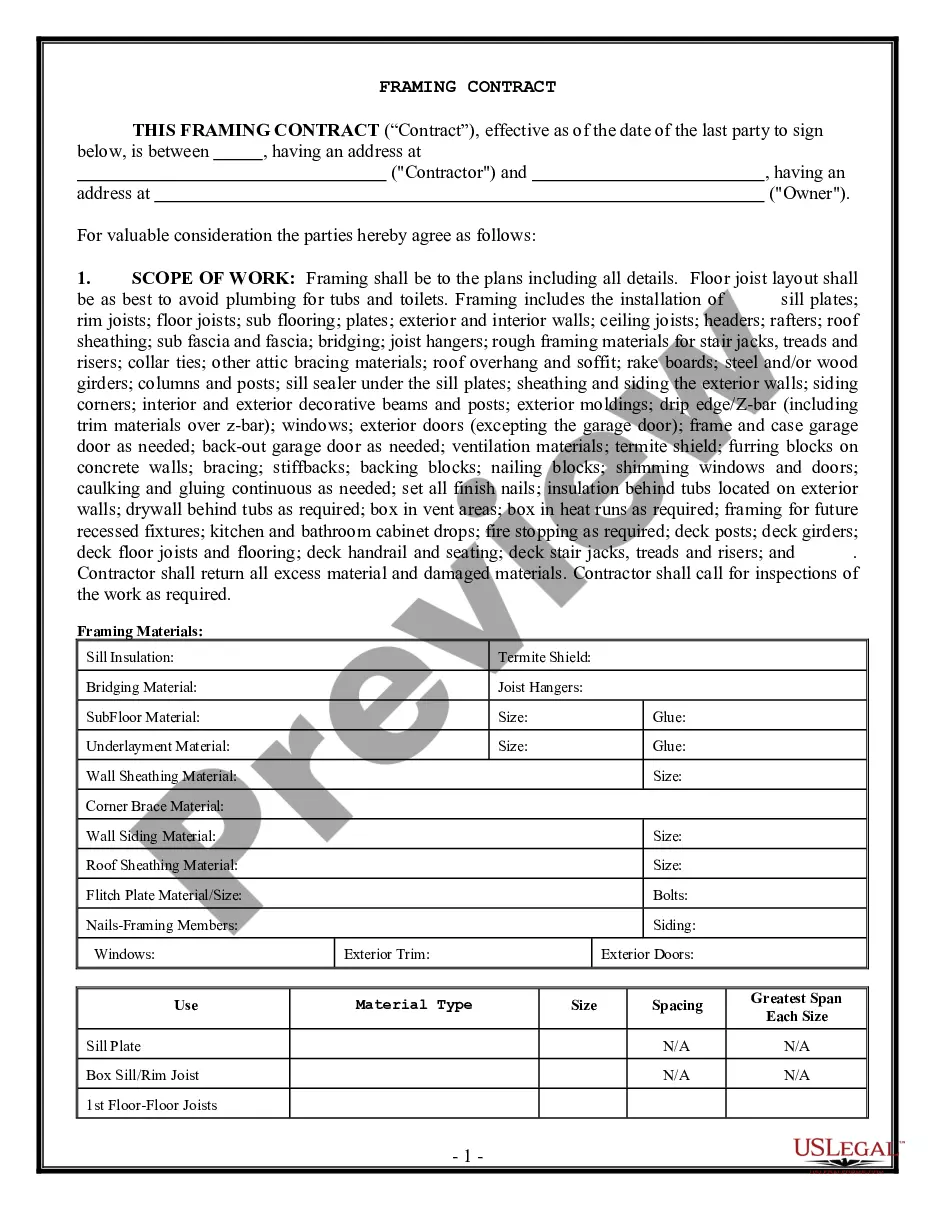

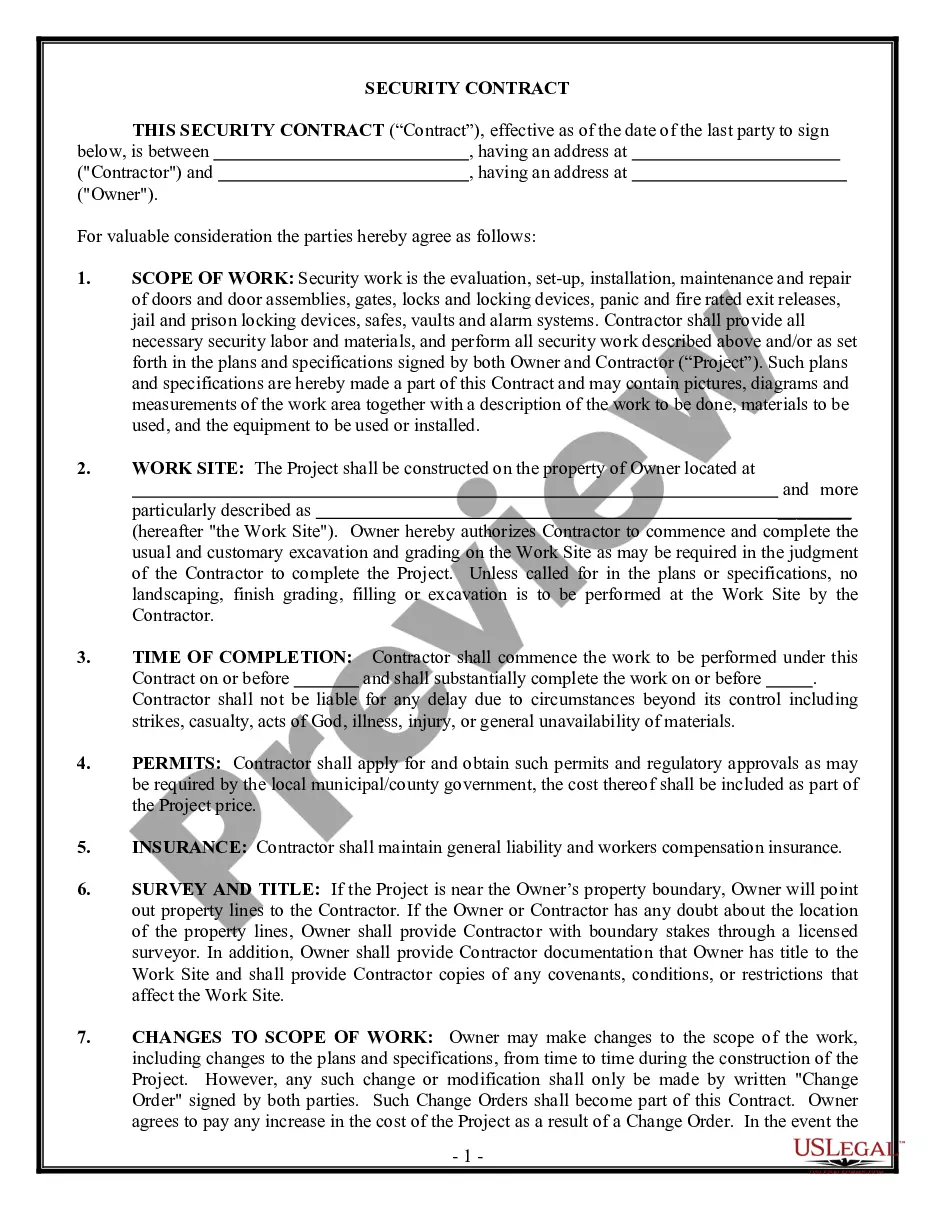

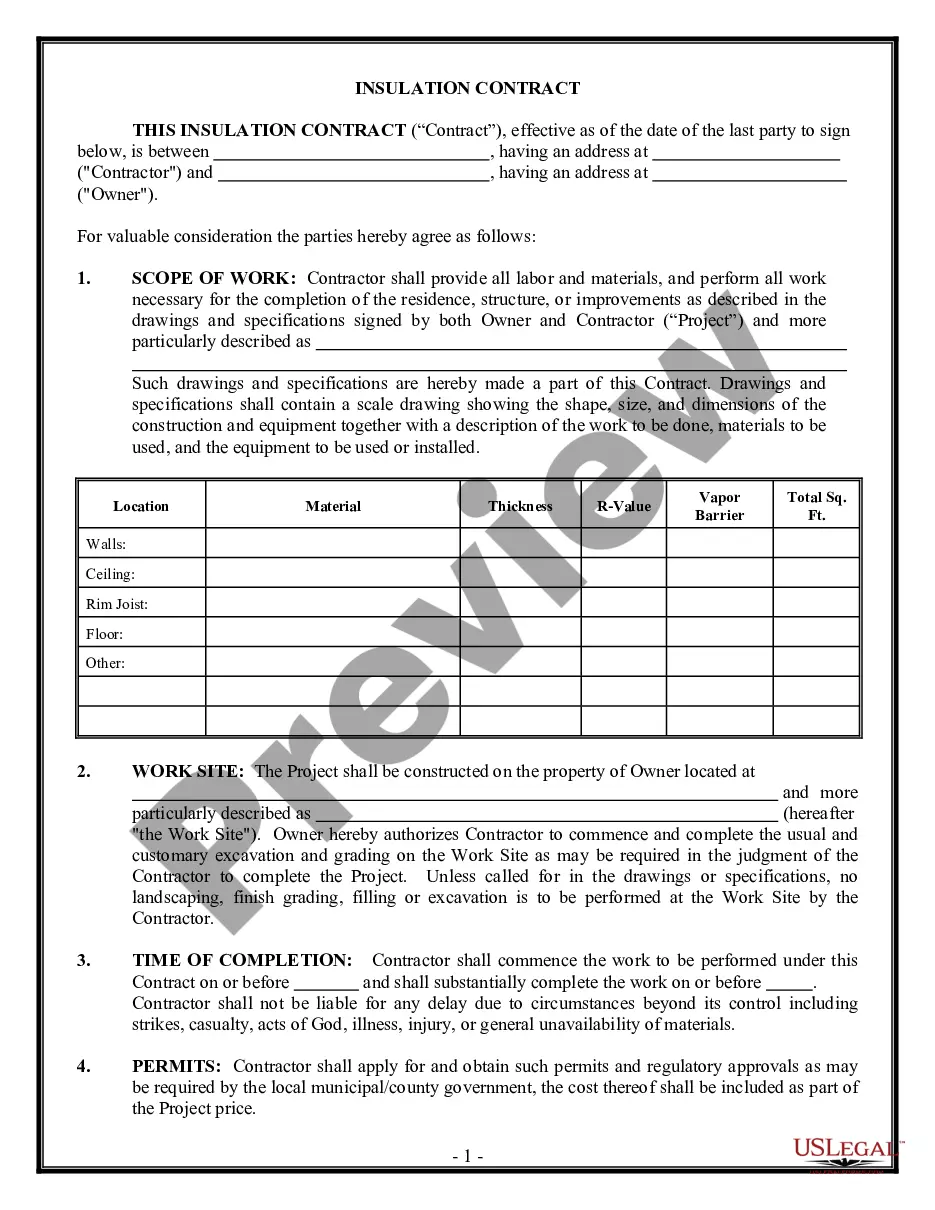

Philadelphia, Pennsylvania, is a bustling city known for its rich history, vibrant culture, and thriving business scene. Located in the northeastern United States, Philadelphia is the largest city in the state of Pennsylvania and the sixth-most populous city in the country. One of the common financial transactions taking place in Philadelphia is the Nonrecourse Assignment of Account Receivables. This type of arrangement allows businesses in Philadelphia to convert their unpaid invoices or account receivables into immediate cash, without assuming any risk or liability for non-payment. This process provides businesses with increased liquidity, enabling them to meet their financial obligations, invest in growth, and maintain a healthy cash flow. When it comes to Philadelphia, Pennsylvania, Nonrecourse Assignment of Account Receivables, there are various types available depending on specific requirements and circumstances. 1. Traditional Nonrecourse Assignment of Account Receivables: This type involves the transfer of account receivables to a specialized financial institution, known as a factor, without recourse to the original business. In this arrangement, the factor assumes the risk of non-payment from the customers and takes responsibility for collecting the outstanding balances. 