28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

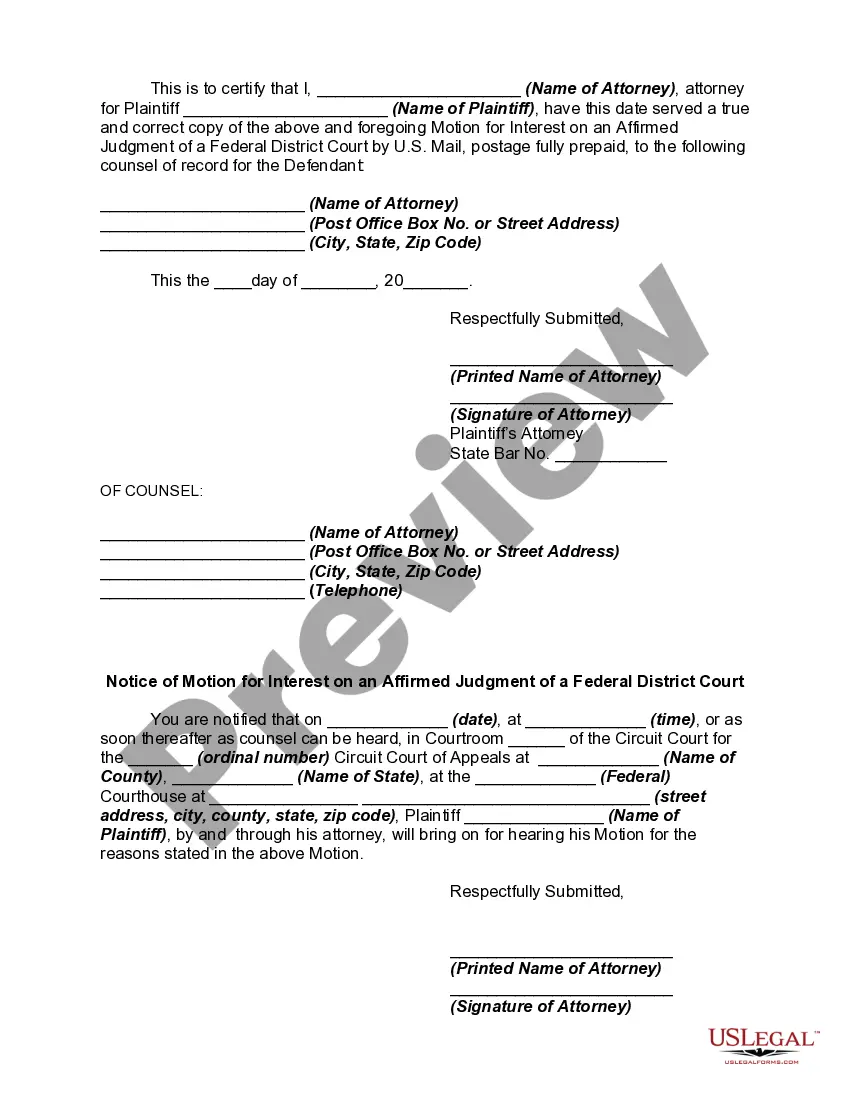

Harris Texas Motion for Interest on an Affirmed Judgment of a Federal District Court is a legal procedure aimed at collecting interest on a judgment amount that has been affirmed by a higher court. This motion is filed in the Harris County district, located in Texas, after a federal district court has already ruled on a case and its decision has been upheld on appeal. When dealing with a Harris Texas Motion for Interest on an Affirmed Judgment of a Federal District Court, it is crucial to understand that there might be different types or variations of this motion, depending on the specific circumstances of the case. Some potential types of motions related to this topic may include: 1. Prejudgment Interest Motion: This motion seeks to collect interest on the judgment amount from the date the cause of action arose to the date the judgment was initially entered by the federal district court. It is filed before the appellate court reviews and affirms the judgment. 2. Post-judgment Interest Motion: This motion aims to collect interest on the affirmed judgment amount from the date the judgment was initially entered by the federal district court to the date of payment or satisfaction. It can be filed after the appellate court's decision upholds the judgment. 3. Compounded Interest Motion: When seeking a higher rate of interest, a party may file a motion for compounded interest, which allows for interest to accumulate not only on the initial judgment amount but also on the previously accrued interest. 4. Calculation Accuracy Motion: In some cases, a party may file a motion challenging the accuracy of the interest calculation applied by the federal district court. This motion requests a recalculation of the interest rate or method used, aiming for a more accurate representation of the accrued interest. 5. Stays or Reductions Motion: In specific situations, a party may file a motion requesting a stay (temporarily halting interest accrual) or seeking a reduction in the interest rate for various justifiable reasons, such as financial hardship. When filing a Harris Texas Motion for Interest on an Affirmed Judgment of a Federal District Court, it is crucial to provide the court with detailed supporting documentation and legal arguments to substantiate the request for interest collection. Precise calculation of the interest amount, reference to applicable statutes, and relevant case law are essential components of such a motion's content. Additionally, it is recommended to consult with an experienced attorney familiar with the local rules and procedures, as well as the specific circumstances of the case, to ensure the motion is drafted accurately and effectively.

Harris Texas Motion for Interest on an Affirmed Judgment of a Federal District Court is a legal procedure aimed at collecting interest on a judgment amount that has been affirmed by a higher court. This motion is filed in the Harris County district, located in Texas, after a federal district court has already ruled on a case and its decision has been upheld on appeal. When dealing with a Harris Texas Motion for Interest on an Affirmed Judgment of a Federal District Court, it is crucial to understand that there might be different types or variations of this motion, depending on the specific circumstances of the case. Some potential types of motions related to this topic may include: 1. Prejudgment Interest Motion: This motion seeks to collect interest on the judgment amount from the date the cause of action arose to the date the judgment was initially entered by the federal district court. It is filed before the appellate court reviews and affirms the judgment. 2. Post-judgment Interest Motion: This motion aims to collect interest on the affirmed judgment amount from the date the judgment was initially entered by the federal district court to the date of payment or satisfaction. It can be filed after the appellate court's decision upholds the judgment. 3. Compounded Interest Motion: When seeking a higher rate of interest, a party may file a motion for compounded interest, which allows for interest to accumulate not only on the initial judgment amount but also on the previously accrued interest. 4. Calculation Accuracy Motion: In some cases, a party may file a motion challenging the accuracy of the interest calculation applied by the federal district court. This motion requests a recalculation of the interest rate or method used, aiming for a more accurate representation of the accrued interest. 5. Stays or Reductions Motion: In specific situations, a party may file a motion requesting a stay (temporarily halting interest accrual) or seeking a reduction in the interest rate for various justifiable reasons, such as financial hardship. When filing a Harris Texas Motion for Interest on an Affirmed Judgment of a Federal District Court, it is crucial to provide the court with detailed supporting documentation and legal arguments to substantiate the request for interest collection. Precise calculation of the interest amount, reference to applicable statutes, and relevant case law are essential components of such a motion's content. Additionally, it is recommended to consult with an experienced attorney familiar with the local rules and procedures, as well as the specific circumstances of the case, to ensure the motion is drafted accurately and effectively.