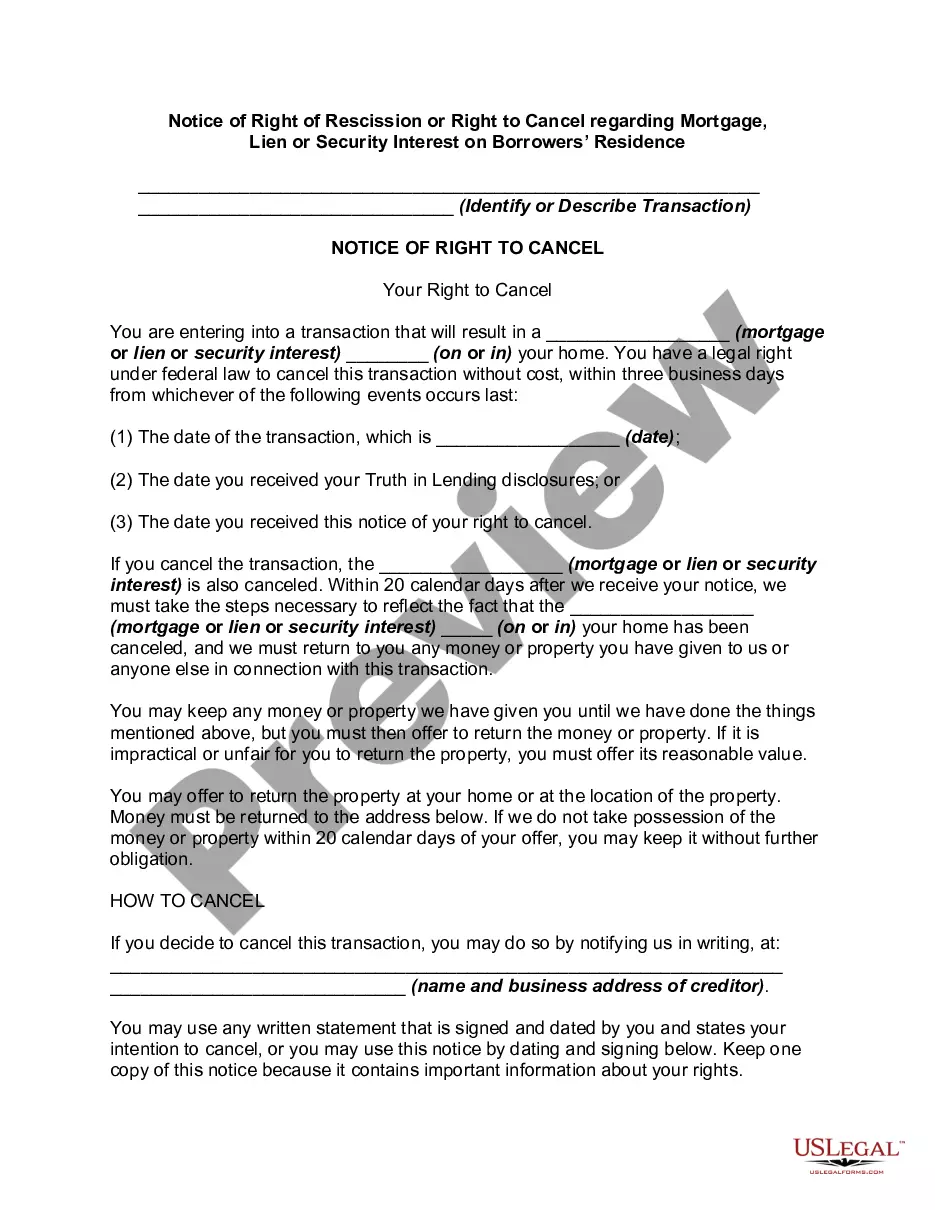

According to 12 CFR 226.23, in a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction, with some exceptions. To exercise the right to rescind, the consumer shall notify the creditor of the rescission by mail, telegram or other means of written communication. Notice is considered given when mailed, when filed for telegraphic transmission or, if sent by other means, when delivered to the creditor's designated place of business. The consumer may exercise the right to rescind until midnight of the third business day following consummation, delivery of the notice required by paragraph (b) of this section, or delivery of all material disclosures, whichever occurs last.

