A Phoenix Arizona Notice of Returned Check is a formal notification that is sent to an individual or business when a check they have issued has been returned unpaid by the bank. It serves to inform the recipient that the check was not honored due to insufficient funds, a closed account, or any other reason that caused the check to be refused. The purpose of the Phoenix Arizona Notice of Returned Check is to alert the check issuer about the returned payment and outline the necessary steps and actions required to rectify the situation. This notice typically includes the details of the returned check, such as the check number, the date it was deposited, and the specific reason provided by the bank for its non-payment. In Phoenix, Arizona, there may be different variations or specific types of notices for returned checks, which could include: 1. Phoenix Arizona Notice of Returned Check — Insufficient Funds: This type of notice is sent when a check bounces due to the issuer's account lacking sufficient funds to cover the payment. 2. Phoenix Arizona Notice of Returned Check — Closed Account: This notice is issued when the issuer's bank account has been closed, leading to the returned check. 3. Phoenix Arizona Notice of Returned Check — Technical Errors: Sometimes, a check may be rejected due to technical errors such as illegible writing, incorrect account numbers, or missing signatures. In such cases, a tailored notice may be sent to address these issues and request a corrected payment. 4. Phoenix Arizona Notice of Returned Check — Stop Payment: This type of notice is sent when the check issuer has placed a stop payment order, preventing the check from being honored by the bank. 5. Phoenix Arizona Notice of Returned Check — Fraudulent Activity: If a check is deemed fraudulent or involved in any financial malpractice, a specialized notice may be issued to alert the check issuer and potentially initiate legal proceedings if necessary. It is important to address a Phoenix Arizona Notice of Returned Check promptly to avoid further consequences, such as penalties, fees, damage to credit ratings, and potential legal actions. Being responsive and taking immediate measures to rectify the situation, such as providing an alternative payment method or arranging for funds to cover the payment, can help resolve the matter swiftly and maintain a good financial standing.

Phoenix Arizona Notice of Returned Check

Description

How to fill out Phoenix Arizona Notice Of Returned Check?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Phoenix Notice of Returned Check, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the recent version of the Phoenix Notice of Returned Check, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Notice of Returned Check:

- Look through the page and verify there is a sample for your region.

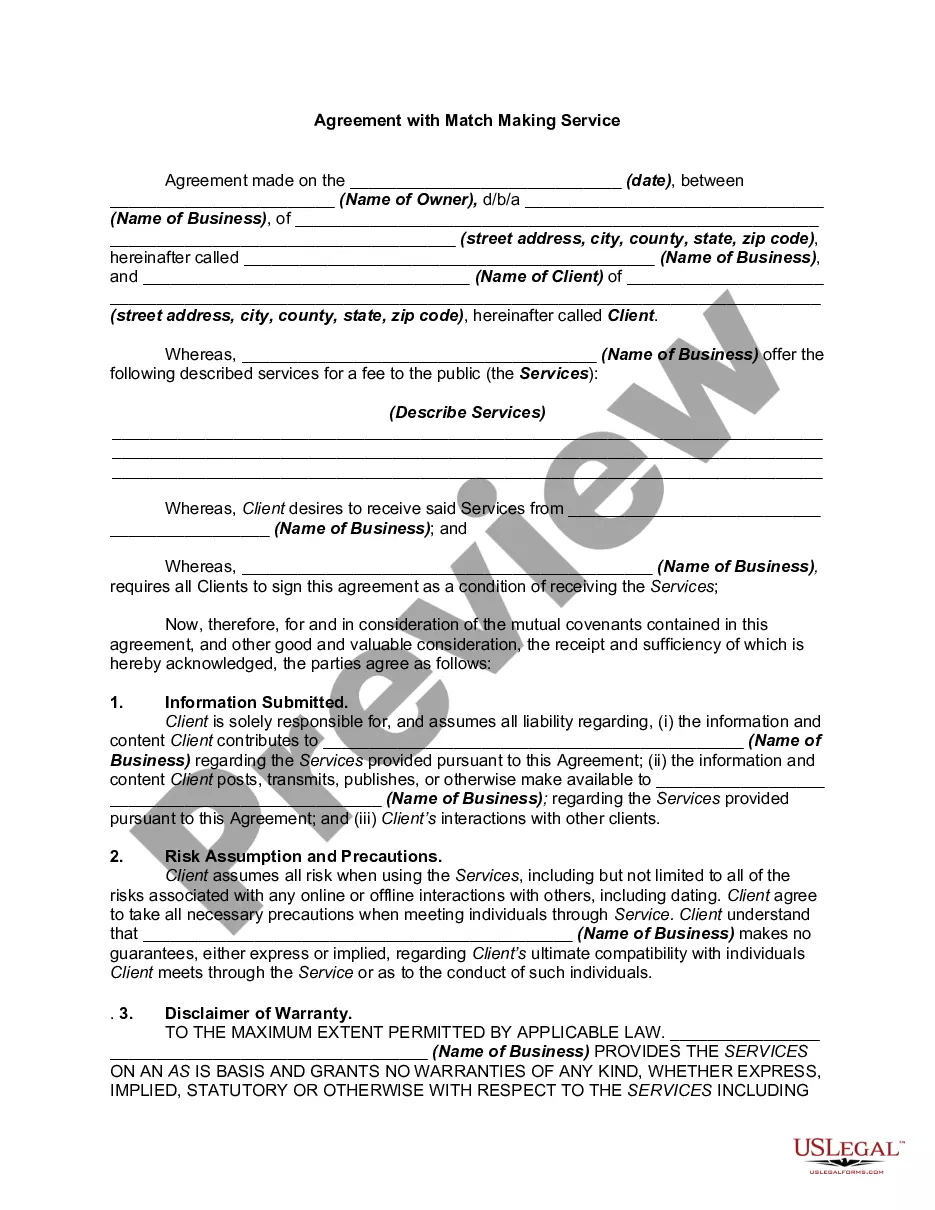

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Phoenix Notice of Returned Check and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!