Maricopa, Arizona Nonrecourse Assignment of Account Receivables is a legal process through which a business can transfer its outstanding accounts receivables to a third party, known as the assignee. This third party then assumes the ownership of the accounts receivables and is responsible for collecting the owed amounts from the debtors. Nonrecourse assignment refers to an agreement where the assignee bears the risk of non-payment by the debtors. In the case of nonrecourse assignment of account receivables, if the assigned debts cannot be collected, the business is exempt from repaying the assignee for the unpaid amounts. Maricopa, as a city within the state of Arizona, follows the legal framework established by the state for the nonrecourse assignment of account receivables. This process can be beneficial for businesses operating in Maricopa as it provides them with the opportunity to efficiently generate immediate cash flow by monetizing their outstanding receivables. There are different types or variations of nonrecourse assignment of account receivables that businesses in Maricopa can consider: 1. Traditional Nonrecourse Assignment: This type involves the complete transfer of ownership and risk of default to the assignee. The assignee assumes the responsibility of collecting the receivables and bears the risk of non-payment. 2. Limited Recourse Assignment: In this type, the assignee assumes some, but not all, of the risk associated with non-payment. The assigning business may still have some obligations or guarantees towards the assignee, depending on the agreement terms. 3. Invoice Factoring: A form of nonrecourse assignment where a financial institution, called a factor, purchases the accounts receivables at a discounted rate from the assigning business. The factor then collects the full amount from the debtors and retains a fee as compensation. 4. Reverse Factoring: In this type, the assignee, usually a financial institution, provides immediate payment to the assigning business for its outstanding invoices. The assignee then manages the collection process from the debtors. This approach helps improve the assigning business's cash flow without transferring the full ownership of the receivables. Businesses in Maricopa, Arizona, considering a nonrecourse assignment of account receivables should consult legal and financial professionals to understand the specific laws, regulations, and options available to them. Implementing such assignments can be a strategic move to access immediate funds and enhance financial stability while mitigating the risk of non-payment.

Maricopa Arizona Nonrecourse Assignment of Account Receivables

Description

How to fill out Maricopa Arizona Nonrecourse Assignment Of Account Receivables?

Preparing legal documentation can be difficult. Besides, if you decide to ask a lawyer to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Maricopa Nonrecourse Assignment of Account Receivables, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the latest version of the Maricopa Nonrecourse Assignment of Account Receivables, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Nonrecourse Assignment of Account Receivables:

- Look through the page and verify there is a sample for your region.

