28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

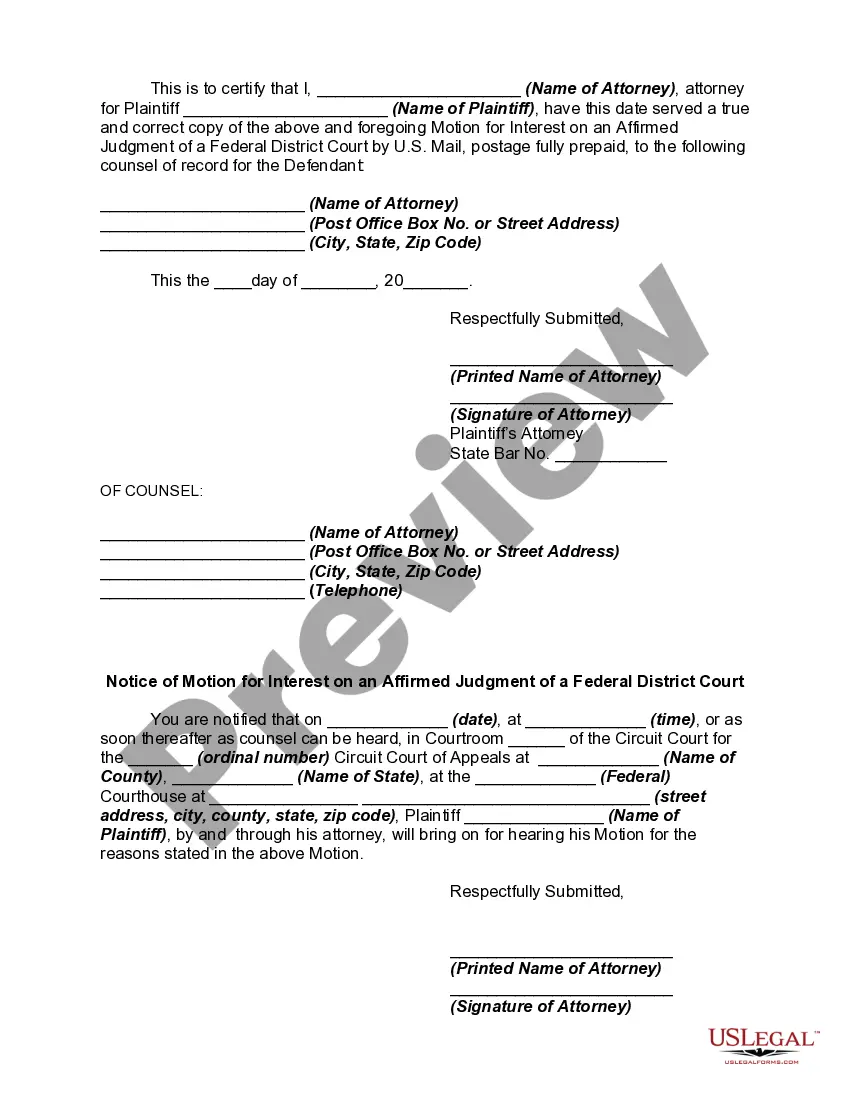

Cook Illinois motion for interest on an affirmed judgment of a federal district court is a legal motion filed by Cook Illinois Corporation, a transportation company based in Illinois, seeking additional interest on a judgment that has been affirmed by a federal district court. This motion is generally filed when there has been a delay in receiving the full amount of the judgment. Keywords: Cook Illinois, motion for interest, affirmed judgment, federal district court, transportation company, Illinois, legal motion, delay, full amount. There are different types of Cook Illinois motion for interest on an affirmed judgment of a federal district court based on the specific circumstances and requirements of the case. Some of these variations include: 1. Prejudgment interest motion: This type of motion is filed before the actual judgment is rendered by the federal district court. Cook Illinois may seek prejudgment interest to compensate for the time period between the accrual of the damages and the final judgment. 2. Post-judgment interest motion: If Cook Illinois has already received a judgment in their favor from the federal district court, but there has been a delay in receiving the full amount, they can file a post-judgment interest motion. This motion aims to recover additional interest on the outstanding amount to compensate for the delay. 3. Motion for compound interest: In some cases, Cook Illinois may also file a motion for compound interest, which allows them to recover not only the outstanding amount and interest but also any interest that has accumulated on the interest itself during the delay period. 4. Motion for statutory interest: Depending on the applicable laws, Cook Illinois may file a motion for statutory interest, which is interest that is awarded based on the legal rate specified by federal or state statutes. This motion seeks to ensure they receive the full amount due, including interest as mandated by the law. 5. Motion for prejudgment interest on appeal: If Cook Illinois files an appeal after an affirmed judgment, but there is a delay in receiving the prejudgment interest, they can file a motion specifically requesting interest for the period during the appeal process. 6. Motion for post-judgment interest on appeal: Similar to the above, Cook Illinois may file this motion when there is a delay in receiving post-judgment interest during the appeal process after an affirmed judgment. The aim is to compensate for the delay in receiving the full amount. It is important to note that the specific types of Cook Illinois motion for interest on an affirmed judgment may differ based on the jurisdiction, applicable laws, and the unique facts of the case.Cook Illinois motion for interest on an affirmed judgment of a federal district court is a legal motion filed by Cook Illinois Corporation, a transportation company based in Illinois, seeking additional interest on a judgment that has been affirmed by a federal district court. This motion is generally filed when there has been a delay in receiving the full amount of the judgment. Keywords: Cook Illinois, motion for interest, affirmed judgment, federal district court, transportation company, Illinois, legal motion, delay, full amount. There are different types of Cook Illinois motion for interest on an affirmed judgment of a federal district court based on the specific circumstances and requirements of the case. Some of these variations include: 1. Prejudgment interest motion: This type of motion is filed before the actual judgment is rendered by the federal district court. Cook Illinois may seek prejudgment interest to compensate for the time period between the accrual of the damages and the final judgment. 2. Post-judgment interest motion: If Cook Illinois has already received a judgment in their favor from the federal district court, but there has been a delay in receiving the full amount, they can file a post-judgment interest motion. This motion aims to recover additional interest on the outstanding amount to compensate for the delay. 3. Motion for compound interest: In some cases, Cook Illinois may also file a motion for compound interest, which allows them to recover not only the outstanding amount and interest but also any interest that has accumulated on the interest itself during the delay period. 4. Motion for statutory interest: Depending on the applicable laws, Cook Illinois may file a motion for statutory interest, which is interest that is awarded based on the legal rate specified by federal or state statutes. This motion seeks to ensure they receive the full amount due, including interest as mandated by the law. 5. Motion for prejudgment interest on appeal: If Cook Illinois files an appeal after an affirmed judgment, but there is a delay in receiving the prejudgment interest, they can file a motion specifically requesting interest for the period during the appeal process. 6. Motion for post-judgment interest on appeal: Similar to the above, Cook Illinois may file this motion when there is a delay in receiving post-judgment interest during the appeal process after an affirmed judgment. The aim is to compensate for the delay in receiving the full amount. It is important to note that the specific types of Cook Illinois motion for interest on an affirmed judgment may differ based on the jurisdiction, applicable laws, and the unique facts of the case.