The Travis Texas Pledge of Personal Property as Collateral Security is a legal document that establishes a binding agreement between a borrower and a lender for the purpose of securing a loan or debt. This pledge ensures that the lender has a legal claim over the borrower's personal property in the event of a default. This type of collateral security is commonly used in various financial transactions, such as loans, mortgages, and credit agreements. By pledging personal property, borrowers provide an additional layer of security to lenders, boosting their confidence in extending credit. The Travis Texas Pledge of Personal Property as Collateral Security can encompass a wide range of personal property items, including but not limited to vehicles, real estate, equipment, inventory, accounts receivable, stocks, bonds, and other valuable assets. The specific types of property that can be pledged will depend on the terms agreed upon by both parties in the pledge agreement. There are different variations of Travis Texas Pledge of Personal Property as Collateral Security that cater to specific circumstances: 1. General Pledge: This is the most common type, in which a borrower pledges their personal property as collateral without any specific restrictions. The lender has a general claim over all the borrower's assets, providing maximum protection for the loan amount. 2. Specific Pledge: In this case, the borrower pledges a specific asset or group of assets as collateral security. This type of pledge allows the borrower to retain ownership and control over other personal property items not included in the pledge. 3. Floating Pledge: A floating pledge enables the borrower to pledge a class of personal property items rather than specific assets. For example, a borrower may pledge their inventory as collateral security, with the understanding that the specific items in the inventory may change over time. 4. Fixed Charge Pledge: This type of pledge grants the lender a fixed charge over a specific asset, ensuring that the borrower cannot dispose of or use it as collateral for other debts without the lender's consent. Fixed charge pledges provide a higher level of security for the lender. 5. Floating Charge Pledge: Unlike the fixed charge pledge, a floating charge pledge grants the lender a claim over a class of assets that may change in value or composition over time. This type of pledge allows the borrower to continue using and disposing of the assets within specific limits until a default occurs. It is important for both borrowers and lenders to understand the implications and legal obligations associated with the Travis Texas Pledge of Personal Property as Collateral Security. Seeking professional advice and maintaining clear documentation is crucial to ensuring fairness and transparency in these agreements.

Travis Texas Pledge of Personal Property as Collateral Security

Description

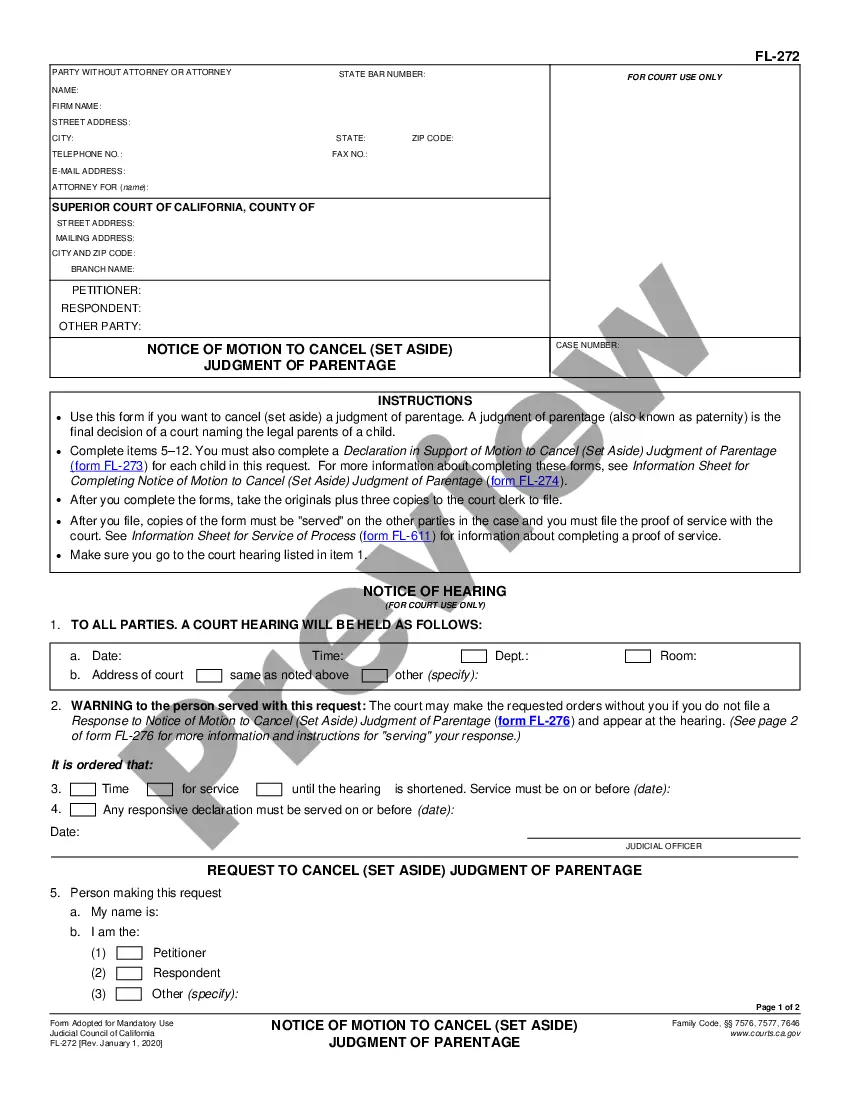

How to fill out Travis Texas Pledge Of Personal Property As Collateral Security?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Travis Pledge of Personal Property as Collateral Security, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Travis Pledge of Personal Property as Collateral Security from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Travis Pledge of Personal Property as Collateral Security:

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!