The Allegheny Pennsylvania Pledge of Personal Property as Collateral Security is a legal document used to secure a loan by offering personal property as collateral in Allegheny County, Pennsylvania. This pledge serves as a guarantee to the lender that if the borrower fails to repay the loan, the lender has the right to take possession of the pledged personal property and sell it to recover the outstanding debt. The "Allegheny Pennsylvania Pledge of Personal Property as Collateral Security" is a general term that refers to the standard agreement used for securing different types of loans and financial transactions in Allegheny County, Pennsylvania. These agreements may vary depending on the type of loan or financial transaction being secured. Some common types of pledges of personal property as collateral security include: 1. Auto Loan Collateral: This type of pledge is specifically used to secure loans related to the purchase or financing of vehicles, such as cars, motorcycles, or trucks. The borrower pledges the vehicle as collateral, and in case of default, the lender has the right to repossess and sell the vehicle. 2. Business Loan Collateral: Business owners may pledge their business assets, such as inventory, equipment, or accounts receivable, as collateral to secure a loan for their business. This type of collateral security ensures that the lender has a claim to the business assets in case of loan default. 3. Personal Loan Collateral: Individuals seeking personal loans may use personal property like real estate, jewelry, expensive artwork, or valuable electronics as collateral. This collateral provides security to the lender, ensuring that they have a means to recover the loaned amount in case of default. 4. Mortgage Collateral: Homeowners in Allegheny County may pledge their property as collateral when taking out a mortgage loan. The property serves as security for the lender, and if the borrower defaults on the mortgage payments, the lender can initiate foreclosure proceedings to recover the loan amount. The Allegheny Pennsylvania Pledge of Personal Property as Collateral Security is a crucial legal instrument that protects both borrowers and lenders in various financial transactions. It outlines the terms and conditions of the collateral arrangement, including the rights and responsibilities of both parties. Understanding these agreements is essential for borrowers and lenders in Allegheny County to ensure fair and secure financial transactions.

Allegheny Pennsylvania Pledge of Personal Property as Collateral Security

Description

How to fill out Allegheny Pennsylvania Pledge Of Personal Property As Collateral Security?

Drafting papers for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Allegheny Pledge of Personal Property as Collateral Security without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Allegheny Pledge of Personal Property as Collateral Security on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to get the Allegheny Pledge of Personal Property as Collateral Security:

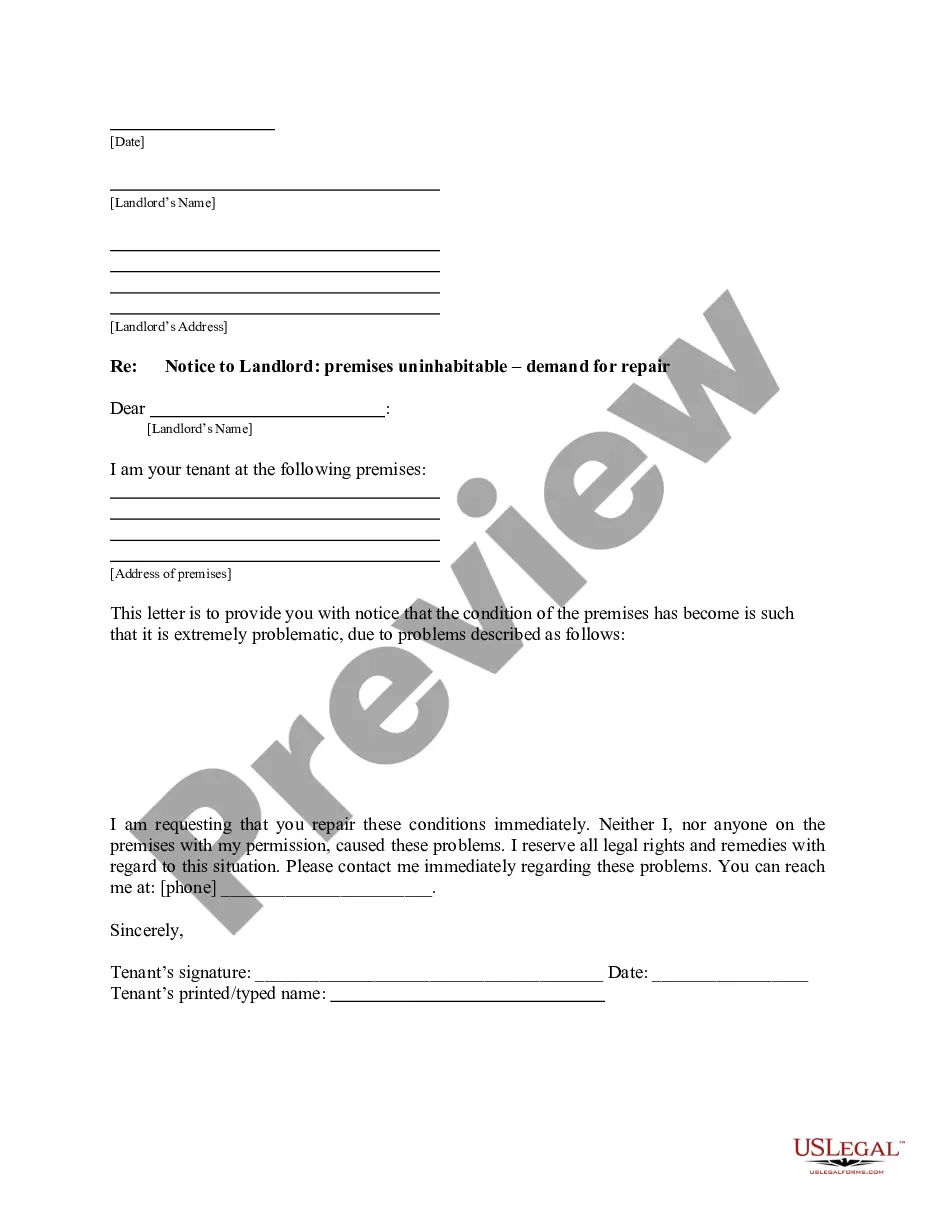

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!