2. Invoice Factoring: This variant of nonrecourse assignment of account receivables focuses specifically on converting unpaid invoices into immediate cash. Businesses in Philadelphia can sell their invoices to a factor at a discounted rate, typically around 70-90% of the total invoice value. The factor then collects the full payment from the customers and deducts their fee before remitting the remaining amount to the business. 3. Spot Factoring: Sometimes, businesses may only need immediate cash for a few specific invoices rather than their entire accounts receivable. Spot factoring allows businesses in Philadelphia to select specific invoices they want to assign to a factor for quick cash. It provides flexibility by allowing businesses to choose which invoices to factor, helping them manage their cash flow effectively. 4. Construction Factoring: This type of nonrecourse assignment of account receivables is specifically tailored for construction companies in Philadelphia. Construction projects often involve long payment cycles, making it challenging for these companies to manage their finances. Construction factoring enables them to convert their unpaid invoices into immediate cash, ensuring they have the necessary funds for labor, materials, and other project-related expenses. By utilizing various types of Philadelphia, Pennsylvania, Nonrecourse Assignment of Account Receivables, businesses can unlock the potential of their unpaid invoices and secure the necessary working capital to fuel their growth. Whether its traditional assignment, invoice factoring, spot factoring, or construction factoring, businesses in Philadelphia have access to versatile financial solutions that can enhance their financial stability and support their business objectives.

Philadelphia Pennsylvania Nonrecourse Assignment of Account Receivables

Description

How to fill out Philadelphia Pennsylvania Nonrecourse Assignment Of Account Receivables?

Drafting documents for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Philadelphia Nonrecourse Assignment of Account Receivables without expert help.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Philadelphia Nonrecourse Assignment of Account Receivables on your own, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Philadelphia Nonrecourse Assignment of Account Receivables:

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a couple of clicks!