In this guaranty, two corporations guarantee the debt of an affiliate corporation.

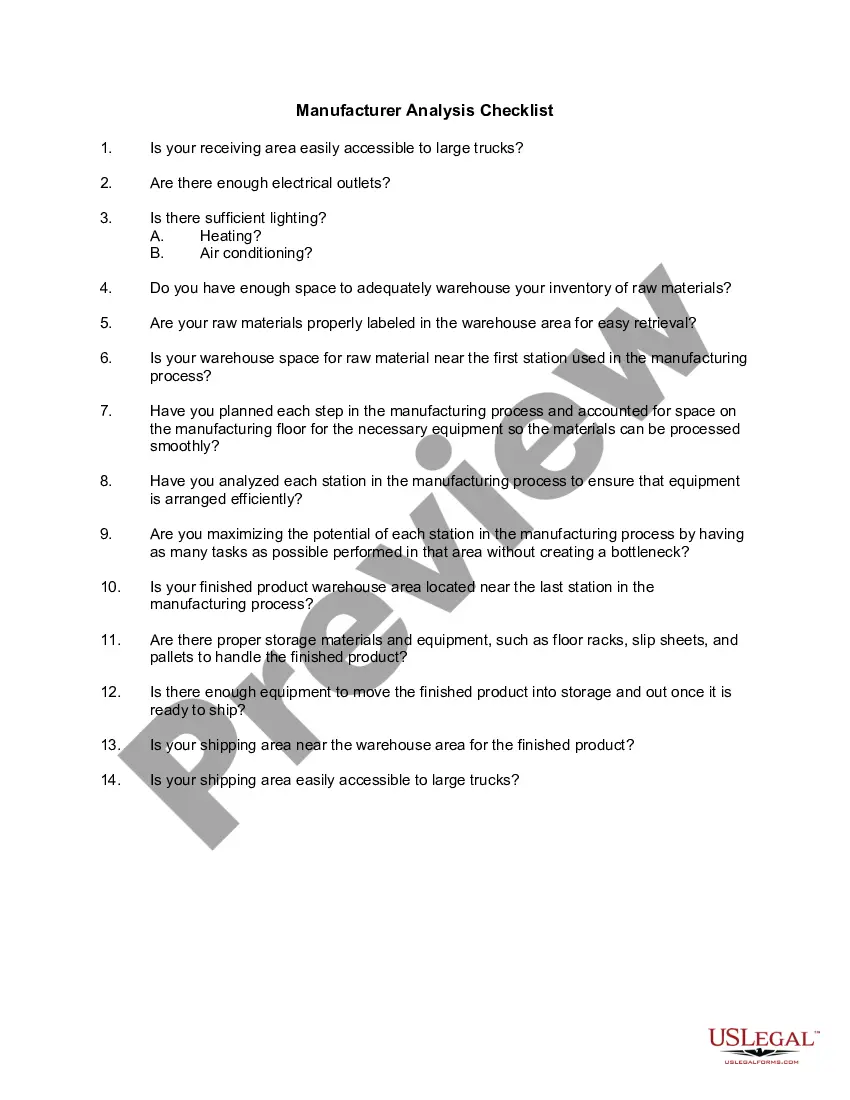

A Nassau New York Cross Corporate Guaranty Agreement is a legally binding contract that involves multiple corporations guaranteeing each other's obligations and liabilities. This agreement ensures that if one corporation fails to fulfill its obligations under a separate contract or agreement, the other corporations will step in and fulfill those obligations on their behalf. This type of guaranty agreement is commonly used in business transactions, such as loans, leases, or supply contracts, where one or multiple corporations are involved. The purpose of this agreement is to provide security to lenders or creditors by mitigating the risk of default or non-payment, as it holds multiple corporations accountable for the performance of the primary obliged. The Nassau New York Cross Corporate Guaranty Agreement outlines the rights and responsibilities of each participating corporation, detailing the scope of the guaranty, the extent of the liability, and the conditions under which the guarantor corporations become liable. Keywords: Nassau New York, Cross Corporate Guaranty Agreement, obligations, liabilities, contract, guarantee, corporations, legal, obligations, lenders, creditors, default, non-payment, security, risk, performance, primary obliged, rights, responsibilities, liability, conditions, guarantor. Types of Nassau New York Cross Corporate Guaranty Agreements: 1. General Cross Corporate Guaranty Agreement: This is the most common type of guaranty agreement where two or more corporations mutually guarantee each other's obligations. It provides a broad guarantee for various types of obligations, irrespective of the transaction or contract involved. 2. Loan Cross Corporate Guaranty Agreement: This type of guaranty agreement is specific to loans and financing arrangements. In this case, corporations agree to guarantee the loan obligations of other corporations within the agreement, enhancing the lender's confidence in repayment. 3. Lease Cross Corporate Guaranty Agreement: This agreement is focused on guaranteeing lease obligations, such as property leases or equipment leases. Corporations involved in this type of agreement provide a guarantee for the fulfillment of lease terms, including timely rental payments and property maintenance. 4. Supply Contract Cross Corporate Guaranty Agreement: In this variation, corporations guarantee the performance and payment obligations of other corporations within supply chain agreements. This type of agreement is commonly used in industries where multiple corporations collaborate in manufacturing, distribution, or procurement processes, ensuring an uninterrupted supply flow. Keywords: General, Loan, Financing, Lease, Property, Equipment, Supply Contract, Guarantee, Rental, Payments, Maintenance, Supply