Houston Texas Promissory Note - Long Form

Description

How to fill out Promissory Note - Long Form?

A legal document process consistently accompanies any legal action you undertake.

Establishing a business, applying for or accepting employment, transferring assets, and many other life situations require you to prepare official documentation that can differ across the nation.

That is why having everything organized in one location is incredibly beneficial.

US Legal Forms offers the largest online repository of current federal and state-specific legal templates.

This is the easiest and most reliable method to acquire legal documents. All templates available in our library are expertly crafted and confirmed for compliance with local laws and regulations. Organize your documentation and manage your legal matters effectively with US Legal Forms!

- Here, you can efficiently locate and download a document for any personal or business purpose used in your area, including the Houston Promissory Note - Long Form.

- Finding forms on the site is exceptionally straightforward.

- If you already possess a subscription to our library, Log In to your account, locate the document via the search bar, and click Download to save it to your device.

- Subsequently, the Houston Promissory Note - Long Form will be accessible for future use in the My documents section of your profile.

- If you are using US Legal Forms for the first time, adhere to this straightforward guide to procure the Houston Promissory Note - Long Form.

- Ensure you have navigated to the correct page with your localized form.

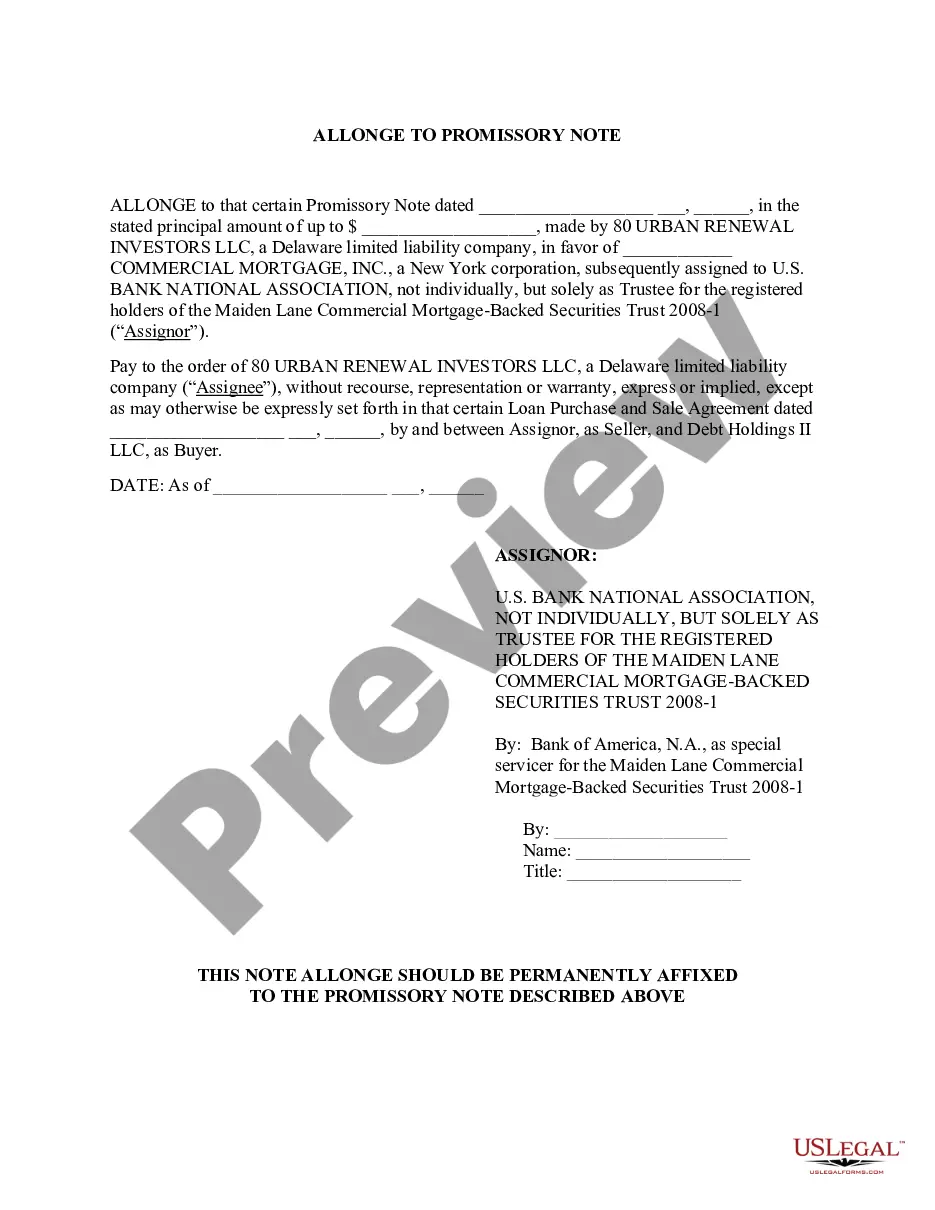

- Utilize the Preview mode (if available) and scroll through the document template.

- Review the description (if applicable) to confirm the form meets your requirements.

- Search for an alternative document using the search tab if the sample does not suit you.

- Click Buy Now once you identify the required template.

- Choose the suitable subscription plan, then Log In or create an account.

- Select the preferred payment method (using a credit card or PayPal) to proceed.

- Pick a file format and save the Houston Promissory Note - Long Form on your device.

- Utilize it as necessary: print it or complete it digitally, sign it, and submit it where requested.

Form popularity

FAQ

To obtain a Houston Texas Promissory Note - Long Form, start by determining your specific needs. You can draft your own note using templates available online, or you can choose a reliable service like US Legal Forms that provides ready-made documents tailored to Texas laws. Ensure you include essential details, such as the amount, interest rate, and repayment schedule. Once completed, both parties should sign the note to formalize the agreement.

In Texas, a promissory note does not require recording; it is an agreement between the borrower and lender. However, recording a related deed of trust, if applicable, adds a layer of legal protection for the lender. Knowing the specifics of a Houston Texas Promissory Note - Long Form can enhance your understanding of documenting and securing your agreements.

