Lima Arizona Pledge of Personal Property as Collateral Security is a legal arrangement where individuals or businesses in Lima, Arizona, pledge personal property as collateral to secure a loan or debt owed to a lender. This provides assurance to the lender that in the event of default, they have the legal right to liquidate the pledged property to recover the amount owed. The Lima Arizona Pledge of Personal Property as Collateral Security is governed by various state laws and regulations, ensuring the protection of both the borrower and the lender's interests. It is crucial for both parties to fully understand the terms and conditions of the pledge, including the rights and responsibilities associated with the pledged property. There can be different types of Lima Arizona Pledge of Personal Property as Collateral Security, depending on the nature of the loan or debt being secured. These may include: 1. Chattel Mortgage: This type of pledge applies to movable personal property, such as vehicles, equipment, inventory, or valuable possessions. The borrower transfers ownership of the pledged property to the lender until the loan is fully repaid. In case of default, the lender can sell the assets to recover the owed amount. 2. UCC Security Agreement: The Uniform Commercial Code (UCC) governs this type of pledge, which covers a broader range of personal property beyond just chattels. It may include intellectual property, accounts receivable, securities, or any other tangible or intangible assets. As with a chattel mortgage, the lender holds a security interest in the pledged property. 3. Collateral Assignment: In certain cases, individuals or businesses may choose to secure a loan by assigning rights to specific personal property as collateral. While the borrower retains ownership, the lender has the right to take possession of the collateral upon default and use it to recover the outstanding debt. Regardless of the type of Lima Arizona Pledge of Personal Property as Collateral Security, it is essential for parties involved to draft a comprehensive agreement that clearly outlines the pledged property, the loan terms, any obligations related to insurance or maintenance of the collateral, and the consequences of default. In conclusion, the Lima Arizona Pledge of Personal Property as Collateral Security is a legal mechanism that enables borrowers in Lima, Arizona, to secure loans or debts by pledging personal property as collateral. Different types, such as chattel mortgages, UCC security agreements, and collateral assignments, provide flexibility based on the nature of the assets involved. It is crucial for borrowers and lenders to understand the terms and obligations associated with this collateral security to ensure a fair and legally binding agreement.

Pima Arizona Pledge of Personal Property as Collateral Security

Description

How to fill out Pima Arizona Pledge Of Personal Property As Collateral Security?

How much time does it usually take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Pima Pledge of Personal Property as Collateral Security suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. In addition to the Pima Pledge of Personal Property as Collateral Security, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Pima Pledge of Personal Property as Collateral Security:

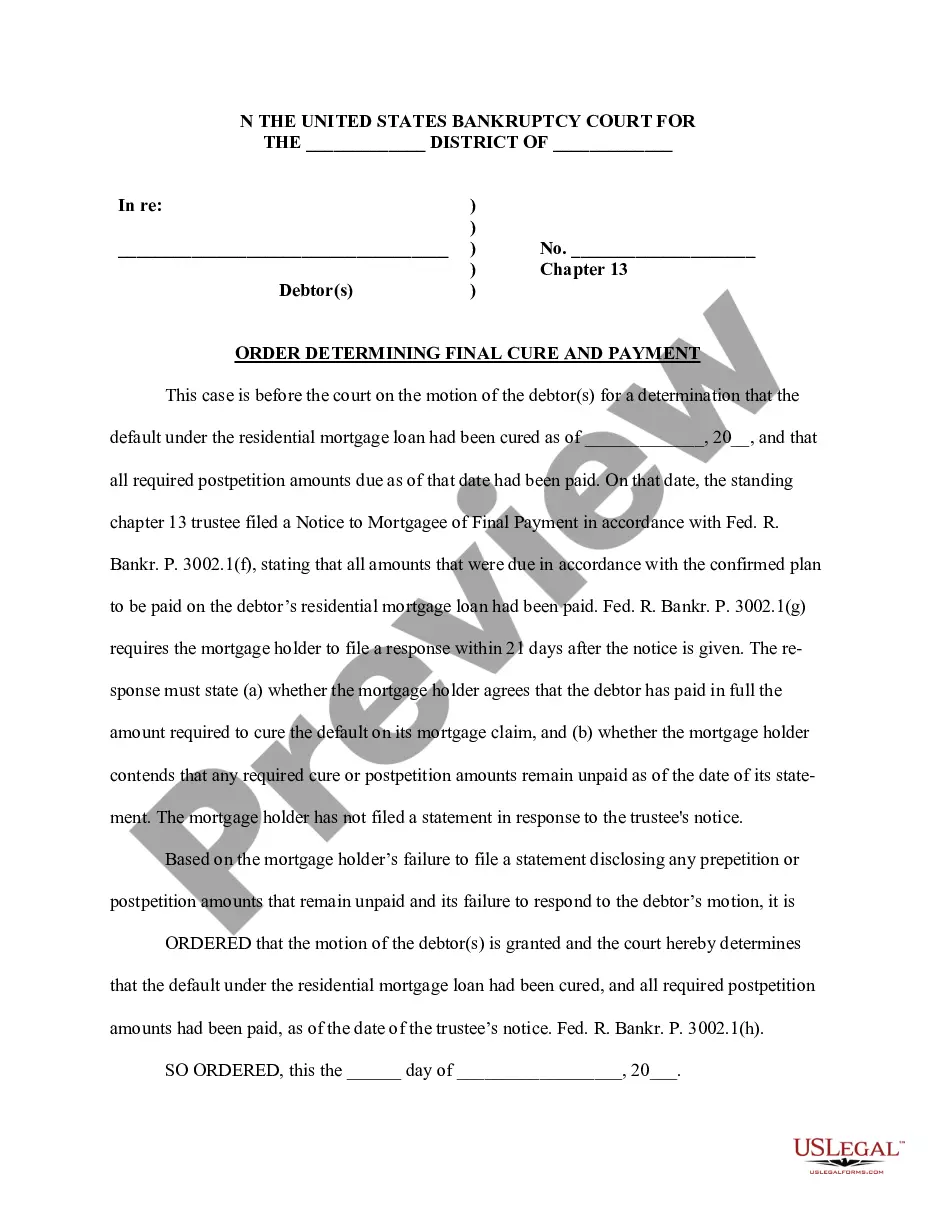

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Pima Pledge of Personal Property as Collateral Security.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!