Chain, Performance, Payment, Industry, Manufacturing, Distribution, Procurement.A Nassau New York Cross Corporate Guaranty Agreement is a legally binding contract that involves multiple corporations guaranteeing each other's obligations and liabilities. This agreement ensures that if one corporation fails to fulfill its obligations under a separate contract or agreement, the other corporations will step in and fulfill those obligations on their behalf. This type of guaranty agreement is commonly used in business transactions, such as loans, leases, or supply contracts, where one or multiple corporations are involved. The purpose of this agreement is to provide security to lenders or creditors by mitigating the risk of default or non-payment, as it holds multiple corporations accountable for the performance of the primary obliged. The Nassau New York Cross Corporate Guaranty Agreement outlines the rights and responsibilities of each participating corporation, detailing the scope of the guaranty, the extent of the liability, and the conditions under which the guarantor corporations become liable. Keywords: Nassau New York, Cross Corporate Guaranty Agreement, obligations, liabilities, contract, guarantee, corporations, legal, obligations, lenders, creditors, default, non-payment, security, risk, performance, primary obliged, rights, responsibilities, liability, conditions, guarantor. Types of Nassau New York Cross Corporate Guaranty Agreements: 1. General Cross Corporate Guaranty Agreement: This is the most common type of guaranty agreement where two or more corporations mutually guarantee each other's obligations. It provides a broad guarantee for various types of obligations, irrespective of the transaction or contract involved. 2. Loan Cross Corporate Guaranty Agreement: This type of guaranty agreement is specific to loans and financing arrangements. In this case, corporations agree to guarantee the loan obligations of other corporations within the agreement, enhancing the lender's confidence in repayment. 3. Lease Cross Corporate Guaranty Agreement: This agreement is focused on guaranteeing lease obligations, such as property leases or equipment leases. Corporations involved in this type of agreement provide a guarantee for the fulfillment of lease terms, including timely rental payments and property maintenance. 4. Supply Contract Cross Corporate Guaranty Agreement: In this variation, corporations guarantee the performance and payment obligations of other corporations within supply chain agreements. This type of agreement is commonly used in industries where multiple corporations collaborate in manufacturing, distribution, or procurement processes, ensuring an uninterrupted supply flow. Keywords: General, Loan, Financing, Lease, Property, Equipment, Supply Contract, Guarantee, Rental, Payments, Maintenance, Supply Chain, Performance, Payment, Industry, Manufacturing, Distribution, Procurement.