Riverside California is a vibrant city located in Southern California, known for its picturesque landscapes, rich cultural heritage, and thriving economy. When it comes to business ventures and investments, understanding the intricacies of a term sheet is crucial. A Riverside California Sample Term Sheet with Explanatory Annotations provides a comprehensive and detailed breakdown of the terms and conditions involved in a potential partnership or investment opportunity. This essential document outlines the key elements of a deal, helping both parties clearly understand the agreement before moving forward. A Riverside California Sample Term Sheet typically covers various aspects of a business arrangement, including but not limited to: 1. Company Overview: This section provides a detailed description of the company seeking investment or partnership, including its background, mission, and goals. It also outlines the current stage of development and potential growth opportunities. 2. Investment Details: The term sheet elaborates on the investment amount, the types of securities offered (such as preferred stock or convertible notes), and the equity percentage the investor will acquire in exchange for their investment. 3. Valuation: This part of the term sheet highlights the pre-Roman and post-money valuation of the company, helping both parties determine the company's worth and the ownership stakes. 4. Governance and Control: The term sheet addresses the decision-making process and governance structure of the company. It may include provisions related to the board of directors, voting rights, protective provisions, and management control. 5. Liquidation and Exit Strategy: In the event of a termination or liquidation, the term sheet outlines the distribution of assets among various stakeholders and defines the criteria for an exit strategy, such as an initial public offering (IPO) or acquisition. 6. Rights and Dilution: This section covers any special rights granted to the investor, such as anti-dilution provisions, which safeguard their ownership percentage in case of future funding rounds. 7. Warranties and Representations: The term sheet includes statements and assurances made by both parties regarding the accuracy of their respective information and any legal compliance required. 8. Conditions Precedent and Closing Requirements: Here, the term sheet provides a list of conditions that must be fulfilled before the deal is finalized, including due diligence, regulatory approvals, and satisfactory vesting of employee stock options. By procuring a Riverside California Sample Term Sheet with Explanatory Annotations, entrepreneurs and investors gain valuable insights into the legal and financial aspects of their potential partnership or investment. It allows them to negotiate and customize the terms to meet their specific requirements. Different types of Riverside California Sample Term Sheets may exist, depending on the nature of the business transaction. For instance, there could be term sheets tailored for seed funding rounds, series A or B investments, debt financing, strategic partnerships, or mergers and acquisitions. Each type caters to the unique needs and goals of the parties involved, with annotations providing clarity on various clauses and provisions.

Riverside California Sample Term Sheet with Explanatory Annotations

Description

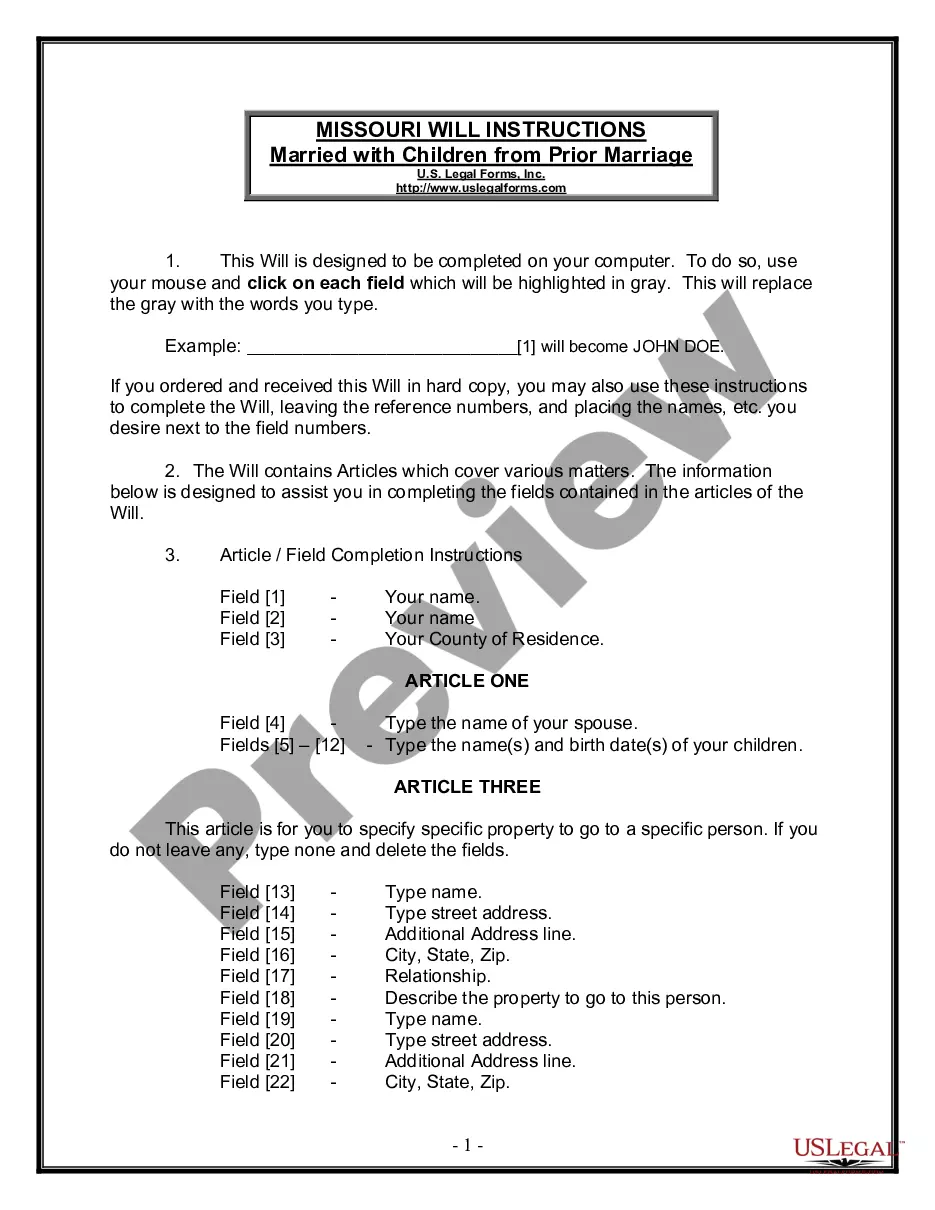

How to fill out Riverside California Sample Term Sheet With Explanatory Annotations?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Riverside Sample Term Sheet with Explanatory Annotations is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Riverside Sample Term Sheet with Explanatory Annotations. Follow the instructions below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Riverside Sample Term Sheet with Explanatory Annotations in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!