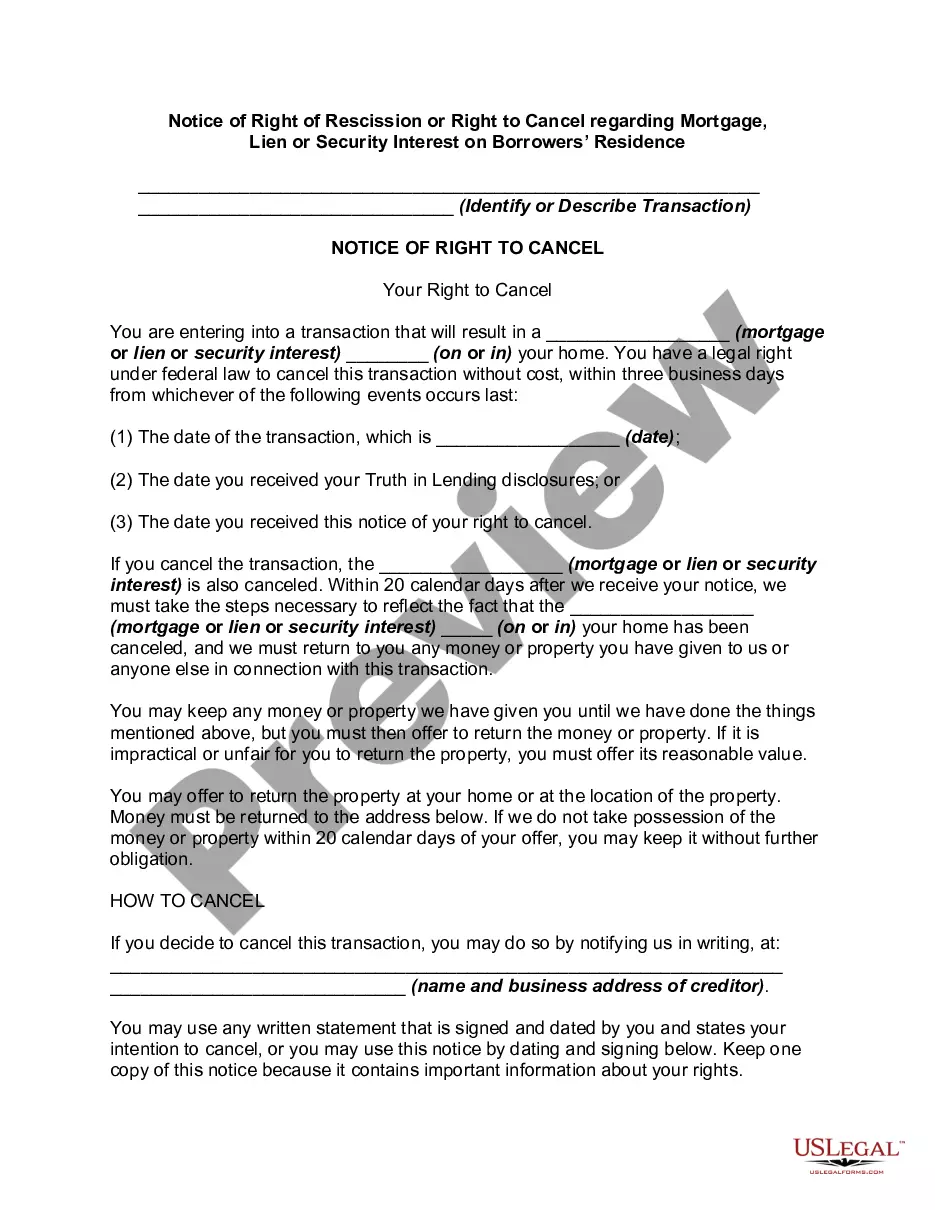

According to 12 CFR 226.23, in a credit transaction in which a security interest is or will be retained or acquired in a consumer's principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction, with some exceptions. To exercise the right to rescind, the consumer shall notify the creditor of the rescission by mail, telegram or other means of written communication. Notice is considered given when mailed, when filed for telegraphic transmission or, if sent by other means, when delivered to the creditor's designated place of business. The consumer may exercise the right to rescind until midnight of the third business day following consummation, delivery of the notice required by paragraph (b) of this section, or delivery of all material disclosures, whichever occurs last.

