: Payment Indemnity Bond, timely payments, suppliers, subcontractors, vendors, financial losses, payment obligations, funds. 3. Bid Indemnity Bond: When participating in a competitive bidding process, the principal may be required to submit a bid indemnity bond to assure the client that they will enter into a contract if awarded the project. It safeguards the client from losses if the principal withdraws the bid or fails to adhere to the terms and conditions specified in the contract. Keywords: Bid Indemnity Bond, competitive bidding, client, bid withdrawal, terms and conditions. Conclusion: The King Washington General Form of Indemnity Bond is a versatile surety bond designed to protect parties from potential financial losses or damages arising from contract breaches, non-performance, or payment defaults. Understanding the various types of indemnity bonds helps individuals and organizations choose the appropriate bond based on their specific needs and circumstances. Note: The mentioned bond types are for illustrative purposes; the actual bond types and their names may vary based on jurisdiction and specific requirements.