A Cook Illinois Promissory Note — Long Form is a legally binding document that outlines the terms and conditions of a financial agreement between a lender and borrower. This type of promissory note is commonly used in the state of Illinois and is designed to provide a detailed description of the loan arrangement. Key Features: 1. Loan Amount: The Cook Illinois Promissory Note — Long Form specifies the total loan amount being borrowed by the borrower from the lender. It ensures clarity and eliminates any confusion in terms of the borrowed sum. 2. Interest Rate: This promissory note clearly states the interest rate applicable to the loan. The interest rate is typically expressed as an annual percentage, and the note outlines whether it is a fixed or variable rate. 3. Repayment Schedule: The document specifies the repayment terms agreed upon by the parties involved. It includes details such as the number of installments, frequency of payments (weekly, monthly, etc.), and the due date for each installment. 4. Late Payment Penalties: In case of late or missed payments, the Cook Illinois Promissory Note — Long Form may outline penalties or fees the borrower will face. These penalties encourage timely repayments and deter delayed or default payments. 5. Security Agreement: This type of long-form promissory note might include provisions related to a security agreement. If the borrower pledges collateral, such as property or valuable assets, to secure the loan, it will be detailed within the document. Different types or variations of Cook Illinois Promissory Note — Long Form: 1. Cook Illinois Promissory Note — Long Form with Balloon Payment: This type of promissory note incorporates a large final payment, known as a "balloon payment," which is due at the end of the loan term. It allows the borrower to make smaller monthly payments throughout the loan duration. 2. Cook Illinois Promissory Note — Long Form with Adjustable Interest Rate: This variation of the promissory note features an interest rate that can change over time based on certain factors, such as changes in the prevailing market rates or a specific index. 3. Cook Illinois Promissory Note — Long Form with Collateral: If the borrower pledges collateral to secure the loan, this specific type of promissory note would outline the terms and conditions related to the collateral. In conclusion, the Cook Illinois Promissory Note — Long Form is a legal document that summarizes the necessary elements of a loan agreement, such as the loan amount, interest rate, repayment schedule, late payment penalties, and any security arrangements. Its various types or variations include the "with balloon payment" option, the "with adjustable interest rate" option, and the "with collateral" option.

Cook Illinois Promissory Note - Long Form

Description

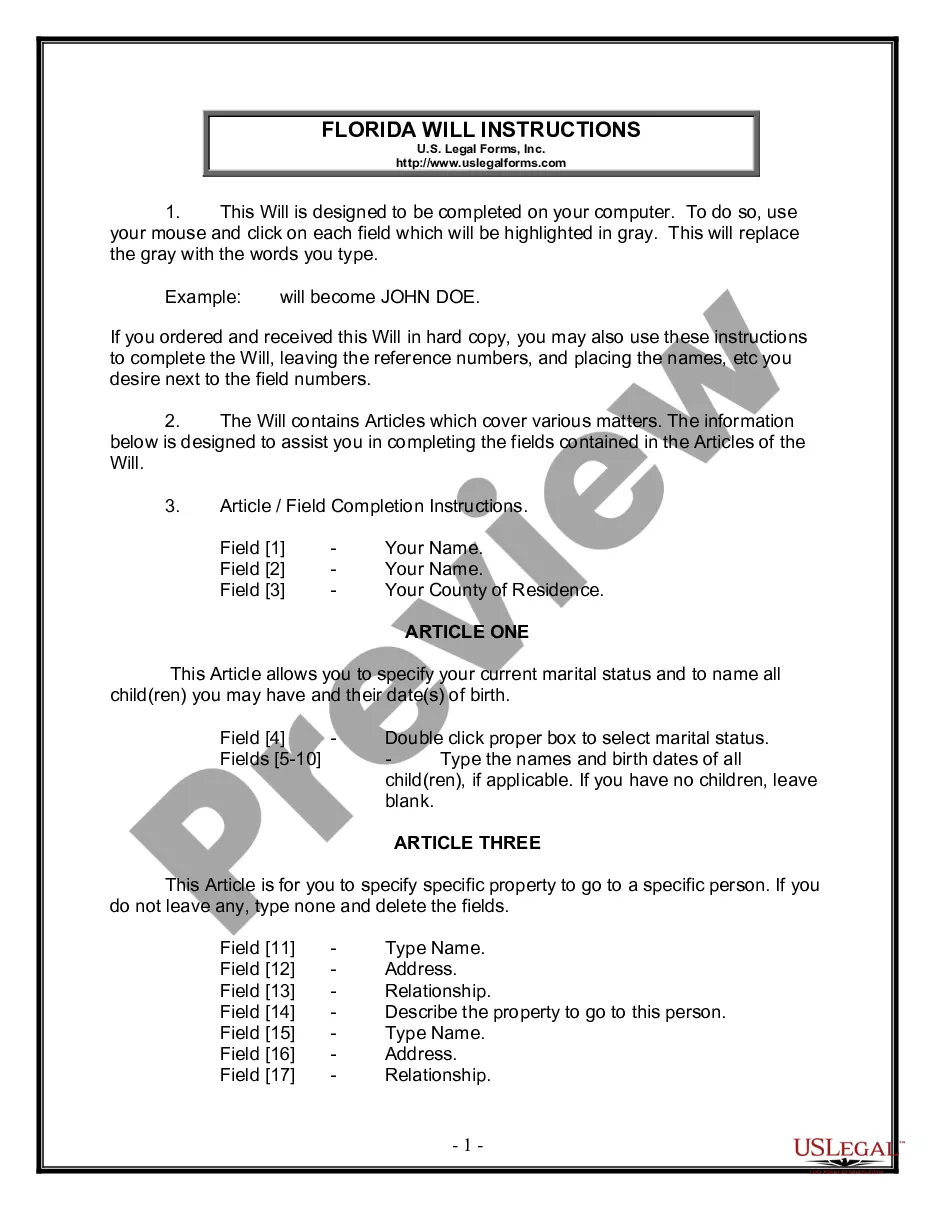

How to fill out Cook Illinois Promissory Note - Long Form?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business purpose utilized in your county, including the Cook Promissory Note - Long Form.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Cook Promissory Note - Long Form will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Cook Promissory Note - Long Form:

- Ensure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Cook Promissory Note - Long Form on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

4 Types of Promissory Notes.

A form of a promissory note to be used when there is no separate loan agreement and the parties are not contemplating a negotiable instrument. This model promissory note includes all the terms of the loan, including payment terms, borrowing mechanics, events of default, remedies, and dispute resolution provisions.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Promissory notes are commonly used in business as a means of short-term financing. For example, when a company has sold many products but has not yet collected payments for them, it may become low on cash and unable to pay creditors.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Types of Promissory Notes Simple promissory note. Demand promissory note. Secured promissory note. Unsecured promissory note.

Types of Promissory Notes Personal Promissory Notes This is a particular loan taken from family or friends.Commercial Here, the note is made when dealing with commercial lenders such as banks.Real Estate This is similar to commercial notes in terms of nonpayment consequences.

Definition of promissory note : a written promise to pay at a fixed or determinable future time a sum of money to a specified individual or to bearer.