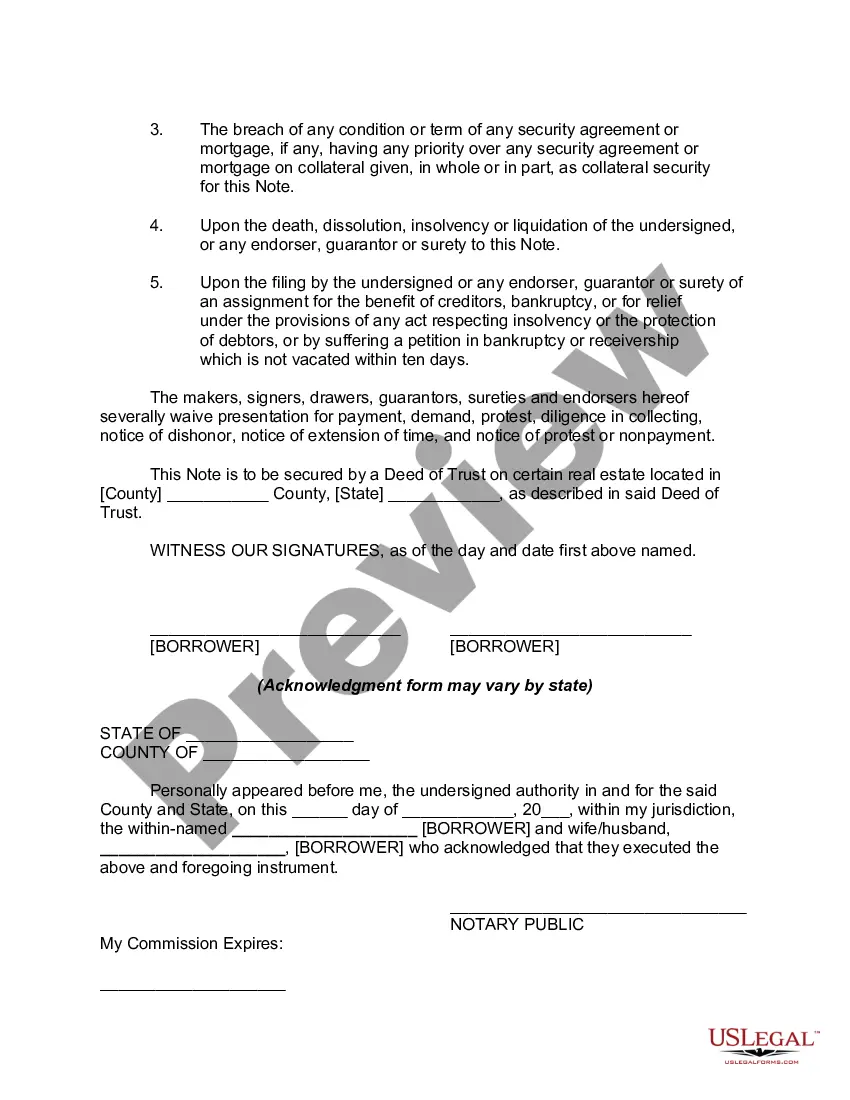

The acknowledgement is the section at the end of a document where a notary public verifies that the signer of the document states he/she actually signed it. Typical language is: "State of ______, County of ______ (signed and sealed) On ____, 20__, before me, a notary public for said state, personally appeared _______, personally known to me, or proved to be said person by proper proof, and acknowledged that he executed the above Deed." Then the notary signs the acknowledgment and puts on his/her seal, which is usually a rubber stamp, although some still use a metal seal. The person acknowledging that he/she signed must be prepared to verify their identity with a driver's license or other accepted form of identification, and must sign the notary's journal. The acknowledgment is required for many official forms and vital for any document which must be recorded by the County Recorder or Recorder of Deeds, including deeds, deeds of trust, mortgages, powers of attorney that may involve real estate, some leases and various other papers.

