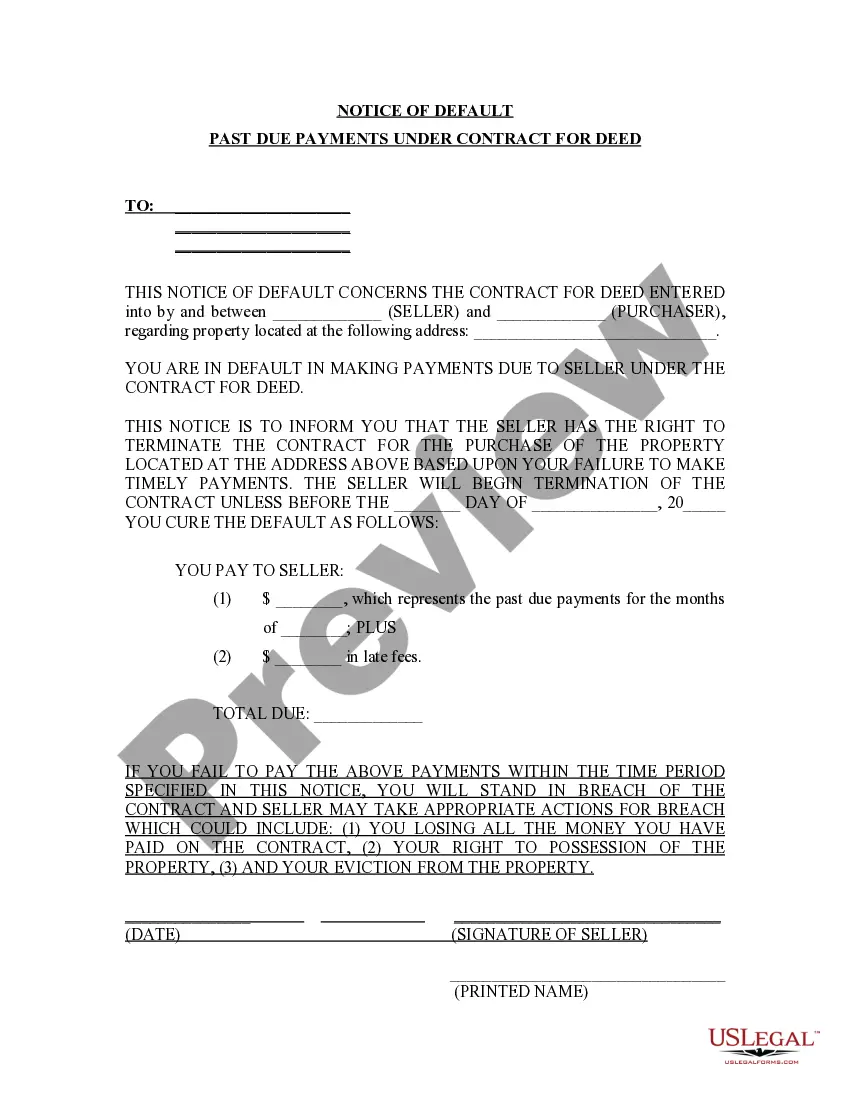

Dear [Sender's Name], I am writing to inform you that a decision has been made to initiate garnishment proceedings against your wages, under the jurisdiction of Nassau County, New York. This letter aims to provide you with a detailed description of the Nassau New York Sample Letter for Garnishment process, ensuring you understand the implications and steps involved. Nassau County, located on Long Island in the state of New York, follows specific guidelines when it comes to wage garnishment. Under the applicable laws, a creditor can file a legal claim and obtain a court order allowing them to collect a portion of your wages to settle outstanding debts. The purpose of this garnishment is to ensure that debts owed are repaid while adhering to legal procedures. There are several common types of Nassau New York Sample Letters for Garnishment that you may encounter, depending on the nature of the debt: 1. Wage Garnishment Notice: This is the initial letter sent to inform you of the intent to garnish your wages. It provides details about the creditor, the outstanding debt amount, and instructions on how to contest the garnishment action if you believe it to be unjust or incorrect. 2. Garnishment Summons: If you failed to respond to the initial notice or dispute the debt within a given timeframe, the creditor may proceed with filing a summons at a local court in Nassau County. This legal document requires your presence in court to address the debt and defend your position. 3. Court Order: After a hearing, if the court finds the debt to be valid and in favor of the creditor, they will issue a formal court order for wage garnishment. The letter will outline the percentage or amount of your wages that will be deducted, as well as the duration of the garnishment. 4. Garnishment Termination Notice: Once you have successfully repaid the debt or fulfilled the court-mandated obligations, you should receive a termination notice confirming the end of the wage garnishment. This communication is crucial, as it allows you to resume receiving your full wages without any further deductions. Nassau County, New York, follows state laws, ensuring that the garnishment process is fair and controlled. It is important to carefully review each letter you receive, seek legal counsel if necessary, and respond within the stipulated time frames to protect your rights and interests. Please note that this letter is intended solely for informational purposes. For specific legal advice and guidance tailored to your situation, it is highly recommended consulting an attorney or reach out to a legal aid service specializing in debt-related matters. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address]

Nassau New York Sample Letter for Garnishment

Description

How to fill out Nassau New York Sample Letter For Garnishment?

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Nassau Sample Letter for Garnishment without professional help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Nassau Sample Letter for Garnishment by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to get the Nassau Sample Letter for Garnishment:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!