Yes, a promissory note can be extended through mutual agreement between the parties involved. This involves creating an amendment or a new note that outlines the new terms, such as a longer repayment period. Adjustments to your Houston Texas Promissory Note - Long Form can provide flexibility when financial circumstances change.

A promissory note does not typically appear on your personal credit record. Instead, it serves as a private agreement between the involved parties. However, if the note leads to a default, the lender may report the default, which could affect your credit score. Understanding the implications of a Houston Texas Promissory Note - Long Form can help you manage your financial obligations effectively.

Filling out a promissory demand note requires careful attention to detail. Begin by identifying the lender and borrower and labeling the document as a Houston Texas Promissory Note - Long Form. Include the amount borrowed, interest terms, and the immediate repayment status upon demand. Don't forget to grab signatures from both parties for legal enforcement.

Filling out a Houston Texas Promissory Note - Long Form involves several key steps. First, clearly state the names and addresses of both the lender and the borrower. Next, indicate the principal amount, the interest rate, repayment terms, and any other relevant conditions. Lastly, ensure both parties sign and date the document to make it legally binding.

A promissory note can technically be as long as necessary to articulate the terms, but clarity is essential. While there is no strict limit on length, it's advisable to keep the document concise and focused on pertinent information. Clear, straightforward language minimizes the chance for misunderstanding or disputes. U.S. Legal Forms can assist you in drafting a well-structured Houston Texas Promissory Note - Long Form.

In Texas, the statute of limitations for collecting on a promissory note is generally four years. This means the creditor has four years from the date of default to take legal action. However, it's crucial to understand that this time frame can vary based on specific circumstances. Make sure to keep track of deadlines with the help of U.S. Legal Forms for your Houston Texas Promissory Note - Long Form.

In Texas, a promissory note must be written and contain specific details to be valid. These requirements include the amount borrowed, the interest rate, repayment terms, and the dates for payment. Furthermore, both parties’ signatures are essential to cement the agreement. To ensure compliance with local laws, it's wise to utilize U.S. Legal Forms for your Houston Texas Promissory Note - Long Form.

A promissory note must contain certain essential components to be enforceable. These components include the principal amount, interest rate, payment schedule, and both parties' signatures. Additionally, the note should clearly state the consequences of default, providing transparency for all parties involved. Using U.S. Legal Forms can help ensure these elements are properly integrated in your Houston Texas Promissory Note - Long Form.