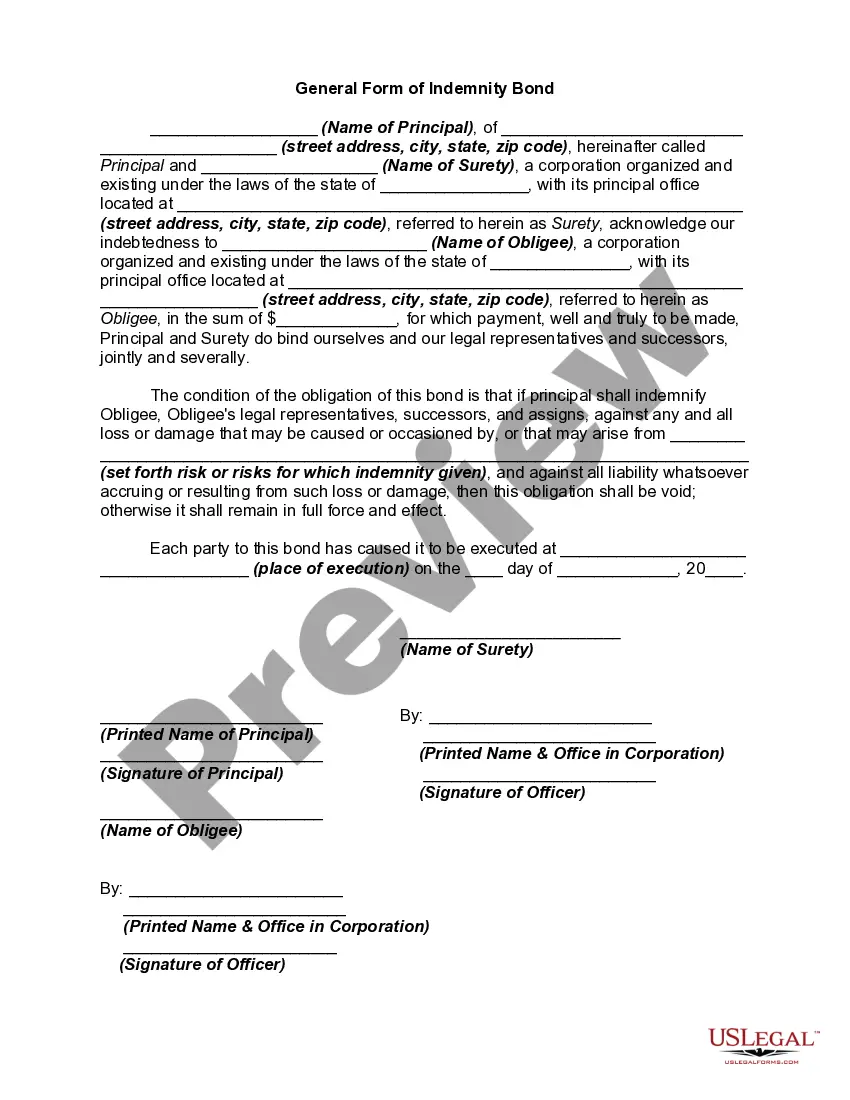

An indemnity bond provides coverage for the loss of an Obligee in the event that the Principal fails to perform according to standards agreed upon between the Obligee and the Principal. A surety is a person obligated by a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the surety's performance will first try to collect or obtain performance from the debtor before trying to collect from the surety. A surety is often found, for example, when someone is required to post a bond to secure a promise.

Orange, California General Form of Indemnity Bond is a legally binding document that serves as a form of protection for individuals or businesses involved in various contractual agreements or obligations within the Orange, California area. This bond is designed to minimize financial risks and provide security to the parties involved. The Orange, California General Form of Indemnity Bond is a versatile and widely used contract tool, applicable to a range of situations such as construction projects, real estate deals, and contractual services. It ensures that all parties involved in the agreement are protected against any potential losses or damages that may arise due to default, negligence, or non-compliance with contractual terms. The bond functions by guaranteeing compensation to the affected party for any financial loss experienced as a result of the actions or inaction of the bonded party. This compensation typically encompasses costs related to property damage, employee wages, legal expenses, and other financial liabilities incurred by the affected party. Though there is a general form of the Orange, California Indemnity Bond, it is important to note that there may be different types of bonds that cater to specific industry requirements or compliance regulations. These variations might include: 1. Construction Indemnity Bond: Specifically designed for construction projects, this type of bond safeguards project owners, general contractors, and subcontractors against potential losses resulting from default by the contractor or subcontractor, ensuring completion of the project and fulfilling contractual obligations. 2. Real Estate Indemnity Bond: This bond is tailored to protect buyers, sellers, and landlords involved in real estate transactions. It provides financial security in case of breaches, such as a failure to complete the transaction, property defects, or non-compliance with legal requirements. 3. Business Indemnity Bond: Designed to protect businesses engaged in contractual services, this bond covers any financial losses incurred by the contracted party if the service provider fails to meet contractual obligations, adhere to quality standards, or causes harm due to negligence. Adhering to the requirements and regulations set forth by the Orange, California General Form of Indemnity Bond is crucial for ensuring legal compliance and promoting transparent business dealings. This bond instills confidence among parties involved, making it an essential instrument for risk mitigation and financial protection.Orange, California General Form of Indemnity Bond is a legally binding document that serves as a form of protection for individuals or businesses involved in various contractual agreements or obligations within the Orange, California area. This bond is designed to minimize financial risks and provide security to the parties involved. The Orange, California General Form of Indemnity Bond is a versatile and widely used contract tool, applicable to a range of situations such as construction projects, real estate deals, and contractual services. It ensures that all parties involved in the agreement are protected against any potential losses or damages that may arise due to default, negligence, or non-compliance with contractual terms. The bond functions by guaranteeing compensation to the affected party for any financial loss experienced as a result of the actions or inaction of the bonded party. This compensation typically encompasses costs related to property damage, employee wages, legal expenses, and other financial liabilities incurred by the affected party. Though there is a general form of the Orange, California Indemnity Bond, it is important to note that there may be different types of bonds that cater to specific industry requirements or compliance regulations. These variations might include: 1. Construction Indemnity Bond: Specifically designed for construction projects, this type of bond safeguards project owners, general contractors, and subcontractors against potential losses resulting from default by the contractor or subcontractor, ensuring completion of the project and fulfilling contractual obligations. 2. Real Estate Indemnity Bond: This bond is tailored to protect buyers, sellers, and landlords involved in real estate transactions. It provides financial security in case of breaches, such as a failure to complete the transaction, property defects, or non-compliance with legal requirements. 3. Business Indemnity Bond: Designed to protect businesses engaged in contractual services, this bond covers any financial losses incurred by the contracted party if the service provider fails to meet contractual obligations, adhere to quality standards, or causes harm due to negligence. Adhering to the requirements and regulations set forth by the Orange, California General Form of Indemnity Bond is crucial for ensuring legal compliance and promoting transparent business dealings. This bond instills confidence among parties involved, making it an essential instrument for risk mitigation and financial protection.