A Wake, North Carolina Nonrecourse Assignment of Account Receivables is a legal agreement in which a party transfers their rights to collect payments from their customers (debtors) to another party, typically a financing or factoring company. This arrangement enables businesses to monetize their accounts receivables, providing them with immediate cash flow and relieving any financial burden caused by pending payments. The term "nonrecourse" refers to the fact that, in case the debtor fails to pay the assigned accounts receivables, the financing company bears the risk and cannot seek compensation from the original business owner. This feature protects the business from any potential losses in case of default. There are two main types of Wake, North Carolina Nonrecourse Assignment of Account Receivables: 1. Traditional Nonrecourse Assignment: In this type of arrangement, the financing company purchases the accounts receivables outright, taking over the responsibility of collecting payments from the debtors. The business owner receives an upfront payment representing a percentage (typically around 80-90%) of the total value of the assigned accounts receivables. The financing company then assumes the responsibility of following up with the debtors, collecting payments, and bearing the risk of any default. 2. Nonrecourse Invoice Financing: This type of arrangement involves a revolving line of credit provided to the business based on their outstanding accounts receivables. Instead of outright purchasing the receivables, the financing company extends a credit limit to the business owner, enabling them to draw funds as needed, up to a specified percentage of the outstanding invoices. The business retains control of the collection process, and the financing company only steps in if there is a default, assuming the risk associated with non-payment. In summary, a Wake, North Carolina Nonrecourse Assignment of Account Receivables is a powerful financial tool that allows businesses to accelerate their cash flow by transferring the responsibility of collecting payments to a financing or factoring company. By understanding the types and benefits of this arrangement, businesses can make informed decisions to effectively manage their accounts receivables and optimize their liquidity.

Wake North Carolina Nonrecourse Assignment of Account Receivables

Description

How to fill out Wake North Carolina Nonrecourse Assignment Of Account Receivables?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the Wake Nonrecourse Assignment of Account Receivables.

Locating samples on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Wake Nonrecourse Assignment of Account Receivables will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Wake Nonrecourse Assignment of Account Receivables:

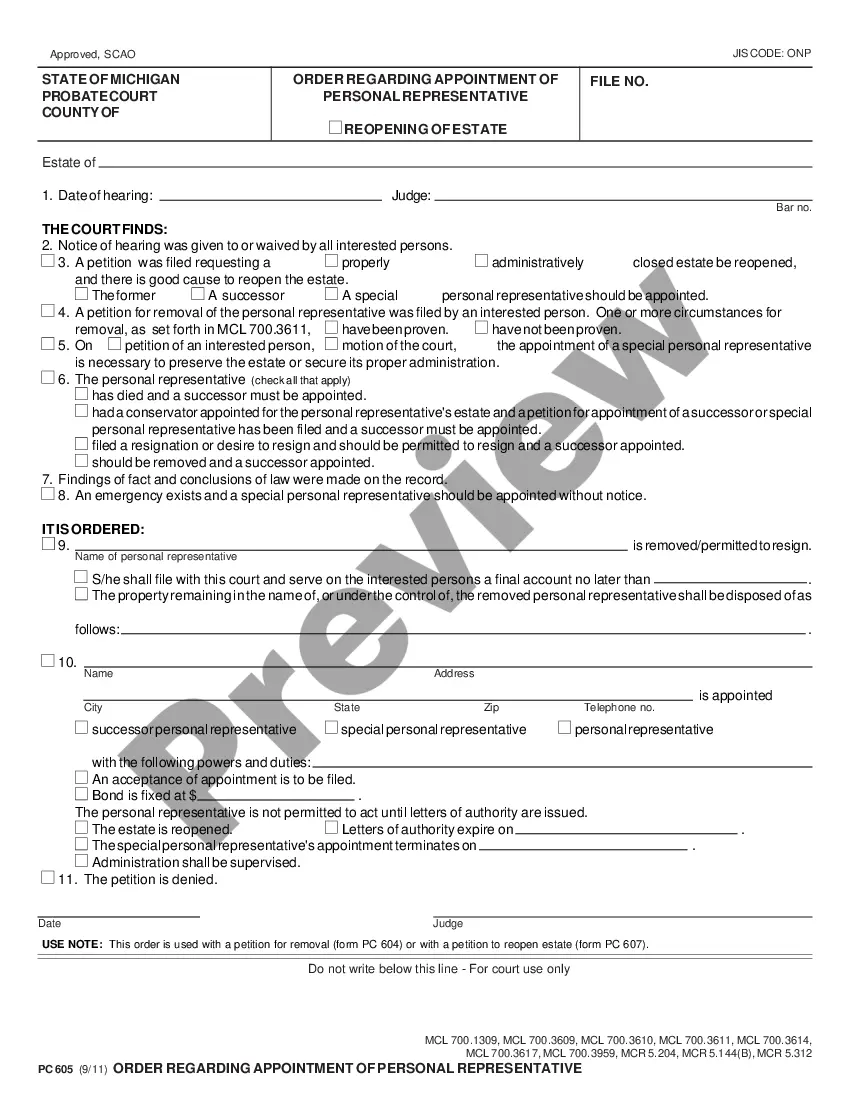

- Make sure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Wake Nonrecourse Assignment of Account Receivables on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!