A deed is an instrument by which an owner (the grantor) transfers an interest in land to a new owner (the grantee). No consideration is required to make the deed effective. The deed is necessary to transfer title to land even if it is a gift. It has no effect, and title does not pass until the deed has been delivered. The recording of the deed is not required to make the deed effective to pass title between the buyer and the seller. However, recording is necessary so that the public will know that the buyer is the present owner. Recording constitutes "notice to the world" of the transfer in title.

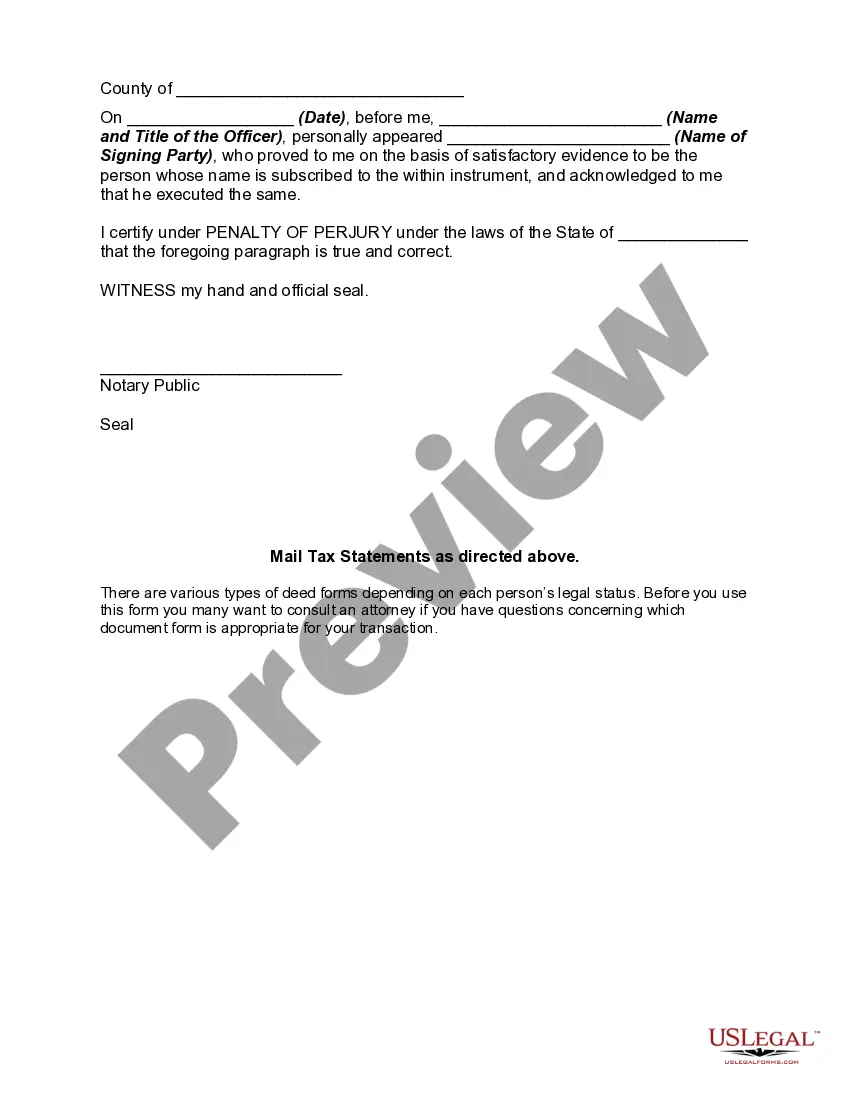

The grantor is the person selling the property. The grantee is the person buying the property. A grant deed is a deed containing an implied warranty that there are no encumbrances on the property not described in the deed and that the person transferring the property actually owns the title. It must describe the property by legal description of boundaries and/or parcel numbers, be signed by all people transferring the property, and be acknowledged before a notary public. It is in contrast to a quit claim deed, which only conveys the interest that the transferor actually owns, if any, without a warranty of ownership.

A Phoenix Arizona Grant Deed is a legally binding document used for transferring property ownership in Phoenix, Arizona. It is commonly used in real estate transactions and acts as proof of ownership transfer from one party (the granter) to another (the grantee). A detailed description of the Phoenix Arizona Grant Deed involves understanding its components and purpose. This essential legal document includes the names and addresses of both the granter and grantee, a legal description of the property, and a statement of consideration (the amount of money or other valuables exchanged for the property). The Phoenix Arizona Grant Deed ensures that the granter has the legal right to transfer the property and guarantees that there are no undisclosed liens or encumbrances on the property. It provides safeguards to protect the interests of both parties involved in the transaction. There are different types of Phoenix Arizona Grant Deeds serving various purposes. Here are a few notable variations: 1. General Warranty Deed: This type of grant deed provides the highest level of protection for the grantee. It guarantees that the granter holds clear and marketable title to the property, free from any prior claims or defects. 2. Special Warranty Deed: This deed also provides some protection to the grantee, but only for claims or defects that arise during the granter's ownership. It does not cover any issues that existed before the granter acquired the property. 3. Quitclaim Deed: A quitclaim deed is another type of grant deed commonly used in Phoenix, Arizona. Unlike general and special warranty deeds, a quitclaim deed does not provide any warranties or guarantees regarding the property's title. It transfers whatever interest the granter may have in the property but does not guarantee that the granter owns the property or has the right to transfer it. The Phoenix Arizona Grant Deed plays a vital role in real estate transactions within the city. It ensures transparency, protects the parties involved, and provides a legal framework for the transfer of property ownership. Consulting with a professional, such as a real estate attorney, is recommended to ensure all necessary legal requirements are met and to understand the specific implications of each type of grant deed.