Title: Understanding the Contra Costa California Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien, or Security Interest on Borrowers' Residence Introduction: The Contra Costa California Notice of Right of Rescission or Right to Cancel is a crucial legal document that protects homeowners in the county. It grants borrowers the right to cancel or rescind certain mortgage agreements, liens, or security interests on their primary residence within a specific timeframe. This detailed description aims to provide an understanding of this notice and its various forms. 1. Conventional Mortgage Cancellation: The Contra Costa California Notice of Right of Rescission allows borrowers to cancel or rescind a conventional mortgage contract within three business days from the date of signing the agreement. This right exists unless the borrower is refinancing an existing loan with the same lender. 2. Home Equity Line of Credit (HELOT) Cancellation: Borrowers who secure a Home Equity Line of Credit (HELOT) on their primary residence in Contra Costa County have the right to cancel the agreement within three business days after signing the loan documents. The cancellation period does not apply when the HELOT is used to purchase the property. 3. Mortgage Loan Modification Cancellation: In certain cases, homeowners may seek to modify their existing mortgage loan terms to ease financial burdens. The Contra Costa California Notice of Right of Rescission enables borrowers to cancel or rescind the loan modification agreement within three business days from the date of signing. 4. Refinancing Cancellation: When homeowners in Contra Costa County decide to refinance their existing mortgage obligation, the Notice of Right of Rescission allows them to cancel or rescind the agreement within three business days, excluding weekends and certain holidays. However, the cancellation period does not apply if the borrower is refinancing with the same lender and not changing the loan product. 5. Judgment Lien Cancellation: In the event a judgment lien is placed on a borrower's residence in Contra Costa County, the Notice of Right of Rescission empowers the homeowner to cancel or rescind the lien within a specific timeframe. Specific guidelines and legal advice are recommended in such cases. Importance of the Notice of Right of Rescission: The Contra Costa California Notice of Right of Rescission is a crucial legal protection for borrowers. It ensures that homeowners have an opportunity to reconsider and cancel certain mortgage, lien, or security interest agreements if they feel the need to do so. By providing this right, the legislation aims to prevent potential financial hardship and protect borrowers' interests. Conclusion: Understanding the Contra Costa California Notice of Right of Rescission or Right to Cancel is essential for homeowners in Contra Costa County. It offers a vital safeguard against potentially unfavorable mortgage agreements, liens, or security interests on borrowers' primary residences. By familiarizing themselves with the various types of notices and their respective cancellation periods, borrowers can exercise their rights and make informed decisions concerning their homes and financial well-being.Title: Understanding the Contra Costa California Notice of Right of Rescission or Right to Cancel regarding Mortgage, Lien, or Security Interest on Borrowers' Residence Introduction: The Contra Costa California Notice of Right of Rescission or Right to Cancel is a crucial legal document that protects homeowners in the county. It grants borrowers the right to cancel or rescind certain mortgage agreements, liens, or security interests on their primary residence within a specific timeframe. This detailed description aims to provide an understanding of this notice and its various forms. 1. Conventional Mortgage Cancellation: The Contra Costa California Notice of Right of Rescission allows borrowers to cancel or rescind a conventional mortgage contract within three business days from the date of signing the agreement. This right exists unless the borrower is refinancing an existing loan with the same lender. 2. Home Equity Line of Credit (HELOT) Cancellation: Borrowers who secure a Home Equity Line of Credit (HELOT) on their primary residence in Contra Costa County have the right to cancel the agreement within three business days after signing the loan documents. The cancellation period does not apply when the HELOT is used to purchase the property. 3. Mortgage Loan Modification Cancellation: In certain cases, homeowners may seek to modify their existing mortgage loan terms to ease financial burdens. The Contra Costa California Notice of Right of Rescission enables borrowers to cancel or rescind the loan modification agreement within three business days from the date of signing. 4. Refinancing Cancellation: When homeowners in Contra Costa County decide to refinance their existing mortgage obligation, the Notice of Right of Rescission allows them to cancel or rescind the agreement within three business days, excluding weekends and certain holidays. However, the cancellation period does not apply if the borrower is refinancing with the same lender and not changing the loan product. 5. Judgment Lien Cancellation: In the event a judgment lien is placed on a borrower's residence in Contra Costa County, the Notice of Right of Rescission empowers the homeowner to cancel or rescind the lien within a specific timeframe. Specific guidelines and legal advice are recommended in such cases. Importance of the Notice of Right of Rescission: The Contra Costa California Notice of Right of Rescission is a crucial legal protection for borrowers. It ensures that homeowners have an opportunity to reconsider and cancel certain mortgage, lien, or security interest agreements if they feel the need to do so. By providing this right, the legislation aims to prevent potential financial hardship and protect borrowers' interests. Conclusion: Understanding the Contra Costa California Notice of Right of Rescission or Right to Cancel is essential for homeowners in Contra Costa County. It offers a vital safeguard against potentially unfavorable mortgage agreements, liens, or security interests on borrowers' primary residences. By familiarizing themselves with the various types of notices and their respective cancellation periods, borrowers can exercise their rights and make informed decisions concerning their homes and financial well-being.