Phoenix, Arizona — Notice of Right of Rescission or Right to Cancel | Mortgage, Lien, or Security Interest on Borrowers' Residence In Phoenix, Arizona, the Notice of Right of Rescission or Right to Cancel plays a crucial role in protecting borrowers' rights when it comes to mortgages, liens, or security interests on their residences. This important legal document ensures that homeowners have the ability to reconsider their decision and cancel certain financial transactions within a specific timeframe without penalty. The primary purpose of the Notice of Right of Rescission or Right to Cancel is to safeguard borrowers from entering into agreements that they may later regret or that were potentially made under duress. It empowers consumers to take a step back, reassess the terms and conditions of the contract, and make an informed decision about their financial obligations on their residential property. Key factors surrounding the Notice of Right of Rescission or Right to Cancel in Phoenix, Arizona include: 1. Mortgage Rescission: In the context of a mortgage, borrowers have the right to cancel the loan within a three-day period after signing the mortgage contract. This rescission period is counted from the date of signing the loan documents or from when they receive the required Truth in Lending Act (TILL) disclosure, whichever occurs later. 2. Lien Rescission: When it comes to liens placed on a borrower's residence, the Notice of Right of Rescission gives homeowners the ability to cancel or rescind the lien agreement within a specific timeframe. The exact duration may vary depending on the specific circumstances and applicable laws, so it is crucial for borrowers to consult their legal advisors or mortgage professionals for accurate information tailored to their situation. 3. Security Interest Rescission: Phoenix, Arizona recognizes and reinforces the borrower's right to cancel or rescind a security interest on their residential property. This means that homeowners can revoke certain secured transactions within a defined period, typically three days, following the date of the agreement or the receipt of the necessary disclosures. It is important to note that these rights can serve as vital protection for borrowers, affording them the opportunity to review loan terms, interest rates, repayment details, and various fees associated with mortgages, liens, or security interests on their residences. It allows homeowners to consult with legal experts, review their financial circumstances, and ensure they are making the right decision for themselves and their homes. Borrowers should exercise due diligence and fully understand the requirements and specific provisions outlined in the notice of right of rescission or right to cancel specific to their particular loan, lien, or security interest situation. Consulting with trusted professionals, such as attorneys or mortgage specialists, is highly advised to guide borrowers through the complex legalities and ensure compliance with applicable laws in Phoenix, Arizona.Phoenix, Arizona — Notice of Right of Rescission or Right to Cancel | Mortgage, Lien, or Security Interest on Borrowers' Residence In Phoenix, Arizona, the Notice of Right of Rescission or Right to Cancel plays a crucial role in protecting borrowers' rights when it comes to mortgages, liens, or security interests on their residences. This important legal document ensures that homeowners have the ability to reconsider their decision and cancel certain financial transactions within a specific timeframe without penalty. The primary purpose of the Notice of Right of Rescission or Right to Cancel is to safeguard borrowers from entering into agreements that they may later regret or that were potentially made under duress. It empowers consumers to take a step back, reassess the terms and conditions of the contract, and make an informed decision about their financial obligations on their residential property. Key factors surrounding the Notice of Right of Rescission or Right to Cancel in Phoenix, Arizona include: 1. Mortgage Rescission: In the context of a mortgage, borrowers have the right to cancel the loan within a three-day period after signing the mortgage contract. This rescission period is counted from the date of signing the loan documents or from when they receive the required Truth in Lending Act (TILL) disclosure, whichever occurs later. 2. Lien Rescission: When it comes to liens placed on a borrower's residence, the Notice of Right of Rescission gives homeowners the ability to cancel or rescind the lien agreement within a specific timeframe. The exact duration may vary depending on the specific circumstances and applicable laws, so it is crucial for borrowers to consult their legal advisors or mortgage professionals for accurate information tailored to their situation. 3. Security Interest Rescission: Phoenix, Arizona recognizes and reinforces the borrower's right to cancel or rescind a security interest on their residential property. This means that homeowners can revoke certain secured transactions within a defined period, typically three days, following the date of the agreement or the receipt of the necessary disclosures. It is important to note that these rights can serve as vital protection for borrowers, affording them the opportunity to review loan terms, interest rates, repayment details, and various fees associated with mortgages, liens, or security interests on their residences. It allows homeowners to consult with legal experts, review their financial circumstances, and ensure they are making the right decision for themselves and their homes. Borrowers should exercise due diligence and fully understand the requirements and specific provisions outlined in the notice of right of rescission or right to cancel specific to their particular loan, lien, or security interest situation. Consulting with trusted professionals, such as attorneys or mortgage specialists, is highly advised to guide borrowers through the complex legalities and ensure compliance with applicable laws in Phoenix, Arizona.