Acknowledgments may also be drafted to affirm a variety of matters, acting in effect as a written confirmation of an act such as receipt of goods, services, or payment.

A Cook Illinois Promissory Note — With Acknowledgment is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This not only serves as a tool for securing the loan but also helps establish a clear understanding of the repayment plan and expectations for both parties involved. The inclusion of an acknowledgment section ensures that the borrower acknowledges their obligation to repay the loan and demonstrates their consent to abide by the terms mentioned in the note. These promissory notes are commonly used in Cook County, Illinois, and come in different types to suit various lending scenarios. Some examples of Cook Illinois Promissory Note — With Acknowledgment variations include: 1. Personal Loan Promissory Note: This type of note is used when an individual borrower obtains a loan from a private lender, such as a friend, family member, or acquaintance. It outlines the loan amount, repayment schedule, interest rate (if applicable), and any additional terms agreed upon. 2. Business Loan Promissory Note: This note is used in the context of business financing, where a business entity borrows funds from a lender to support its operations, expansion, or specific project. The terms mentioned in this note address the repayment structure, interest rate, collateral (if any), and other relevant conditions related to the loan. 3. Student Loan Promissory Note: As the name suggests, this note is specific to lending arrangements between educational institutions or loan providers and students. It outlines the loan amount, interest rate, repayment terms, and any applicable grace period. Often, these promissory notes outline the consequences of defaulting on student loan payments, possible deferment options, and repayment assistance programs. 4. Mortgage Promissory Note: A mortgage promissory note is used to secure a loan for purchasing real estate property. It outlines the loan amount, interest rate, repayment terms, and the property that will serve as collateral until the loan is fully repaid. This note is usually used in conjunction with a mortgage or deed of trust to protect the lender's interests in case of default or foreclosure. By utilizing a Cook Illinois Promissory Note — With Acknowledgment, both borrowers and lenders can ensure a transparent and legally-binding agreement. These notes help establish clear expectations regarding loan repayment, interest rates, and any other agreed-upon terms, protecting both parties throughout the lending process.A Cook Illinois Promissory Note — With Acknowledgment is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This not only serves as a tool for securing the loan but also helps establish a clear understanding of the repayment plan and expectations for both parties involved. The inclusion of an acknowledgment section ensures that the borrower acknowledges their obligation to repay the loan and demonstrates their consent to abide by the terms mentioned in the note. These promissory notes are commonly used in Cook County, Illinois, and come in different types to suit various lending scenarios. Some examples of Cook Illinois Promissory Note — With Acknowledgment variations include: 1. Personal Loan Promissory Note: This type of note is used when an individual borrower obtains a loan from a private lender, such as a friend, family member, or acquaintance. It outlines the loan amount, repayment schedule, interest rate (if applicable), and any additional terms agreed upon. 2. Business Loan Promissory Note: This note is used in the context of business financing, where a business entity borrows funds from a lender to support its operations, expansion, or specific project. The terms mentioned in this note address the repayment structure, interest rate, collateral (if any), and other relevant conditions related to the loan. 3. Student Loan Promissory Note: As the name suggests, this note is specific to lending arrangements between educational institutions or loan providers and students. It outlines the loan amount, interest rate, repayment terms, and any applicable grace period. Often, these promissory notes outline the consequences of defaulting on student loan payments, possible deferment options, and repayment assistance programs. 4. Mortgage Promissory Note: A mortgage promissory note is used to secure a loan for purchasing real estate property. It outlines the loan amount, interest rate, repayment terms, and the property that will serve as collateral until the loan is fully repaid. This note is usually used in conjunction with a mortgage or deed of trust to protect the lender's interests in case of default or foreclosure. By utilizing a Cook Illinois Promissory Note — With Acknowledgment, both borrowers and lenders can ensure a transparent and legally-binding agreement. These notes help establish clear expectations regarding loan repayment, interest rates, and any other agreed-upon terms, protecting both parties throughout the lending process.