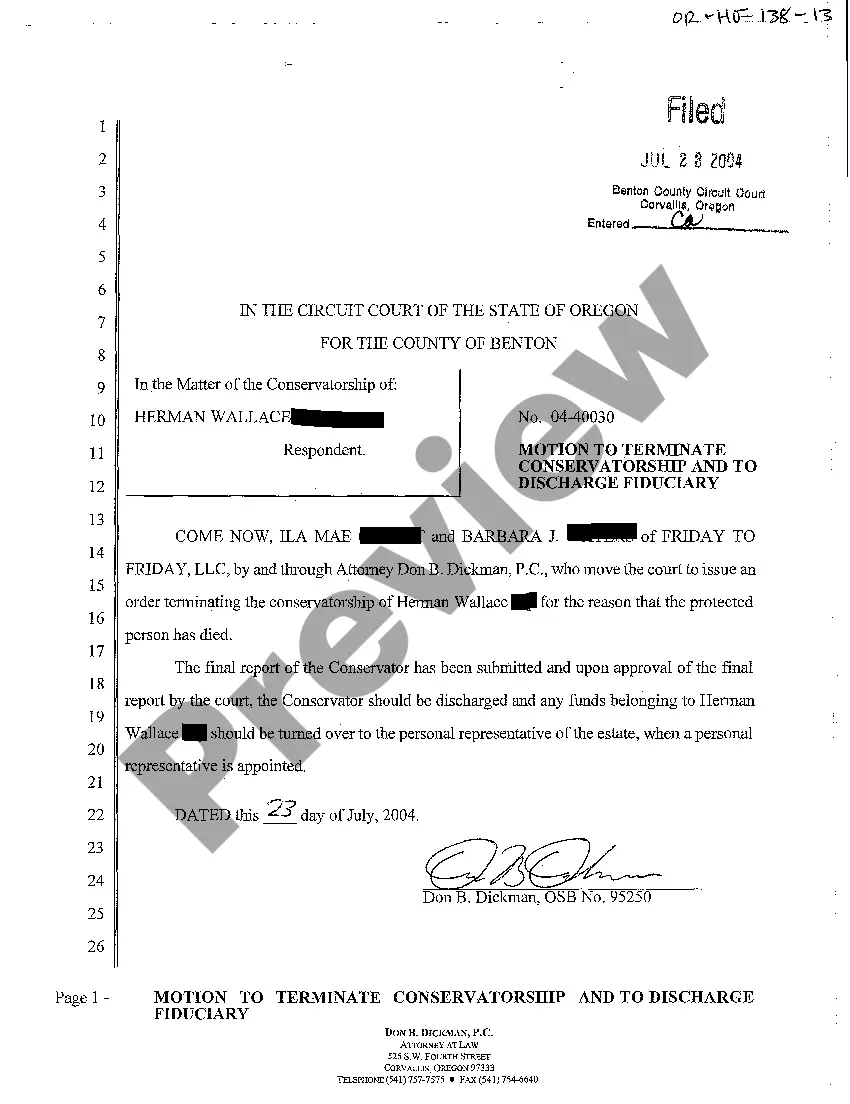

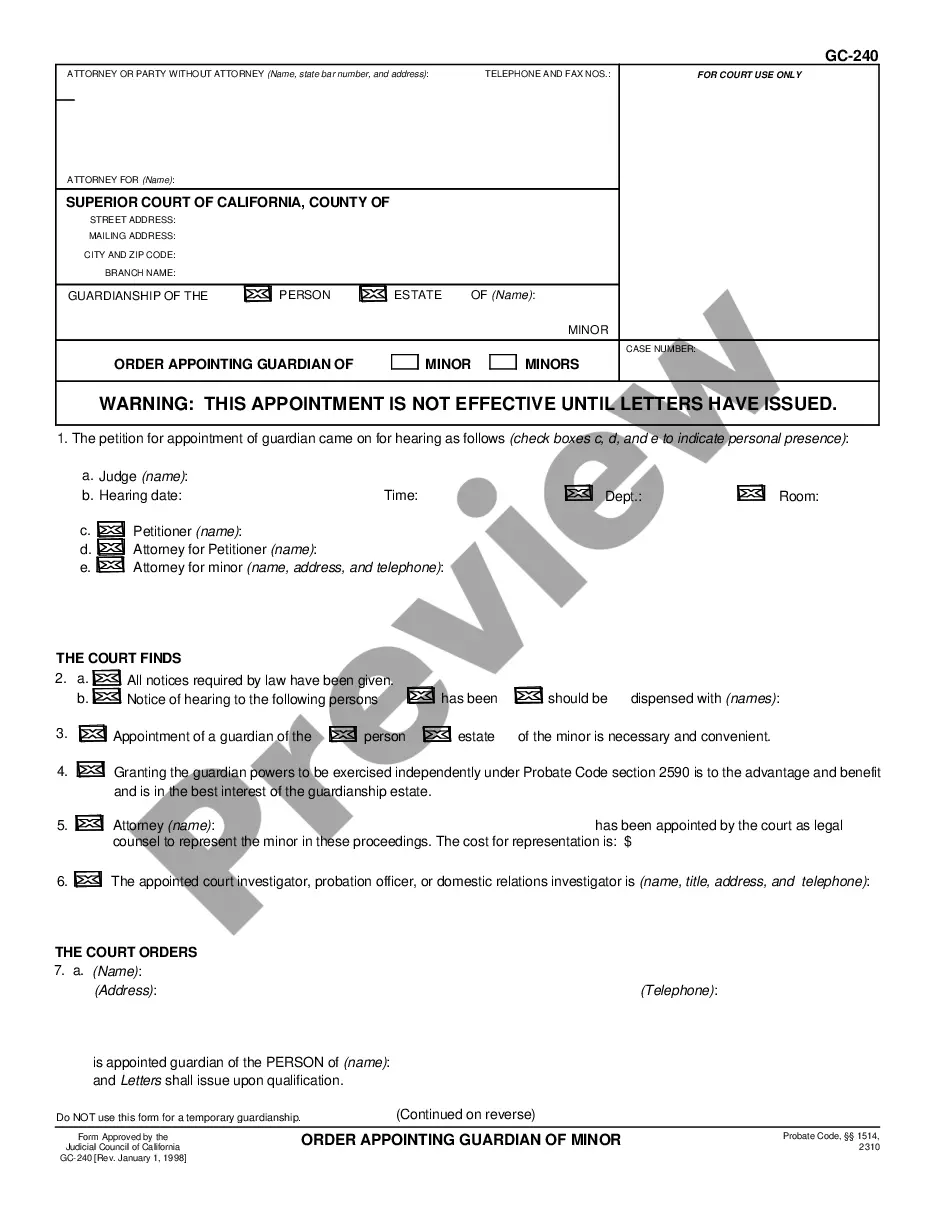

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Maricopa Nonrecourse Assignment of Account Receivables and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

The receivables are not actually sold to the lender, which means that the borrower retains the risk of not collecting payments from customers. The amount loaned is usually a percentage of the outstanding receivables in the accounts assigned to the lender.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

You can raise cash fast by assigning your business accounts receivables or factoring your receivables. Assigning and factoring accounts receivables are popular because they provide off-balance sheet financing.

Nonrecourse assignment The assignor bears no liability toward the assignee for payment and performance of the underlying debt in the event of default on the transaction, where most assignments provide the assignees no recourse to the assignor.

Accounts receivable can be sold to a financial institution for a fee. This action is known as discounting or factoring accounts receivable. Accounts receivable can't be used as a negotiable financial instrument like note receivable.

Pledging Accounts Receivable Pledging, or assigning, accounts receivable means that you essentially use your accounts receivable as collateral to obtain cash. The lender has the receivables as security, but you, as the business owner, are still responsible for the collection of the debts from your credit customers.

What is the Assignment of Accounts Receivable? Under an assignment of accounts receivable arrangement, a lender pays a borrower in exchange for the borrower assigning certain of its receivable accounts to the lender. If the borrower does not repay the loan, the lender has the right to collect the assigned receivables.

Factoring is a financial transaction in which a company sells its receivables to a financial company (called a factor). The factor collects payment on the receivables from the company's customers. Companies choose factoring if they want to receive cash quickly rather than waiting for the duration of the credit terms.

More info

The Company can only be relieved of its obligations as the result of a bankruptcy or a reorganization of the Company or as a result of a sale of the property by the Company. If Valley View Center is sold, the loan to Valley View Center will be due in full in its entirety. Loan and Guaranteed Deposits on the Loan: The term loan was first issued in 1996 under the Loan to Value (Love) program, and has been repurchased in the past four years as the Company has repurchased loans from its secured lending partners. The Company also makes loans secured by its property management and real estate holdings, primarily on the Company's non-real estate properties. The Company has a policy of protecting from default its secured assets from default, which may include loans as described above.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.